Last week, Bitcoin exchange-traded funds (ETFs) made headlines with record inflows, reflecting a growing appetite for bitcoin among institutional and retail investors alike.

The buzz around the spot bitcoin ETFs has not only brought massive capital into the Bitcoin space but has also solidified bitcoin’s position as a key asset class for both short-term traders and long-term holders.

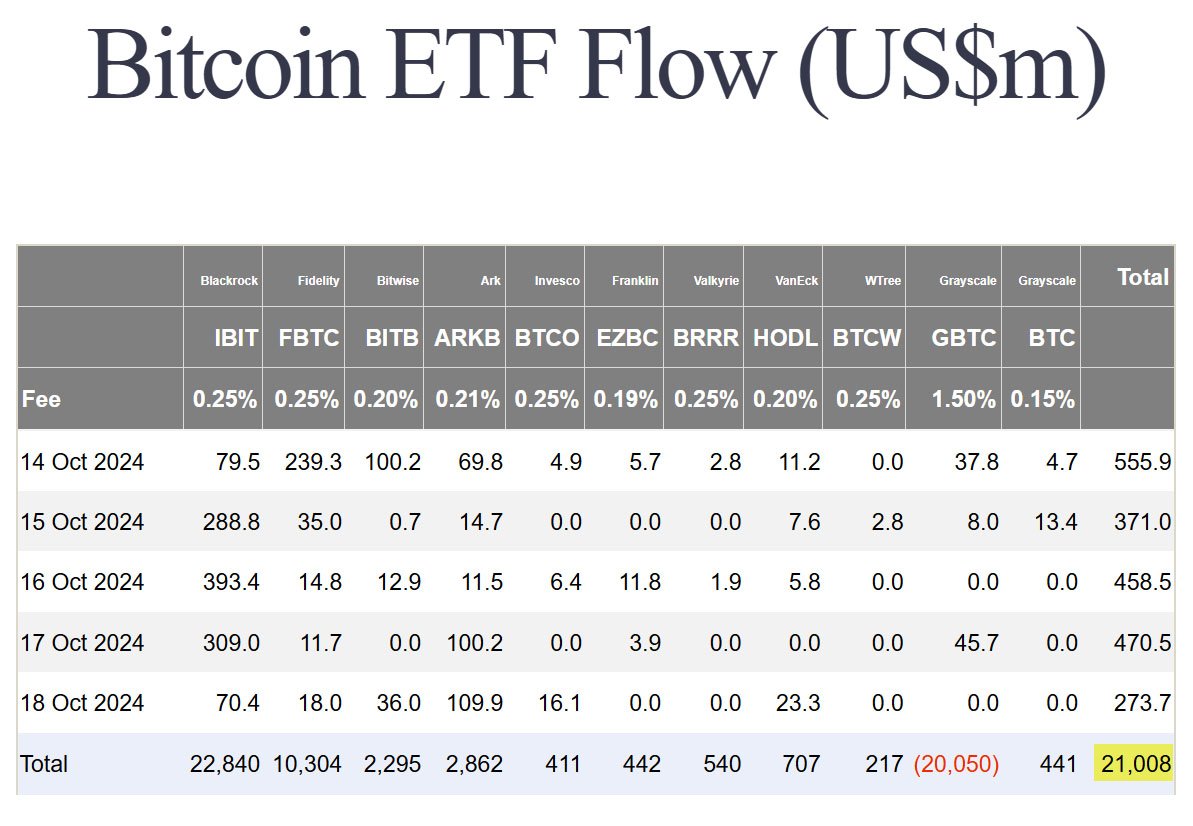

According to data from Farside Investors, spot Bitcoin ETFs have seen inflows surpass $21 billion, with last week recording over $2 billion in purchases. This surge marks the first time in history that Bitcoin ETFs ended a week without any negative outflows.

On October 11, Bitcoin ETFs broke a three-day streak of outflows by pulling in $253.6 million in a single day.

According to Farside Investors’ data, this was the third-largest inflow day in history for Bitcoin ETFs, even though BlackRock’s flagship ETF, iShares Bitcoin Trust (IBIT), reported no activity that day.

Fidelity’s Wise Origin Bitcoin Fund led the charge, netting $117.1 million, while the ARK 21Shares Bitcoin ETF followed closely with $97.6 million. Bitwise Bitcoin ETF added $38.8 million to its assets, its largest inflow in over 11 trading days.

These purchases coincided with a 7.3% rally in bitcoin’s price, pushing it to a local high of $63,360 before cooling off slightly. The collective action helped recover the $140 million that left the ETFs between October 8 and October 10.

By October 18, Bitcoin ETFs had reached a record-breaking $21 billion in total net inflows.

BlackRock’s IBIT and ARK Invest’s ARKB were among the top performers, contributing significantly to the weekly gains. On October 17 alone, Bitcoin ETFs attracted over $470 million, bringing total inflows over the past five days to an impressive $2.11 billion.

BlackRock’s IBIT ETF has been a standout, contributing heavily to the record inflows.

On October 17, IBIT alone attracted $309 million, making it the single largest contributor for the day. With total net assets now standing at $25.79 billion, IBIT has firmly established itself as the premier Bitcoin ETF.

Related: BlackRock’s IBIT Claims Third Spot Among Commodity Giants

Other key players in the space include Fidelity’s Bitcoin ETF, which recorded $11.69 million in net inflows on the same day, contributing to its cumulative total of $10.29 billion.

The ARK 21Shares Bitcoin ETF also saw substantial inflows, exceeding $100 million on both Thursday and Friday of the week, with its total net assets continuing to grow.

The rising popularity of Bitcoin ETFs has sparked a broader conversation about the potential for these financial products to deepen market liquidity and attract even more investors.

Adding to the anticipation was the U.S. Securities and Exchange Commission’s (SEC) decision on October 18, approving proposals to list options for spot Bitcoin ETFs on major U.S. exchanges.

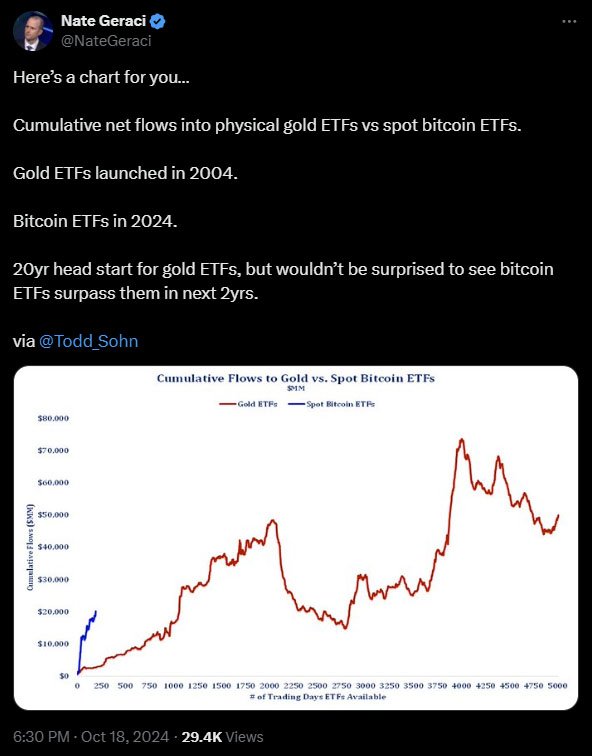

Nate Geraci, the president of The ETF Store, forecasted that Bitcoin ETFs would surpass the total inflows of gold ETFs within two years. At present, gold ETFs see inflows of about $50 billion, though they reached $75 billion at their highest point.

He credited the swift rise of Bitcoin ETFs to the growing involvement of major financial institutions, which are becoming more active in the bitcoin market.

Geraci believes that options trading will further strengthen the Bitcoin ETF market by adding liquidity and drawing more institutional players into the space. He explained:

“In terms of the potential impact here, I think that options trading on spot Bitcoin ETFs is decidedly good. Because all options trading is going to do is deepen the liquidity around spot Bitcoin ETFs, It’s going to bring more players into the space, I would say especially institutional players.”

This move is expected to attract more sophisticated retail investors as well, who are increasingly seeking options trading to hedge against the volatility of bitcoin.

On a related note, a recent survey conducted by financial services giant Charles Schwab revealed that nearly half of U.S. investors plan to invest in digital assets through ETFs over the next year.

Among millennials, 62% expressed interest in allocating funds to digital assets via ETFs, signaling a generational shift in investment preferences.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, highlighted that bitcoin’s ranking in investment plans is pretty stunning, underlining that investors are looking at digital assets as part of their long-term financial strategy.

He noted, “For context, it took gold ETFs about five years to reach [the] same number.”

As Bitcoin ETFs continue to attract massive inflows and reach record net assets, it’s clear that bitcoin is no longer just a speculative investment.

With growing institutional and retail interest, coupled with the upcoming introduction of options trading, Bitcoin ETFs are likely to play a pivotal role in the financial markets for years to come.