In a significant milestone for the Bitcoin world, recently approved Bitcoin Exchange-Traded Funds (ETFs) have collectively accumulated 95,000 bitcoin in their first week of trading. Fidelity’s FBTC and BlackRock’s iShares Bitcoin Trust (IBIT) have emerged as frontrunner spot Bitcoin ETFs, attracting over $1.2 billion each in inflows.

The Rise of Spot Bitcoin ETFs in Traditional Finance

Since gaining approval on January 10, 2024, Bitcoin ETFs have taken the traditional finance (TradFi) industry by storm. This surge in popularity reflects a growing interest and confidence in Bitcoin as a viable investment option. The total assets under management (AUM) for these ETFs are now approaching the $4 billion mark.

Key Players and Inflows

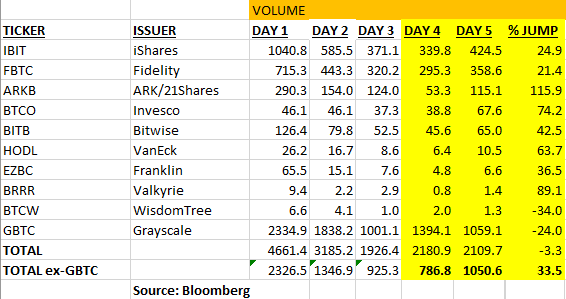

BlackRock‘s IBIT and Fidelity‘s FBTC lead the pack, accumulating significant inflows. While FBTC has slightly higher inflows, IBIT boasts more AUM, with $1.4 billion compared to Fidelity’s nearly $1.3 billion. Invesco’s ETF and VanEck’s ETF have also seen substantial growth, with Invesco attracting over $63 million in a single day.

Analyzing Market Data

Data from senior ETF analyst Eric Balchunas reveals that the capital influx into these ETFs has surpassed the outflows from the Grayscale Bitcoin Trust (GBTC). GBTC’s assets under management decreased by $2.8 billion in the first six days of trading. This marks a shift in market dynamics and showcases the growing preference for spot Bitcoin ETFs.

He stated that while Grayscale had $590 million of outflows, the other 9 ETFs witnessed $623 million of inflows. So the net growth for bitcoin ETFs has been positive in face of Grayscale’s massive outflows. He also noted he believes that only a small percentage of Grayscale outflows is going back into bitcoin ETFs. He suspected that most of it is related to FTX and traders who took profit from the Grayscale NAV discount.

Comparing Perspectives on Bitcoin ETFs

Analysts suggest that the success of spot Bitcoin ETFs could lead to a Bitcoin supply crunch. These ETFs have become the third-largest commodity ETF, trailing behind Silver and gold ETFs. The emergence and success of Bitcoin ETFs signal a new chapter in digital asset investments, providing a regulated and accessible avenue for investors.

Investors looking to navigate the plethora of Bitcoin ETF options should consider fees or expense ratios. With 11 spot Bitcoin ETFs approved by the SEC, fees vary widely. Notably, the Grayscale Bitcoin Trust (GBTC) stands out with a high expense ratio of 1.5%.

For buy-and-hold investors, focusing on fees is crucial. The iShares Bitcoin Trust (IBIT), with an expense ratio of 0.25%, stands out as a top choice. Larger asset managers like BlackRock, overseeing IBIT, may offer more stability and less susceptibility to liquidity problems.

| Bitcoin ETF | Fees |

| Bitwise : BITB | 0.20% |

| Ark 21Shares : ARKB | 0.21% |

| Fidelity Wise: FBTC | 0.25% |

| BlackRock iShares: IBIT | 0.25% |

| Valkyrie: HODL | 0.25% |

| Franklin Templeton: EZBC | 0.29% |

| WisdomTree: BTCW | 0.3% |

| Invesco Galaxy: BTCO | 0.39% |

| Hashdex: DEFI | 0.94% |

| Grayscale: GBTC | 1.5% |

Bottom Line

As Bitcoin ETFs continue to reshape investor preferences and strategies, the financial world witnesses a transformative moment. With the digital assets market now valued at $1.6 trillion and Bitcoin accounting for over 50%, the impact of these ETFs reaches far beyond the digital realm, setting the stage for unprecedented growth and acceptance within traditional finance.