As bitcoin continues reaching new all-time highs, Bitcoin Exchange-Traded Funds (ETFs) are also making history, attracting a record-breaking $1.3 billion in daily inflows.

The recent spike in interest for the spot bitcoin ETFs highlights a dramatic shift in sentiment and attention toward the scarce digital asset. This momentum comes amid bitcoin’s price hitting an all-time high of $76,943, marking a remarkable phase in the market.

IBIT, launched by BlackRock in January, has swiftly dominated the field, eclipsing its rivals and capturing the majority of inflows among U.S.-listed spot Bitcoin ETFs.

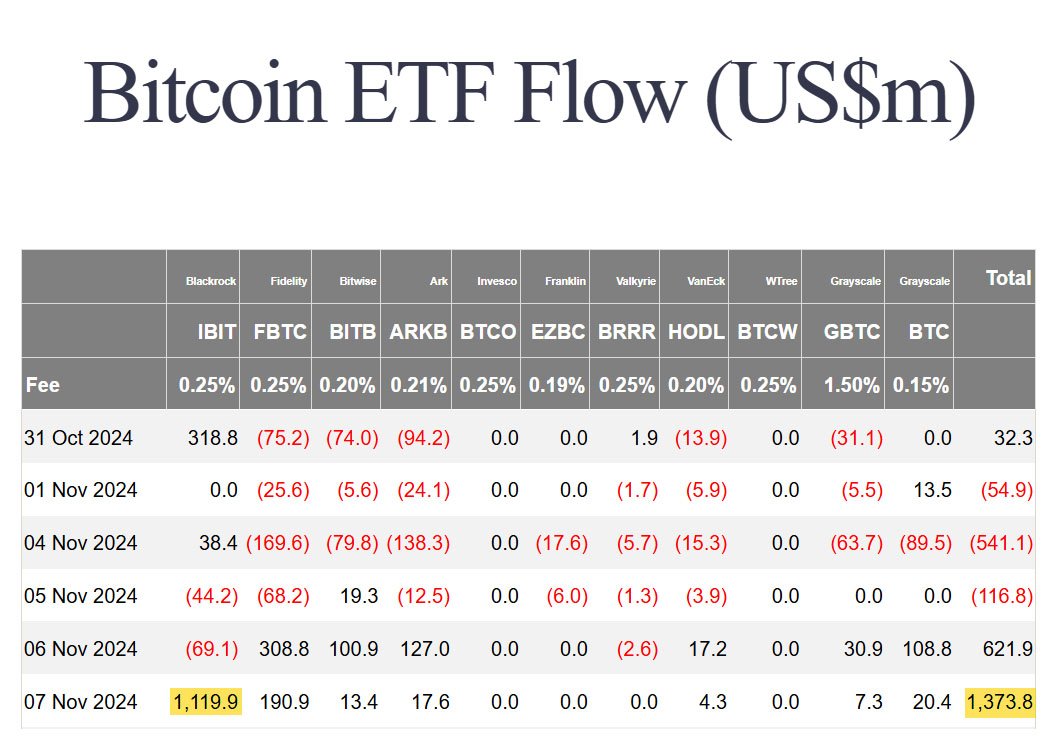

According to data from Farside Investors, IBIT accounted for a massive 82% of the total $1.34 billion that poured into spot Bitcoin ETFs in a single day. Fidelity’s Wise Origin Bitcoin Fund (FBTC) trailed with $190.9 million in inflows, and ARK’s 21Shares Bitcoin ETF (ARKB) attracted $17.6 million.

Bloomberg ETF analyst Eric Balchunas expressed surprise at the figures, noting, “Told y’all it was prob gonna be big, altho even I am surprised it’s that big—by far the biggest one-day flow of any BTC ETF ever.”

BlackRock’s recent success comes after two days of outflows totaling $113.3 million, which analysts had attributed to a temporary pause in the market. However, after this brief downturn, a massive surge in inflows ensued.

Continued record-breaking spree of the Bitcoin ETFs has made bitcoin traders and enthusiasts very excited.

“The Bitcoin Therapist” on X shared their excitement, saying, “Expect another massive day tomorrow.” Similarly, financial analyst Rajat Soni advised investors to “buckle up” for what’s ahead.

This renewed optimism has sparked speculation about continued gains, especially with predictions of more inflows continuing into next week.

The timing of the surge in inflows appears closely connected to recent political developments. Donald Trump’s recent victory in the U.S. presidential election has injected optimism into the market, particularly among Bitcoin advocates.

His campaign promises included a pledge to establish a national bitcoin reserve, support bitcoin mining, and initiate favorable policies for digital assets. With his victory, industry participants now hope for a “golden age” of Bitcoin-friendly regulation, as Bitwise’s Chief Investment Officer Matt Hougan put it.

This sentiment is shared by many who view Trump’s administration as a potential catalyst for growth in the sector. Pav Hundal, lead market analyst at digital asset exchange Swyftx stated:

“The ETFs are accumulating Bitcoin faster than it can be created by a factor of two to one. Sooner or later, this will tip across into a broad-based crypto rally. Probably sooner.”

The appeal of BlackRock’s Bitcoin ETF lies in its efficiency and relatively low fees, with BlackRock charging a 0.25% management fee—a significant draw when compared to rivals like Grayscale’s GBTC, which charges 1.5%.

Fidelity’s FBTC, with a similar fee of 0.25%, also saw notable inflows but was outpaced by IBIT’s unprecedented numbers.

Eric Balchunas described this level of interest as “extraordinary velocity,” indicating strong institutional confidence in Bitcoin and highlighting BlackRock’s reputation as the world’s largest asset manager.

Over the last week, digital asset products have seen impressive gains, bringing in inflows of $2.2 billion and pushing year-to-date totals to $29.2 billion—a historic peak for the bitcoin investment sector.

Bitcoin was the primary asset benefitting from these inflows, absorbing the bulk of capital, while short-Bitcoin products and altcoins experienced more modest gains. Farside Investors reports that the total investment in spot Bitcoin ETFs has now reached $25.5 billion.

According to another report by Apollo, the 11 U.S. spot bitcoin ETFs now hold 1,023,455 BTC in total.

The surge in bitcoin investment comes against a backdrop of growing competition in the global digital assets market, with the United States and Russia taking diverging approaches to the regulation and integration of digital assets.

Reports indicate that Russia mined approximately $3 billion worth of bitcoin in the past year, bringing in $555 million in taxes from mining activities.

Fred Thiel, CEO of the mining firm Mara, highlighted this development recently, and referred to Bitcoin as a matter of “national security”, advocating for the U.S. to take bitcoin mining and strategic reserves more seriously.

These remarks are fueled by concerns that Russia’s expanding bitcoin activities could pose economic risks to the United States, particularly as Russia seeks to circumvent Western sanctions by trading in digital assets.

Related: BRICS Nations Eye Bitcoin to Break Free from the U.S. Dollar

Russia has also been developing its digital asset framework, establishing two state-regulated exchanges to facilitate international trade and pushing for stablecoins pegged to other national currencies.

The massive inflows into BlackRock’s IBIT ETF reflect a broader shift in how institutional investors view Bitcoin.

Analysts point to a “goldilocks scenario” in the current economic environment, with conditions like monetary easing, political stability, and strong economic data fostering a favorable backdrop for digital assets. Hundal stated:

“We’re in a goldilocks scenario right now of monetary easing, political certainty, and robust US data. Capital is everywhere, and right now, it’s flooding into the ETFs at an extraordinary velocity.”

According to him, the ETFs are accumulating bitcoin at a rate that could soon outpace supply, creating a potential supply shock in the market.

With record volumes surpassing $4 billion on Wednesday, IBIT outperformed its competitors, once again solidifying BlackRock’s position as the dominant player in Bitcoin ETFs.