In a remarkable turn of events, the United States spot Bitcoin exchange-traded funds (ETFs) achieved an unprecedented milestone on March 5, with a staggering record of $10 billion in trading volume.

This extraordinary surge in spot bitcoin ETFs’ volume occurred as the digital asset reached a new all-time high before experiencing a sharp decline of around 14% within the next five hours.

“Bananas Numbers” for Spot Bitcoin ETFs Volume

Bloomberg ETF analyst Eric Balchunas reported the impressive numbers on X. He expressed surprise at the “bananas numbers for ETFs under [two months] old,” highlighting the significance of this accomplishment.

On the other hand, Bitcoin analyst Alessandro Ottaviani reported a slightly lower trading volume of $9.58 billion for the funds, still surpassing the prior record set on February 28 at $7.7 billion.

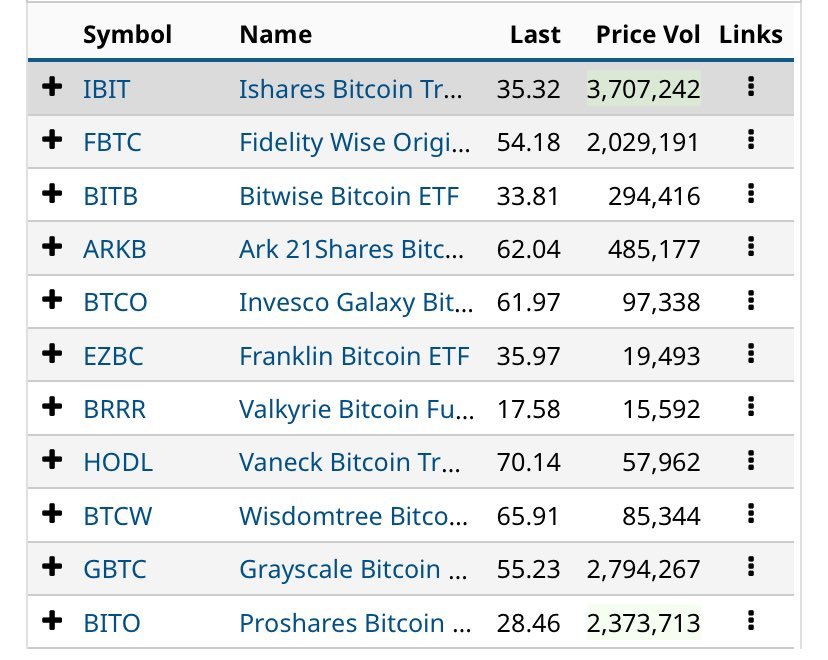

According to Ottaviani’s data, BlackRock’s iShares Bitcoin ETF (IBIT) emerged as the leader in trading volume, securing $3.7 billion. Following closely were the Grayscale Bitcoin Trust (GBTC) and the Fidelity Wise Origin Bitcoin Fund (FBTC) with $2.8 billion and $2 billion, respectively.

Record Net Inflow

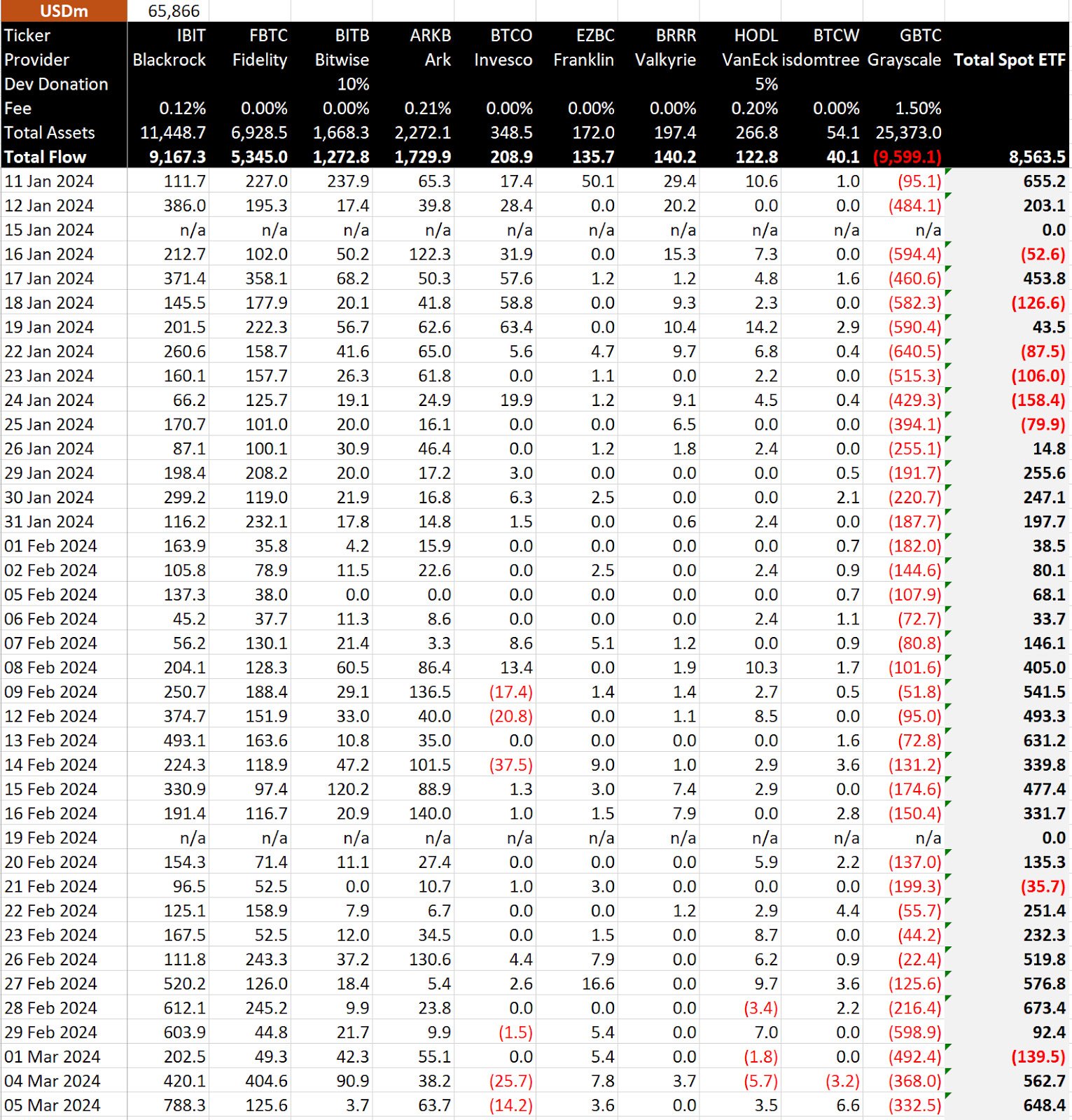

March 5 also marked the highest net inflows since the launch of spot ETFs, with a staggering $648 million pouring into the market.

BitMEX Research data highlights Blackrock’s exceptional performance, achieving a record-breaking day with an inflow of $788.3 million. On the other hand, Fidelity secured an inflow of $125.6 million.

Bitcoin’s Increased Volatility

Meanwhile, the market experienced notable volatility during the U.S. trading day, witnessing bitcoin achieving a new all-time high of $69,200 at around 3:00 pm UTC on March 5. However, the digital asset faced a subsequent 14% dip, reaching as low as $59,500 five hours later, as per the data by TradingView.

IBIT and FBTC both experienced an 8.6% decline on the day, paralleled by similar price drops in other spot Bitcoin ETFs, as indicated by Google Finance.

The Bitcoin Community Reacts

Pseudonymous analyst Bit Paine, in a post on March 5, humorously referred to the price swing as a “monthly ritual during bull markets” aimed at flushing out “leveraged degenerates.”

While still exhibiting a 16% increase over the last seven days, the flash crash prompted discussion among market participants. Market analyst Aksel Kibar, on March 4, cautioned investors about the “FOMO stage” as Bitcoin traded between $65,000 and $68,000. He stated:

“$BTCUSD I don’t think this is a breakout to an all-time signal. Don’t FOMO this part of the move.”

Alex Thorn, Head of Research at Galaxy Research, drew parallels with Bitcoin’s historical price action in 2020, suggesting a potential 11.3% retracement over 15 days before “definitively breaking” the all-time high again in the coming weeks.

As reported earlier by BitcoinNews, 97% of all Bitcoin wallet addresses are currently in profit for the first time in more than two years.

While the market experienced increased volatility, the performance of Bitcoin ETFs showcased the growing investor interest and confidence in these financial instruments. As the digital asset landscape continues to evolve, market participants will undoubtedly remain attentive to developments and fluctuations.