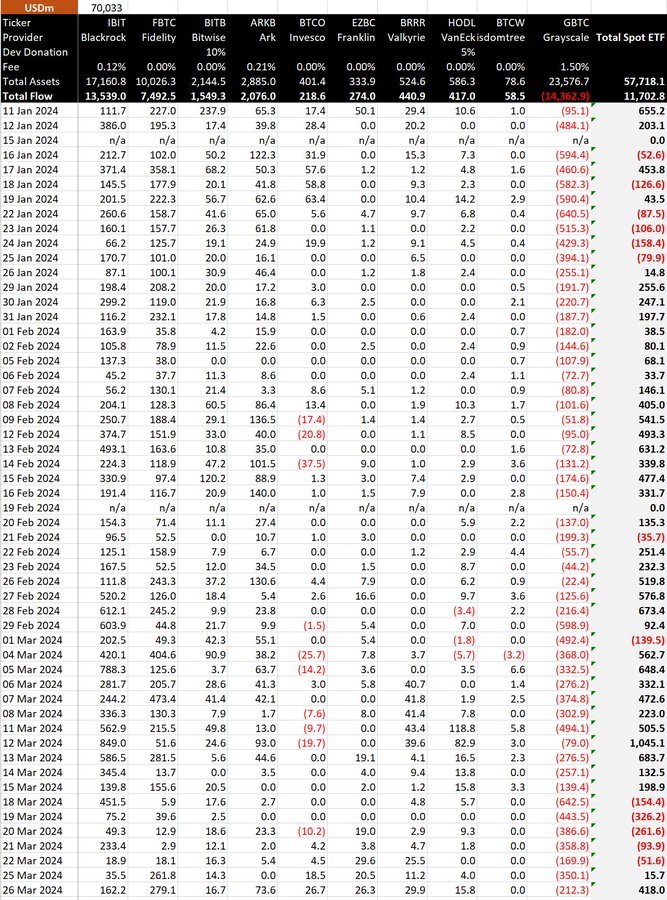

Bitcoin spot Exchange-Traded Funds (ETFs) in the United States have witnessed a remarkable turnaround, with significant net inflows recorded after a period of consecutive outflows. Fidelity and BlackRock stand out as frontrunners in attracting investor capital to their spot bitcoin ETFs.

Spot Bitcoin ETFs: Rebound in Inflows

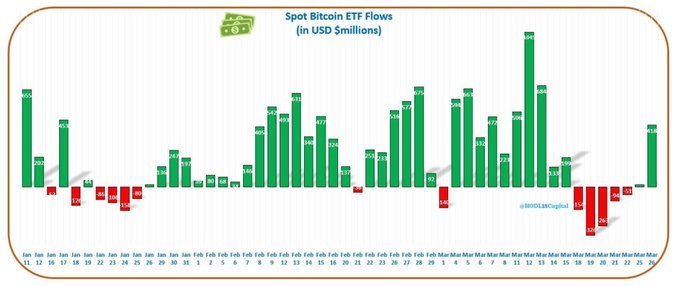

After a brief spell of investor apprehension, the US spot market for Bitcoin ETFs has regained momentum, recording a total inflow of $418 million on March 26th. This positive trend comes after five consecutive days of net outflows from these funds, indicating renewed investor confidence in the bitcoin market.

Fidelity and BlackRock Lead

Fidelity’s Bitcoin ETF experienced its most substantial daily inflow since March 13th, securing an impressive $279.1 million. Fidelity, an investment giant, added approximately 4,000 BTC to its holdings, highlighting its strong performance in attracting investor capital. Similarly, BlackRock’s ETF garnered significant investment totaling $162.2 million, although daily inflows were slightly lower compared to previous months.

While Fidelity and BlackRock lead the pack, other participants also witnessed inflows. Ark 21Shares’ Bitcoin ETF recorded $73.6 million in inflows on its best day, while Invesco Galaxy, Franklin Templeton, and Valkyrie each secured inflows exceeding $26 million for their respective funds.

Notably, QCP Capital, a Singapore based digital trading company, highlighted the surge in demand for structured products like Accumulators and FCNs, indicating a keen interest in diversifying portfolios with BTC, noting:

”Anecdotally, wealth desks at major banks have been pleasantly shocked at the tremendous demand from clients for BTC spot ETFs, along with requests for structured products like Accumulators and FCNs.”

Grayscale’s Challenge

Despite the overall positive sentiment, Grayscale’s Bitcoin Trust (GBTC) experienced outflows amounting to $212 million. This continued downward trajectory contrasts with the upbeat outlook in the broader ETF market. Since transforming into an ETF model, Grayscale has seen a significant decrease in its holdings, shedding approximately 277,393 BTC, worth $19.5 billion at current rates.

Expert Insights

Bloomberg’s senior ETF analyst, Eric Balchunas, emphasized the growing popularity of Bitcoin ETFs, noting their presence among the top 30 asset funds in their initial 50 trading days. Balchunas highlighted BlackRock’s IBIT and Fidelity’s FBTC as standout performers, underscoring sustained investor interest in these innovative financial instruments.

Hashdex Enters the Race

The competition in the Bitcoin ETF market continues to intensify, with Hashdex, a digital asset management firm, announcing its entry into the fray. Hashdex’s futures fund has transitioned into a spot product, marking the eleventh spot Bitcoin ETF launch in the United States. This move reflects the evolving landscape of the sector, with Hashdex now trading under the ticker DEFI.

Conclusion

The resurgence of net inflows into US spot Bitcoin ETFs signals renewed investor confidence in the bitcoin market. Fidelity and BlackRock have emerged as leaders in attracting investor capital to their respective funds, while other participants also experienced positive inflows. Despite challenges faced by Grayscale, the overall trajectory of Bitcoin ETFs remains noteworthy, reflecting growing investor interest in this innovative asset class.