Bitcoin, the world’s largest digital asset, has been on a remarkable journey recently, driven by a surge in institutional investment through Exchange-Traded Funds (ETFs). In just a matter of days, these spot Bitcoin ETFs have attracted staggering inflows, signaling a significant shift in the bitcoin investment landscape.

Thomas Fahrer, the co-founder of Bitcoin tracking platform Apollo, noted the fast growth of funds’ inflow into the bitcoin ETFs, stating:

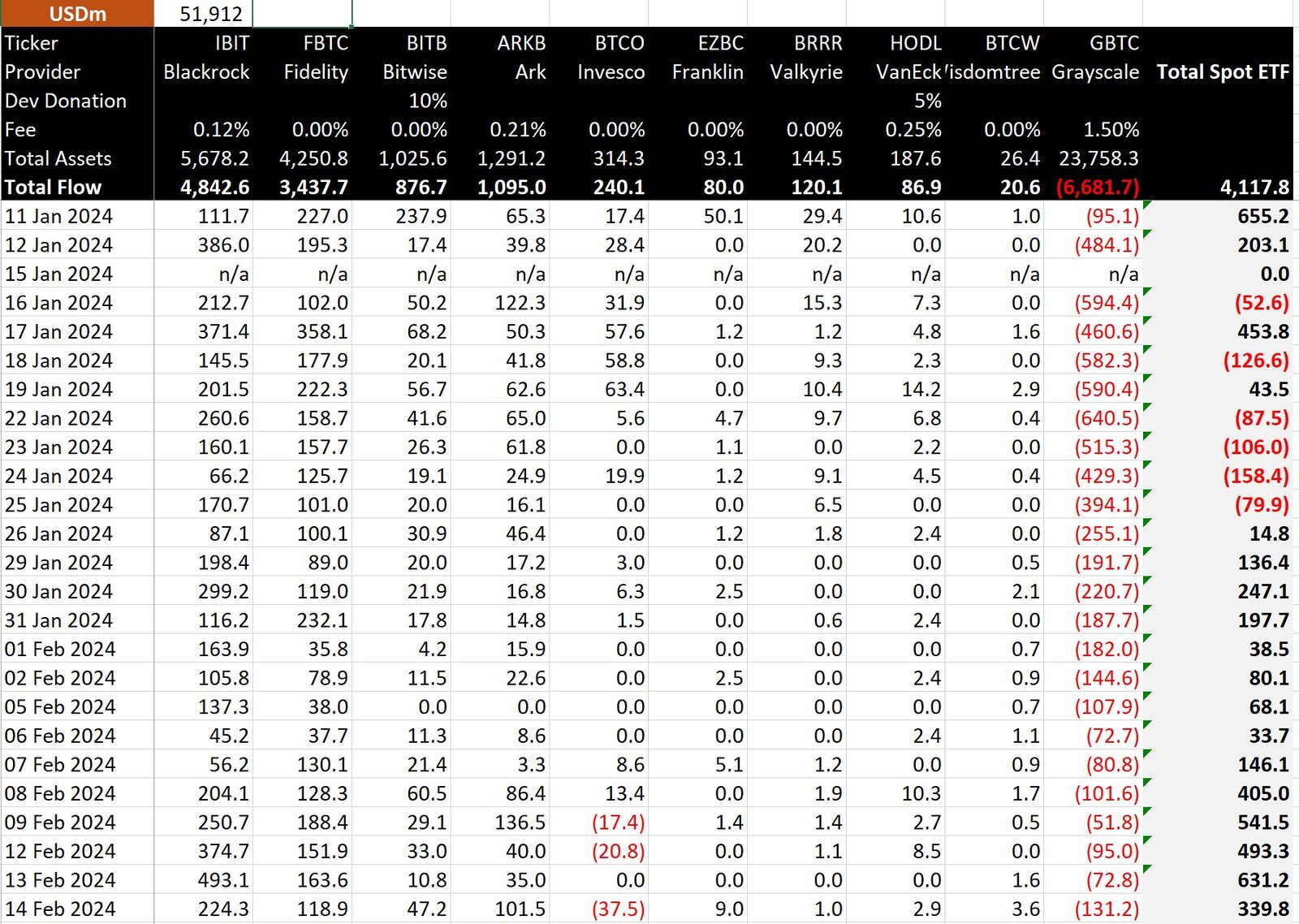

“We’re witnessing total acceleration of #BTC ETF inflows. First 20 days of Trading ~ 42K BTC Inflows. Last 4 Days of trading ~ 43k BTC Inflows”

Spot Bitcoin ETFs Gain Momentum

Institutional interest in Bitcoin has been steadily growing, with ETFs emerging as a favored investment vehicle. These funds offer investors a regulated and convenient way to gain exposure to bitcoin without directly owning the digital asset. Recent data reveals that institutional investors are flocking to Bitcoin ETFs, pouring billions of dollars into these products within a short span of time.

On a similar note recently, Cathie Wood, CEO of Ark Invest, stated that investors are ditching gold for bitcoin, and that the introduction of bitcoin ETFs has shifted investors’ preference from the precious metal to the digital asset.

Digital-asset-related stocks on U.S. exchanges have also seen significant increases. In the past 48 hours, Coinbase Global Inc surged over 20% amid expectations of positive earnings, while Marathon Digital Holdings Inc rose 14%, and MicroStrategy Inc, the top corporate Bitcoin owner, gained 17%.

Stock of Bitcoin companies have skyrocketed in the past week, many jumping more than 50% to new highs.

Unprecedented Inflows in Just Four Days

The influx of capital into Bitcoin ETFs has been nothing short of astonishing. In the last four days alone, over $2.2 billion has flowed into these funds, surpassing the total inflows seen in the initial four weeks of trading. This rapid pace of investment underscores the growing confidence among investors in the potential of bitcoin as a long-term asset.

Data from BitMex research shows unprecedented inflows to bitcoin ETFs, especially BlackRock’s IBIT. With a daily inflow of over $493 million, BlackRock’s ETF saw its largest daily inflow since its introduction on January 11.

The liquidations’ numbers have also been noteworthy. During the past couple of days, according to data from Coinglass, short positions worth more than $250 million have been liquidated.

Spot Bitcoin ETFs Lead the Charge

The “New 9” Bitcoin ETFs have witnessed a remarkable increase in inflows, with over 43,000 Bitcoin pouring in within the last four days. BlackRock’s IBIT and Fidelity’s FBTC have been at the forefront of this surge in investment. This increase in demand highlights the growing acceptance of bitcoin as a legitimate asset class among both retail and institutional investors.

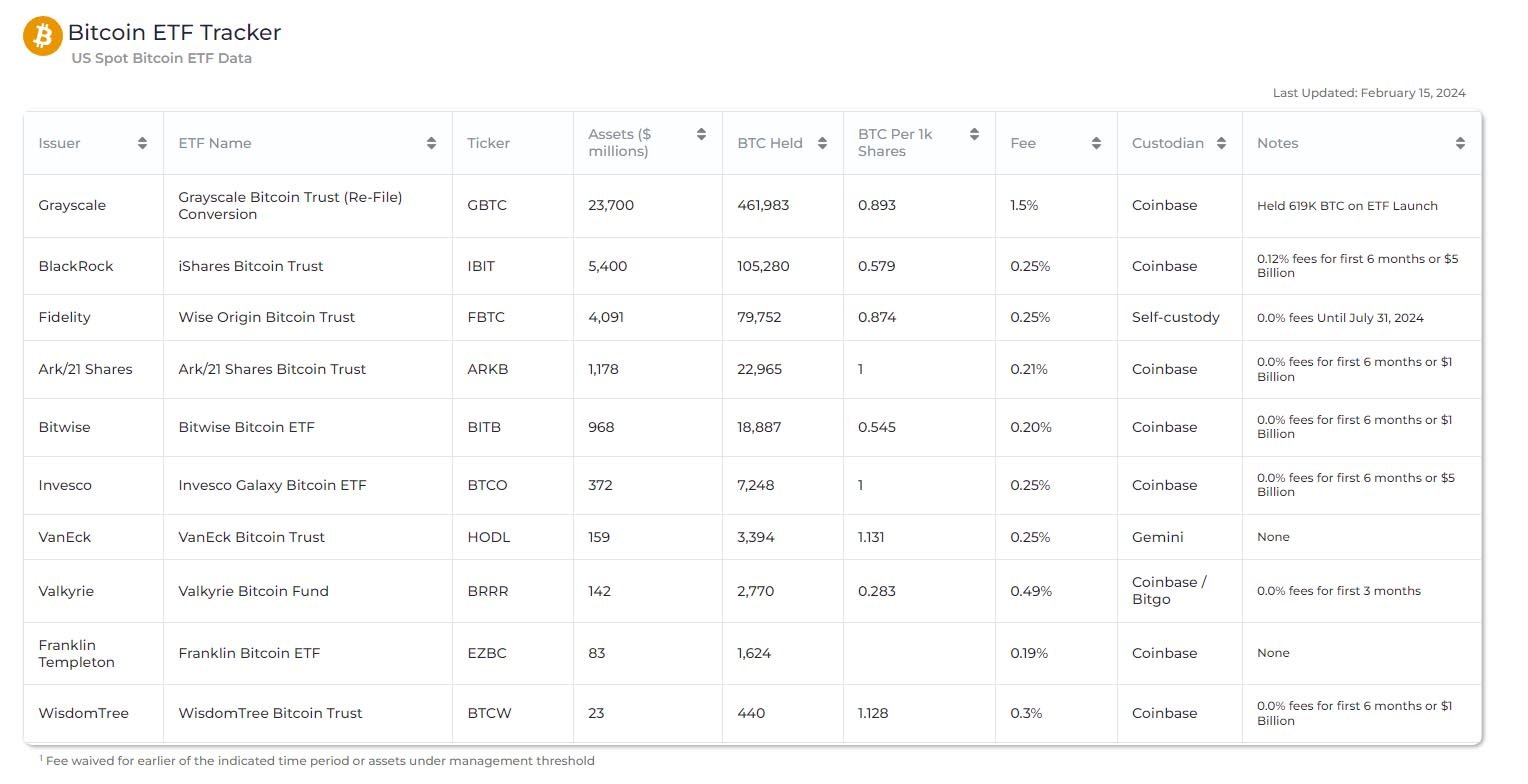

It’s worth noting that BlackRock’s iShares Bitcoin Trust saw record-breaking inflows, surpassing $5 billion in assets under management (AUM). Bitwise’s Bitcoin ETF also achieved a significant milestone, joining the elite “billionaire club” of funds with over $1 billion in assets.

Nate Geraci, who serves as the president of The ETF store, praised Bitwise’s performance as the most remarkable. He emphasized that Bitwise stood out as the sole investment fund focused on digital assets among the leading providers.

Eric Balchunas, Bloomberg Intelligence analyst stated:

“$IBIT is popping off, took in nearly half a billion all by itself yesterday, showing an unusually strong second wind for a new launch, is now over $5b which puts it in Top 7% of all ETFs by size in just 23 trading days.”

Grayscale Faces Outflow Challenges

While Bitcoin ETFs thrive, Grayscale, a prominent player in the bitcoin investment space, has faced challenges. Despite being a pioneer in the industry and the leading firm in AUM, Grayscale has experienced significant outflows as investors shift their focus to ETFs with lower fees. However, the company still holds a substantial amount of bitcoin, indicating continued interest in its products despite recent challenges.

Bitcoin’s Market Cap Hits $1 Trillion

The surge in interest in Bitcoin ETFs has coincided with a significant milestone for Bitcoin itself. The digital asset’s market capitalization has surpassed $1 trillion, solidifying its position as a major player in the global financial landscape. This milestone further validates Bitcoin’s status as a mainstream investment option.

This surge in bitcoin’s worth beyond $1 trillion, places the digital asset above Tesla’s market value, establishing bitcoin’s ranking alongside the world’s leading technology giants.

Notably, newly launched U.S. spot Bitcoin ETFs have surpassed $10 billion in AUM recently. BlackRock iShares Bitcoin ETF (IBIT) leads, exceeding $5.6 billion AUM. Continued growth is anticipated.

Outlook for Bitcoin and ETFs

Looking ahead, the future appears bright for both Bitcoin and ETFs. With continued interest from institutional investors and the potential approval of new ETFs, the stage is set for further growth in the digital asset market. Additionally, the upcoming Bitcoin halving event could fuel even greater investor enthusiasm in the coming months.

The surge in inflows into Bitcoin ETFs highlights the increasing institutional adoption of bitcoin as an investment asset. With record-breaking investments pouring into these funds, bitcoin’s rally seems poised to continue, paving the way for a new era of mainstream acceptance and adoption in the digital asset space.