Standard Chartered bitcoin price prediction was recently revised by the Bank, seeing upward potential increase to $150,000 from its previous estimate of $100,000, indicating a significant bullish sentiment among major financial institutions towards the leading digital asset. In a recent note, analysts at Standard Chartered, led by Geoffrey Kendrick, stated:

“For 2024, given the sharper-than-expected price gains year-to-date, we now see potential for the BTC price to reach the $150,000 level by year-end, up from our previous estimate of $100,000.”

Standard Chartered Bitcoin Sentiment: Rise in Institutional Interest

According to Standard Chartered, the narrative of bitcoin as “digital gold” continues to gain traction, bolstering its outlook for the digital asset. As the highly anticipated bitcoin halving event approaches, coupled with its fixed supply and positive underlying fundamentals, the bank foresees substantial room for further upside in the price of bitcoin.

The bank’s bold call highlights a notable shift in the stance of institutional players, reflecting a growing confidence in bitcoin’s potential as an investment asset. If realized, the projected increase to $150,000 would signify a remarkable 120% gain from the current levels of $67,000.

Spot ETFs’ Massive Inflows

The recent approval of spot bitcoin ETFs in the United States has also contributed to Standard Chartered’s bullish outlook. It believes that these regulated investment vehicles are attracting significant institutional demand, further bolstering bitcoin’s upward trajectory.

The analysts noted that spot bitcoin ETF inflows are surpassing the growth of bitcoin derivatives’ open interest, indicating a more sustainable positioning this time around.

the British multinational bank states:

“This means that while open interest measures are approaching stretched (2021) levels, overall positioning should be more sustainable this time. Most of the inflows are likely to be sticky pension-type flows.”

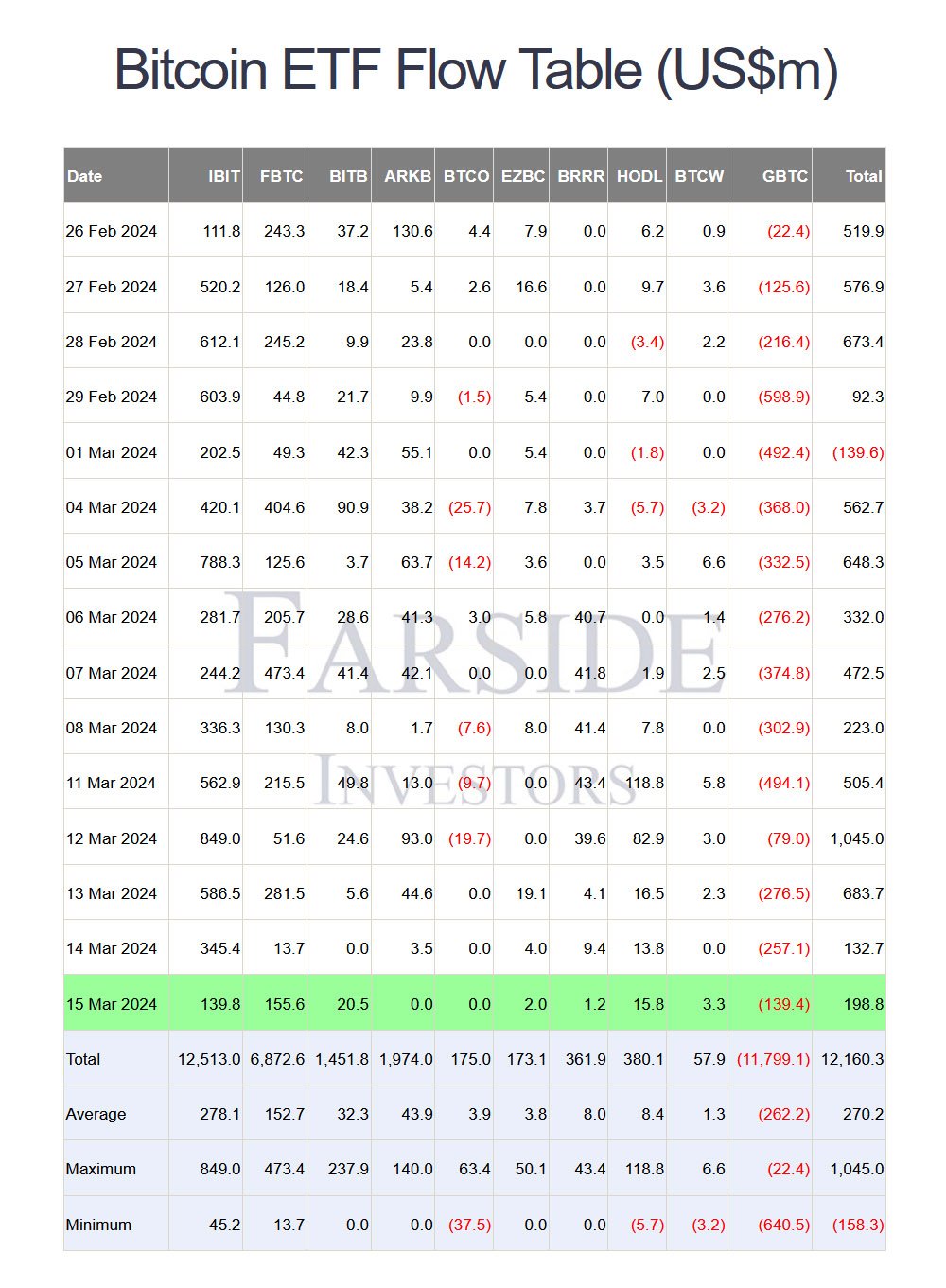

Notably, spot Bitcoin ETFs have collectively amassed more than $12 billion in net inflows since their launch on January 11. As per the latest data by BitMEX Research, March 15 marked a net inflow of $198.8 million.

$50B to $100B Inflows Ahead

Standard Chartered’s revised price forecast represents a 50% increase from its previous estimate of $100,000 for December 2023. With the impending Bitcoin halving and the approval of ETFs, the bank anticipates that bitcoin could attract inflows ranging from $50 billion to $100 billion within a year.

Looking ahead to 2025, Standard Chartered maintains its bitcoin price target of $200,000, citing parallels with the gold market. The analysts also highlighted the potential impact of the involvement of forex reserve managers, which could propel bitcoin’s price even higher, possibly reaching $250,000 at some point in 2025.

They believe:

“FX reserves are another large sticky (potential) cash pool, which could follow in the footsteps of new U.S. pension money. If they do, we would expect the largest and most liquid assets—such as bitcoin—to receive most of the inflows. We see a rising likelihood that large reserve managers may announce BTC buying in 2024.”

Standard Chartered Bank’s revised bitcoin price prediction underscores the growing institutional interest and confidence in the digital asset market. With supportive factors such as regulatory developments and increasing adoption, bitcoin continues to solidify its position as a viable investment asset.