Standard Chartered, one of the leading financial services firms based in the United States, has predicted that the price of Bitcoin (BTC) can surge to $200,000 by the end of 2025. This Standard Chartered Bitcoin sentiment is linked to the approval of Spot Bitcoin Exchange-Traded Funds (ETFs) in the country.

On January 8, Standard Chartered head of digital assets Geoff Kendrick and precious metals analyst Suki Cooper presented a report on Bitcoin, stating that “if ETF-related inflows materialize as we expect, we think an end-2025 level closer to USD 200,000 is possible.”

Standard Chartered Bitcoin Prediction: Inflows Worth Billions of Dollars

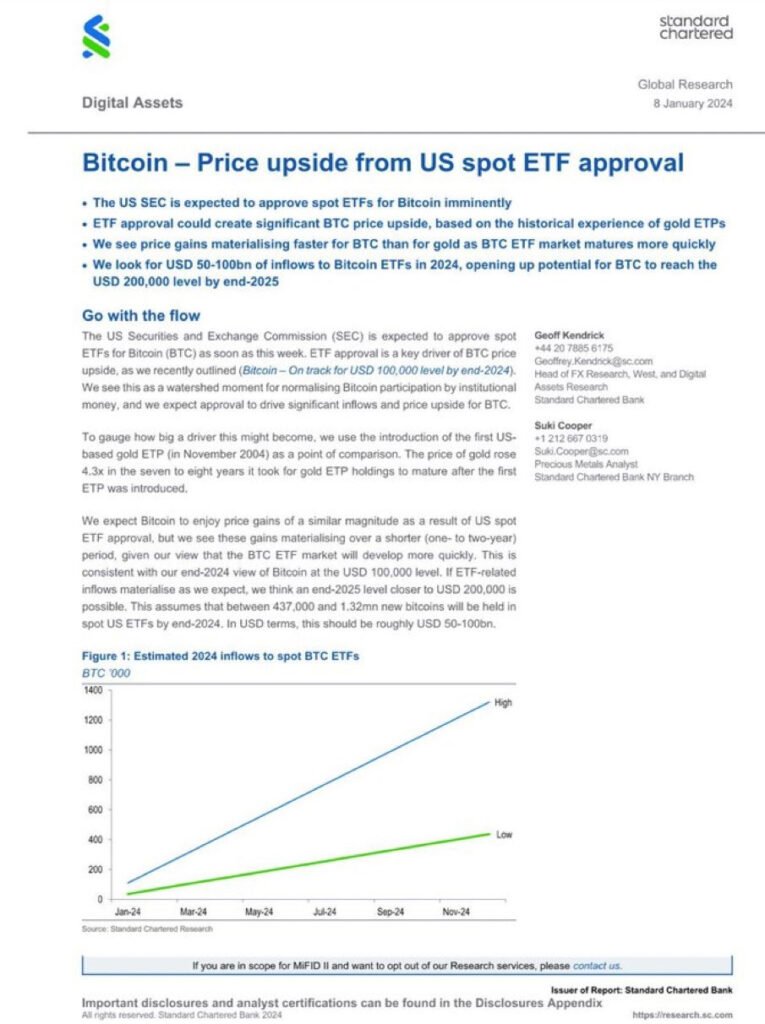

The Standard Chartered report based its prediction of BTC hitting the $200,000 mark by 2025-end on the assumption that Spot Bitcoin ETFs will hold between 437,000 and 1.32 million bitcoin by the end of 2024. The banking firm calculated that the approval of a Spot ETF by the Securities and Exchange Commission (SEC) would bring inflows worth $50–100 billion into the digital asset space.

The price of Bitcoin at the time of writing stands around $46,000, and based on the predictions of Kendrick and Cooper, BTC will witness a surge of 4.3 times by the time 2025 ends.

The report draws parallels with the historical performance of gold Exchange-Traded Products (ETPs), emphasizing a remarkable 4.3-fold surge in value approximately seven to eight years after the introduction of gold ETPs in November 2004.

Standard Chartered suggests that Bitcoin enthusiasts could witness a similar trajectory as they navigate the evolving landscape of digital assets, especially if the approval of Spot ETFs accelerates market development.

“We expect Bitcoin to enjoy price gains of a similar magnitude as a result of US spot ETF approval, but we see these gains materializing over a shorter (one- to two-year) period, given our view that the BTC ETF market will develop more quickly,” said the report.

Kendrick and Cooper further stated that they see the approval of a Spot Bitcoin ETF by the SEC in the United States as a “watershed moment” for the adoption and integration of the digital asset in the traditional finance industry.

Bitcoin to $100K by 2024-end

Standard Chartered has consistently remained bullish on Bitcoin. In November 2023, the company stated that the digital asset would reach a price tag of $100,000 by the end of 2024. “We now expect more price upside to materialize before the halving than we previously did, specifically via the earlier-than-expected introduction of US spot ETFs,” Kendrick said while adding:

“This suggests a risk that the USD 100,000 level could be reached before the end of 2024.”

Kendrick also suggested that due to the upcoming Bitcoin halving and surge in hash rate, BTC miners will continue to hoard their assets instead of selling them, pushing prices higher.

“Increased miner profitability per BTC (bitcoin) mined means they can sell less while maintaining cash inflows, reducing net BTC supply, and pushing BTC prices higher,” Kendrick noted.

Similar predictions have been made by Blockstream CEO Adam Back, who also stated recently that bitcoin has the potential to skyrocket to $100,000 prior to the approval of a Spot BTC ETF.