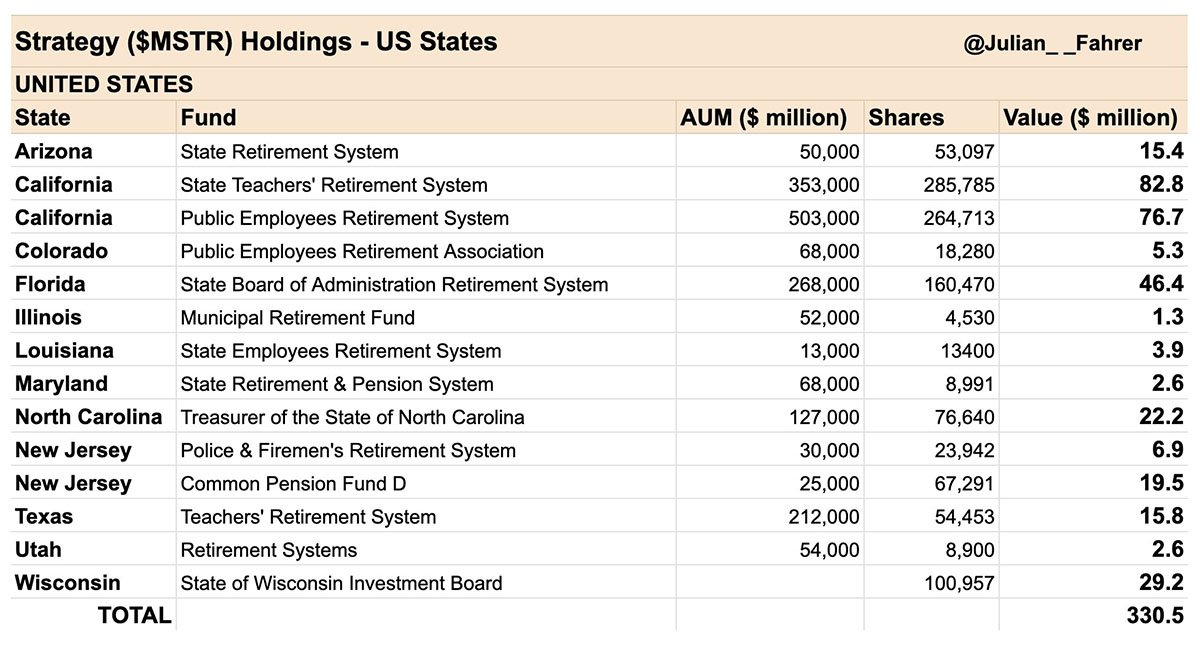

Twelve US state pension funds and treasuries have invested over $330M in Strategy (formerly MicroStrategy) making it a big player in institutional bitcoin exposure. California, Florida, Wisconsin and North Carolina lead the way according to recent filings.

Strategy’s surging stock price and massive bitcoin holdings have made it an attractive option for state-managed investment funds looking to get bitcoin exposure without buying bitcoin directly.

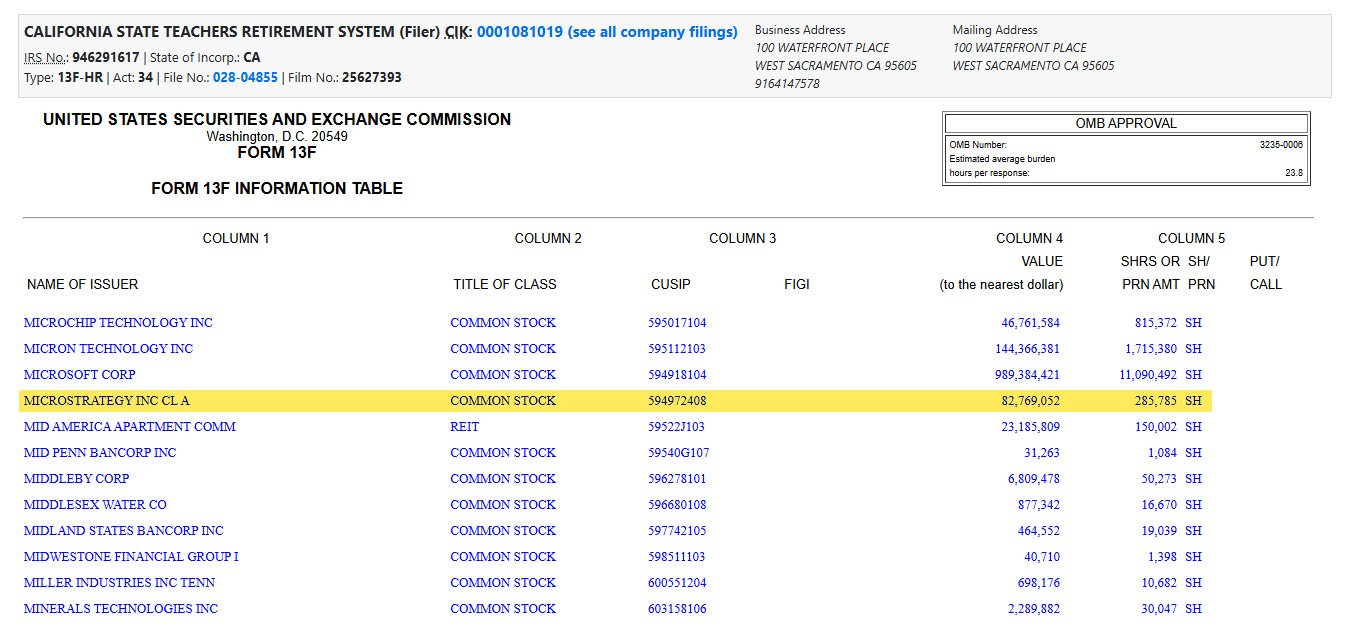

California is the largest investor in Strategy stock (MSTR). The California State Teachers Retirement System (CalSTRS) owns 285,785 shares of Strategy valued at around $83M according to a February 14 filing with the US Securities and Exchange Commission (SEC).

The California Public Employees’ Retirement System (CalPERS) also owns 264,713 shares worth approximately $76 million. In addition to Strategy, both funds also have big positions in Coinbase (COIN) the popular exchange.

California isn’t the only state investing in Strategy.

- Florida’s State Board of Administration owns 160,470 shares worth $46 million.

- Wisconsin’s State Investment Board holds 100,957 shares valued at $29 million.

- North Carolina’s State Treasury has invested $22 million in Strategy stock.

- New Jersey’s Police and Firemen’s Retirement System and Common Pension Fund together hold $26 million in shares.

Other states with investments include Arizona, Colorado, Illinois, Louisiana, Maryland, Texas and Utah.

The main reason seems to be Strategy’s vast bitcoin holdings. The company owns 478,740 BTC valued at around $46 billion at current prices. Instead of buying bitcoin directly, states are using Strategy as a way to get bitcoin exposure while still investing in a publicly traded company.

Bitcoin analyst Julian Fahrer said states are getting bitcoin exposure through strategic methods without buying it directly.

Since January 2025, Strategy’s stock has risen 16.5% and over the past year it has skyrocketed 383%, far outperforming the broader digital asset market which has gained 62% in the same period.

Recent bitcoin purchases have boosted investor confidence, and to top it off, Strategy bought 7,633 more bitcoin between February 3 and February 9 at an average price of $97,255 per BTC. This is all part of the company’s long-term strategy to accumulate bitcoin as its primary asset.

Despite its success, Strategy’s bitcoin-focused strategy also comes with risks.

In its Q4 2024 earnings report, the company reported a $670.8 million loss mostly due to a $1 billion impairment charge on its bitcoin holdings. This shows the volatility of bitcoin and the potential downside of such investments.

But Strategy is sticking to its plan. The company remains committed to its “21/21 Plan”, aiming to raise $42 billion over the next three years to buy more bitcoin.

This institutional bitcoin investment trend isn’t limited to Strategy. Lawmakers in several states are working on legislation that would allow state treasuries to invest in bitcoin.

Even at the federal level, U.S. President Donald Trump has started a working group to explore a federal digital asset reserve.