This article was published by Caleb Fenton on Substack.com

It is your human right to be able to store your wealth, and with bitcoin, you can exercise it for the first time.

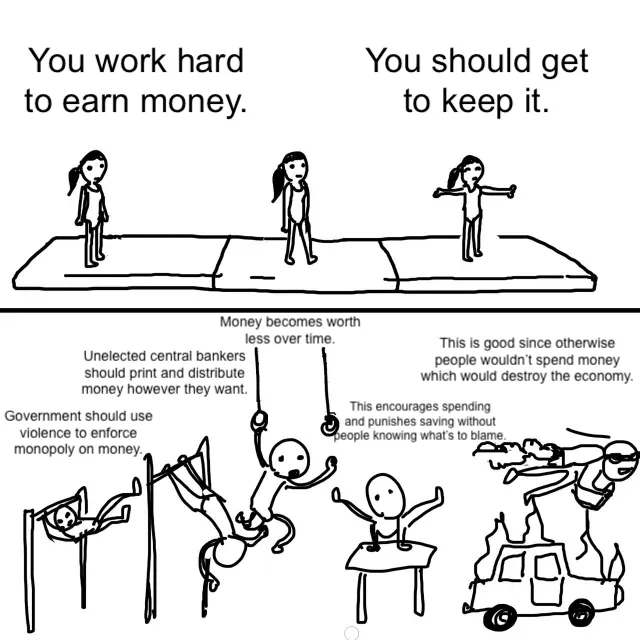

When someone pays you, it’s because you’ve done something valuable for them. The money is a measure of this value. If you make hamburgers and someone is willing to give you $5 for one, then that’s how valuable the hamburger is to that person. If you become rich selling those $5 hamburgers, it means society really appreciated your ability to provide hamburgers and were willing to reward you with more money so you can do whatever you want with it, hopefully make more hamburgers. In short, unless you’re stealing or lying to people, the money you earn is a measure of how much value you’ve provided to the world. Shouldn’t you be allowed to store that value over time? Shouldn’t it be as potent today as it is tomorrow, a week, ten years, or for your grandchildren?

To be clear, there are lots of ways to provide value to the world that don’t result in money — helping a friend move, taking care of children, mothering in general, watching your neighbors dog, charity work, introducing someone to Pink Floyd, and so on. I’m not trying to knock these things. They’re all good and important. They’re just not relevant to a conversation about money.

Related reading : Without Bitcoin You Could End Up Working Longer and For Less Money

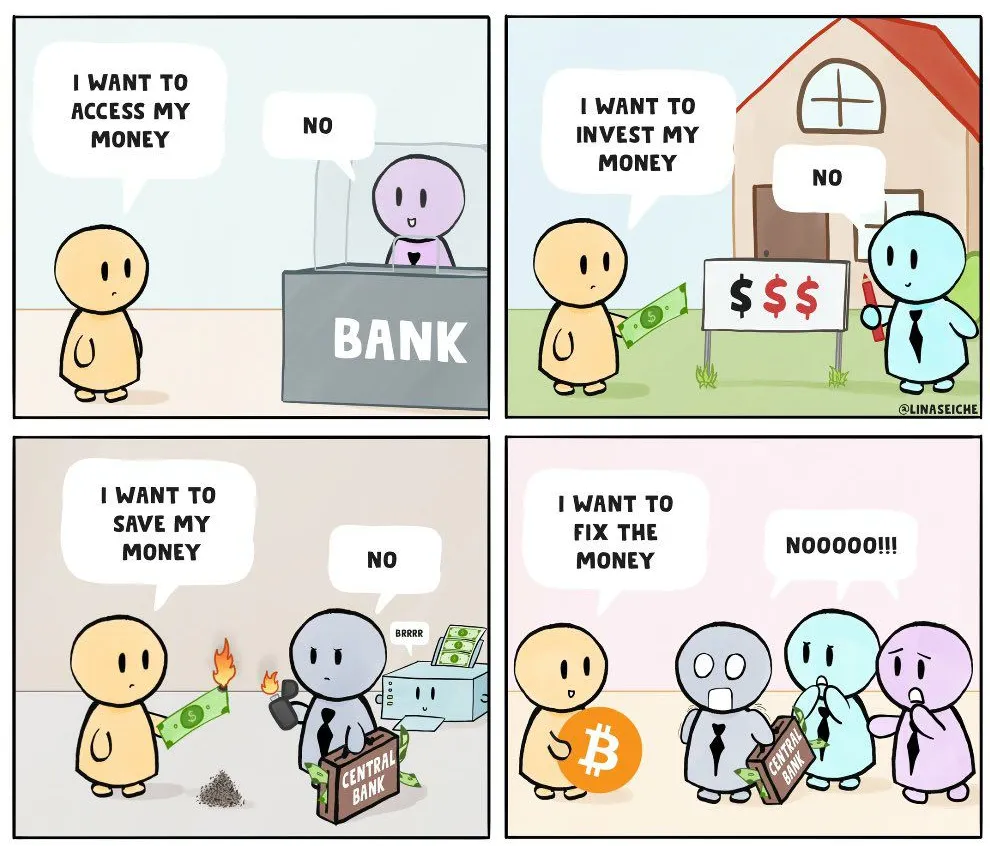

If you work hard, provide value to people, and they give you money, the value of your money is constantly being robbed by corrupt governments and central banks. This is why you can’t just put your money under a mattress for 50 years and preserve its value. If you could, I wouldn’t be writing this article and there wouldn’t be any point for bitcoin to exist. We don’t notice it because the theft is slow and the process is too complicated for most people to understand, but it doesn’t make it any less immoral and wrong. Storing your wealth is a human right just like speech, owning property, having children, and so on. People in power aren’t going to just walk away from free money, though. You can’t just expect them to stop being corrupt. In the past, the only way to acquire freedom was to fight for it, but bitcoin gives us a bloodless alternative: simply trade your broken money for good money. For the first time, there’s an unstoppable competitor to your government-issued fake money.

Related reading : The US Dollar Is A Ponzi You Shouldn’t Invest In

The Argument Against Storing Wealth

Believe it or not, the argument I just put forward goes against most mainstream thinking which believes the government should be in control of the money supply and without the wise stewardship of the central bankers printing money, we dirty, ignorant savages would ruin the economy by hoarding all of our money and not spending it. We’d rather starve to death in holes in the ground then spend money, apparently. Without someone slowly burning away the money and forcing us to spend it, we’d go into a deflationary death spiral. In my opinion, this is blatantly absurd and transparently convenient for those in power, and the mental gymnastics needed to believe it are vastly complex.

What if you disagree? Where do you vote for central bankers? Where is the people’s voice reflected in the central bank’s policies? No where! You don’t vote for central bankers, silly! This isn’t a democracy or a republic. You’re too dumb to be trusted with the magical workings of money. Pay no attention to the man behind the curtain!

Bitcoin changes this. Now, if you disagree with the premise that we shouldn’t be allowed to save our wealth, you can just buy bitcoin and hold it.

How Does Bitcoin Let You Store Your Wealth?

The price of bitcoin is unstable, but that’s a temporary result of how small and young it is. A large fraction of the bitcoin price is from people treating it like a speculative tech stock. When the markets are fearful, like they are now, the price of bitcoin and other speculative assets drop, like tech stocks. These investors don’t really understand the long term value of bitcoin or else they wouldn’t be selling. Everyone gets the price they deserve. So if you understand the technology, the value of sound money, and have a low time preference, you’re going to get a great price no matter what the price is. If your time preference is high and you need money now, don’t put much of your wealth in bitcoin. It’ll be there later when you want to store any extra you have. It may go up or down a lot in the short term, but in the long term, it’s going up.

Most importantly, there will only ever be 21 million bitcoin. There’s no CEO or company in charge of bitcoin that can change this. The government can’t just print more bitcoin when it wants to pay for something like stimulus checks or invading another country. The fixed supply of bitcoin is totally different than what we have right now in dollars and is a lot closer to how gold works. The problem with gold is that its supply is inflated by ~2% a year from gold mining. Although some of that 2% goes into industrial uses, there’s nothing preventing humanity from stumbling across a large gold deposit, discovering some means at creating it, mining it from space, and so on. In fact, a recent gold deposit was recently discovered in Uganda which is estimated to have ~320k tonnes of gold. Since the entire world only has ~170k tonnes right now, this represents a potentially large increase in the total amount. This will make gold worth less than it otherwise would have been worth unless it’s mined very slowly.

Related reading : Bitcoin Is Digital Scarcity

Not only is bitcoin not inflatable, but it’s also digital. You can store it in your head as a dozen “seed words”. Or you can have it on your phone. You could even have a normal wallet secured behind a password that you could give up if seized by the authorities and a second hidden wallet only revealed by a different password or derivation path. It’s just data and all the clever tricks and toys of hiding data can be used. You could store your bitcoin on a wallet that requires one or multiple trusted third parties to sign off on any large transactions.

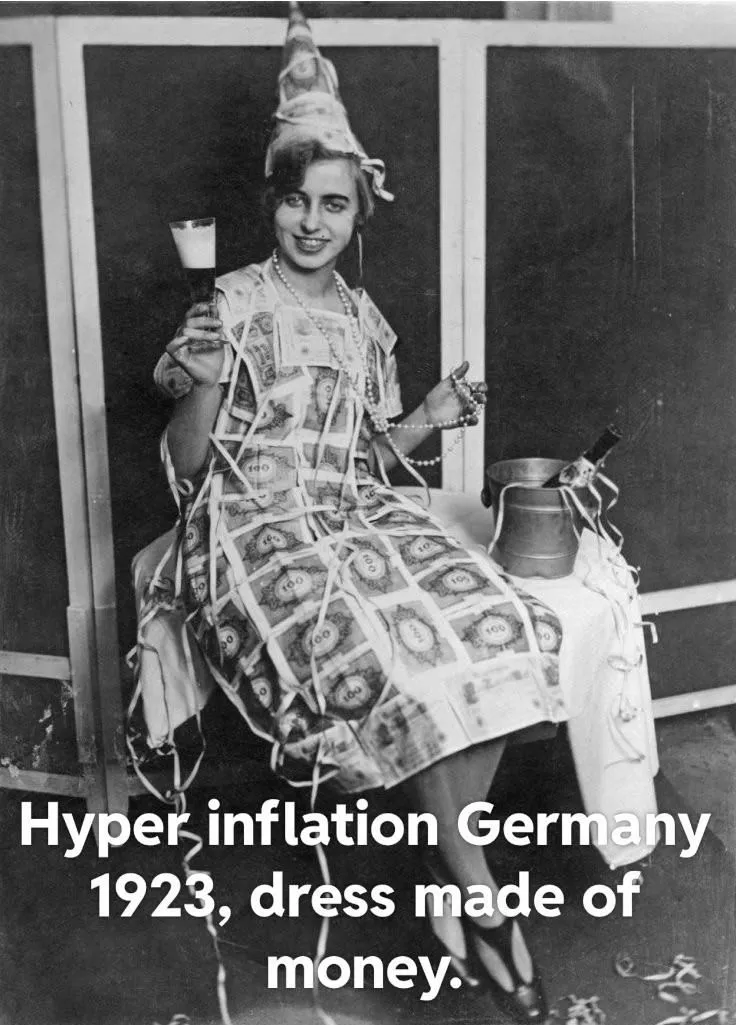

Economic slavery isn’t binary, it’s a spectrum. If you get to keep 0% of your wealth, then you’re 100% a slave. If you can keep 50% of your wealth, you’re “only” 50% a slave. Consider that the middle class in the united states pay 30-35% in income taxes. Add to that all the other taxes like sales tax, state tax, property tax, inheritance tax, licenses and fees, etc. Then remember that everyone loses 10-20% of their wealth every year due to inflation. You have people who are 60-70% economic slaves who work January, February, March, April, May, June, and some of July just for the government. And this is just if everything goes as expected, but what happens over and over again throughout history is the government creates too much money, which leads to hyperinflation, and everyone is greatly impoverished, lives are ruined, babies starve, and society takes decades to recover.

Do you feel like you’re getting good value from your government? When I talk to people in smaller countries, even those with +50% tax rates, people often say they do. This is probably because their government is smaller, more homogeneous, and more beholden to the people. But in the united states, the federal government is huge and growing, meddling all over the world, giving out money to corrupt governments, and the politicians are completely out of touch. Do they treat you like a valued customer or as a slave? Does Apple have to use violence to force people to buy their products or do people pay for them voluntarily? Do charities have to threaten to freeze someone’s bank account if they don’t donate or do people give freely because they believe in the work the charity is doing?

The historian and economist Thomas Sowell once asked his history professor where slavery came from. His teacher quickly responded: “That’s the wrong question. Slavery has been around forever. The real question is where does freedom come from.” In the past, freedom has come from brave men and women sacrificing their time, reputations, labor, energy, and in some cases lives so they could wrest some meager measure of independence and liberty away from the sociopathic, narcissistic, domineering hands of those in power. The bitcoin revolution doesn’t need to be as brutal. As long as you have a means of communicating, like the internet, and as long as there’s someone who’s willing to trade bitcoin for pseudo money, there will be an escape to self sovereignty and there will be a way to signal to the central banks that you’re not going to play their rigged game.

Is Bitcoin Really The Answer?

You don’t think about something until it stops working and it becomes a problem. This is normal and even necessary because reality is infinitely complex and you need some filtration mechanism to filter out the 99% that doesn’t matter and focus on what’s important. Most people don’t fully understand their cars, computers, the internet, their own bodies, and so on. You know how to use these things but they don’t manifest themselves in their entirety until they break and you have to figure out what went wrong. As a species, our money is broken. Most currencies in history have failed just like most species have gone extinct. The effects of the broken dollar are just now starting to be felt.

If you’re not having problems or you don’t appreciate the value of sound money, then congratulations, you’re the beneficiary of vast financial privilege that most of the world doesn’t enjoy. As I’ve written about previously, the world is sick and dying from broken money, and the effects used to be limited to ascending countries, but with the developing economic crisis, a lot of the lower and middle classes in descending countries are starting to be rudely woken up. They’re looking around for scape goats and many are starting to point fingers at the broken money. You can tell from all the inflation memes on Twitter and Reddit. Kids growing up in this environment are going to instinctively understand the central banks are not their friends and are not the wise stewards that you’re indoctrinated into believing in university economics classes.

If you evaluate money as a technology, bitcoin is clearly superior. It’s programmable internet money completely immune to corruption. It’s a fair playing ground for everyone. Even if you believe central banks should inflate the money supply, you can’t deny the temptation to over-inflate is irresistible and historically almost all monies have failed because of this. You also have to admit that monopolies are generally a bad thing. Why not have some currency competition? If government issued paper money is superior, it’ll win in the long run and you can ignore me. But do you really think people will choose to have their money inflated when there’s an alternative? May the best money win.