As the highly anticipated Bitcoin halving event approaches, the market is abuzz with excitement. Recent reports indicate a significant surge in demand for bitcoin, potentially signaling a supply shock that could drive prices higher in the near future.

Demand Outpaces Miner Issuance

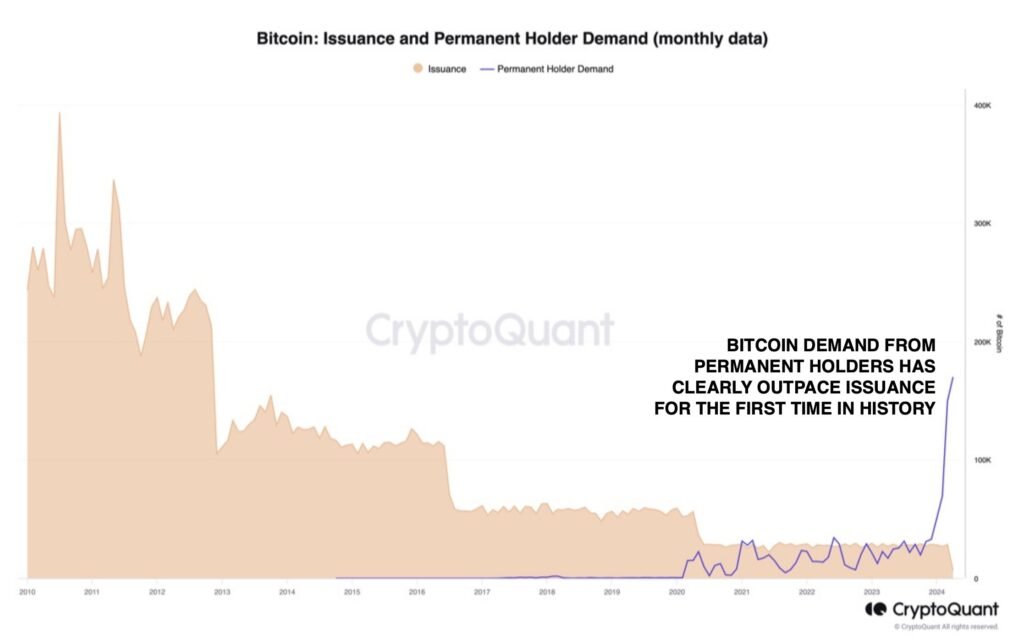

According to data from CryptoQuant, demand for Bitcoin from long-term holders, often referred to as “HODLers,” has surpassed miner issuance for the first time in history. This unprecedented phenomenon suggests a notable shift in bitcoin’s supply-demand dynamics. Analysts note that the cohort of long-term holders is adding around 200,000 BTC per month, far exceeding the monthly issuance of approximately 28,000 BTC.

CryptoQuant head of research, Julio Moreno, emphasizes the significance of this trend, stating, demand for the flagship digital asset “has become more important than supply.”

Interestingly, the data reveals that known exchange addresses now hold only 9.8% of bitcoin’s total circulating supply, indicating a decline in supply on exchanges as investors adopt a long-term holding strategy.

Implications of Decreasing Exchange Reserves

The diminishing supply of bitcoin on exchanges could potentially lead to a supply shock if demand were to suddenly surge. A supply shock occurs when the readily available supply of an asset on exchanges abruptly drops while demand increases. This buying pressure could drive prices higher, particularly as short sellers are forced to cover their positions to avoid liquidation.

Supply Shock: Halving Event and Supply Reduction

The impending Bitcoin halving event adds another layer of significance to the current market dynamics. Scheduled to occur on April 20, the halving will cut the coinbase reward miners receive per block found on the network in half, reducing it to 3.125 BTC. This halving, programmed into Bitcoin’s monetary policy to occur once every 210,000 blocks (approximately every four years), effectively halves the supply of newly minted BTC entering the market.

Opinions among digital asset executives vary regarding the potential impact of the halving event. Arthur Hayes, former head of BitMEX, anticipates price declines before and after the halving, citing limited dollar liquidity during this period. However, Marathon CEO Fred Thiel suggests that the halving’s impact may already be priced in, pointing to successful spot Exchange-Traded Fund (ETF) approvals as evidence.

Historical Trends and Future Outlook

Historical data on previous halving events provides insights into potential market trends. In each instance of historical halvings, bitcoin prices have surged, reaching higher highs and higher lows. Analysts emphasize the importance of considering supply and demand dynamics in evaluating bitcoin’s performance.

As the Bitcoin halving event approaches, the market is witnessing a surge in demand, potentially signaling a supply shock that could drive prices higher. With demand outpacing miner issuance and decreasing exchange reserves, market dynamics suggest a bullish outlook for bitcoin in the near future. As investors eagerly await the halving event, all signs point to a potential price rally ahead.