While several big names have called the launch of the Bitcoin Exchange-Traded Fund (ETF) a flop, it is still too early to make such statements. Thomas Young, the managing partner at RUMJog Enterprises, has recently outlined a compelling case for Bitcoin’s significant upward trajectory by the end of the year, based on bullish projections of the influence of Bitcoin ETF inflows.

This analysis comes at a time when Grayscale’s GBTC outflows have considerably slowed down, resulting in consistent net inflows over the past five days, ranging from $14.8 million to $247 million.

Bitcoin ETF Trends

Bitcoin ETF shares experienced a broad rise recently, marking consecutive days of gains. Simultaneously, Bitcoin rebounded about 9% over the past week after a dip from two-year highs near $49,000 in early January.

The launch of spot bitcoin ETFs on January 11 was initially labeled as a “sell-the-news” event, as some analysts predicted. However, profit-taking seems to be subsiding, and Grayscale Bitcoin Trust (GBTC) shares are rebounding, making a bullish move off a key level of support.

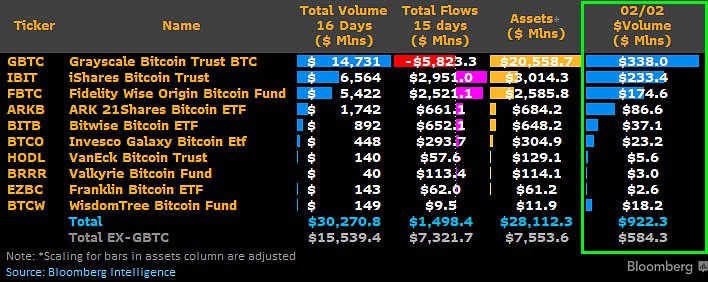

Since the launch of these ETFs after the SEC’s approval, Grayscale ‘s GBTC has experienced a net outflow of $5.8 billion, while iShares and Fidelity are leading in inflows, with $3 billion and $2.5 billion, respectively.

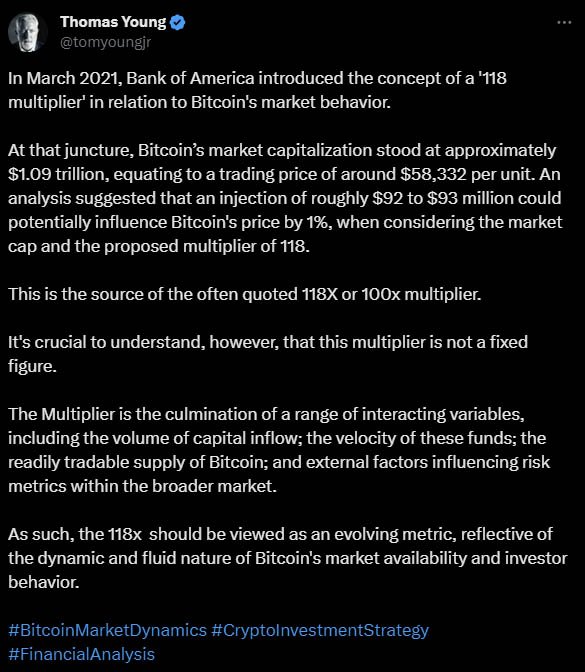

Thomas Young Cites The 118 Multiplier Concept

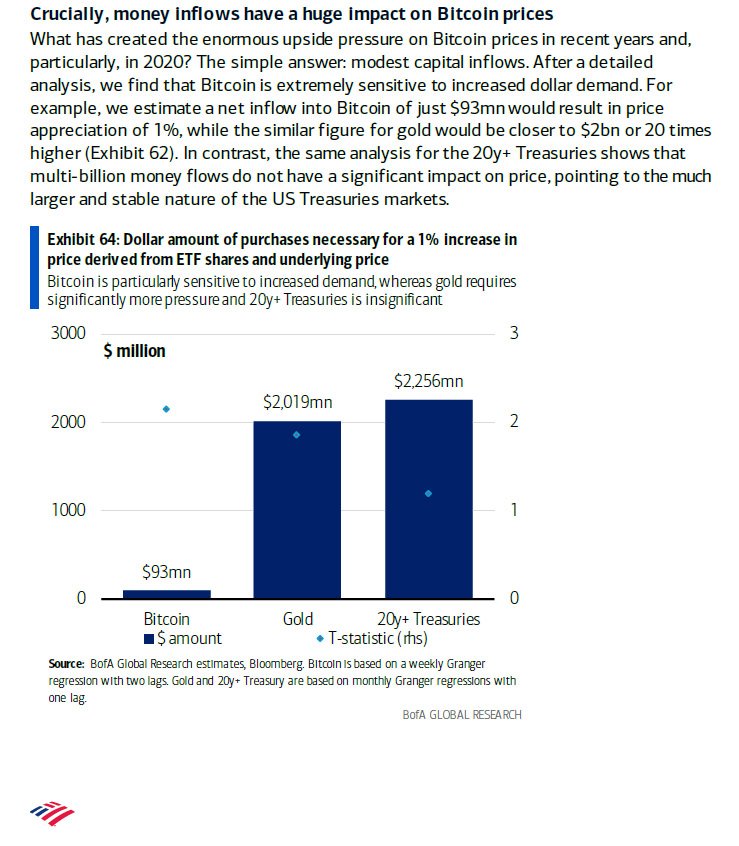

In a recent analysis released via X, Young shared the ‘118 multiplier’ concept, a metric introduced by the Bank of America in March 2021. Originally, this multiplier suggested that an investment influx of around $92 to $93 million was required to move Bitcoin’s price by 1%. At that time, bitcoin was standing at a market capitalization of around $1.09 trillion and a price of around $58,332.

Young’s forecast revisits and modifies this concept, emphasizing its dynamic nature. He believes that the 118x multiplier should be considered a dynamic rather than a fixed indicator, stating:

“The multiplier is the culmination of a range of interacting variables, including the volume of capital inflow; the velocity of these funds; the readily tradable supply of Bitcoin; and external factors influencing risk metrics within the broader market. As such, the 118x should be viewed as an evolving metric reflective of the dynamic and fluid nature of Bitcoin’s market availability and investor behavior.”

Year-End Price Projection

Young identifies a consistent surge in Bitcoin ETFs, registering an average daily influx of 4,193 BTC. This daily inflow translates to a staggering $176 million in net new capital.

Notably, to enhance the precision of his forecasts, Young adjusts this figure to $150 million daily, evenly distributed across the typical 20–23 trading days each month. He employs a more cautious multiplier of 50x, in contrast to the original 118x or 100x, to conduct a meticulous calculation.

This conservative approach yields an estimated monthly upward pressure of $8,000 per bitcoin, consequently projecting the year-end target to reach at least $131,000 for bitcoin.

Adjusted Analysis and Monthly Predictions

The refined analysis also considers irregularities witnessed in January, specifically the one-time selling occurrence of GBTC. Young revises the January dataset to present a more accurate depiction of the trend for the remaining months of the year. Young states:

“We know that capital will not flow uniformly and other factors could drive up the multiple from 50x. But the rough rule of thumb is this. The monthly BTC gains across all ETF’s times $2 will give you the predicted lower bound price effect of the ETF growth.”

Based on this model, Young’s monthly bitcoin price predictions, assuming ETF inflows continue at the observed rate in the first 15 days, are detailed as follows:

| Month- 2024 | Young’s BTC price prediction |

| January | $42,000 |

| February | $50,022 |

| March | $58,044 |

| April | $66,448 |

| May | $74,852 |

| June | $82,492 |

| July | $90,896 |

| August | $99,300 |

| September | $106,940 |

| October | $115,726 |

| November | $123,366 |

| December | $131,388 |

Young’s analysis not only illuminates the potential impact of ETF inflows on the BTC price but also underscores the intricate and fluid nature of digital asset markets. Nonetheless, various external events, such as the upcoming BTC halving and macroeconomic shifts like Fed rate cuts, would introduce potential complexities, molding this price prediction to some extent.