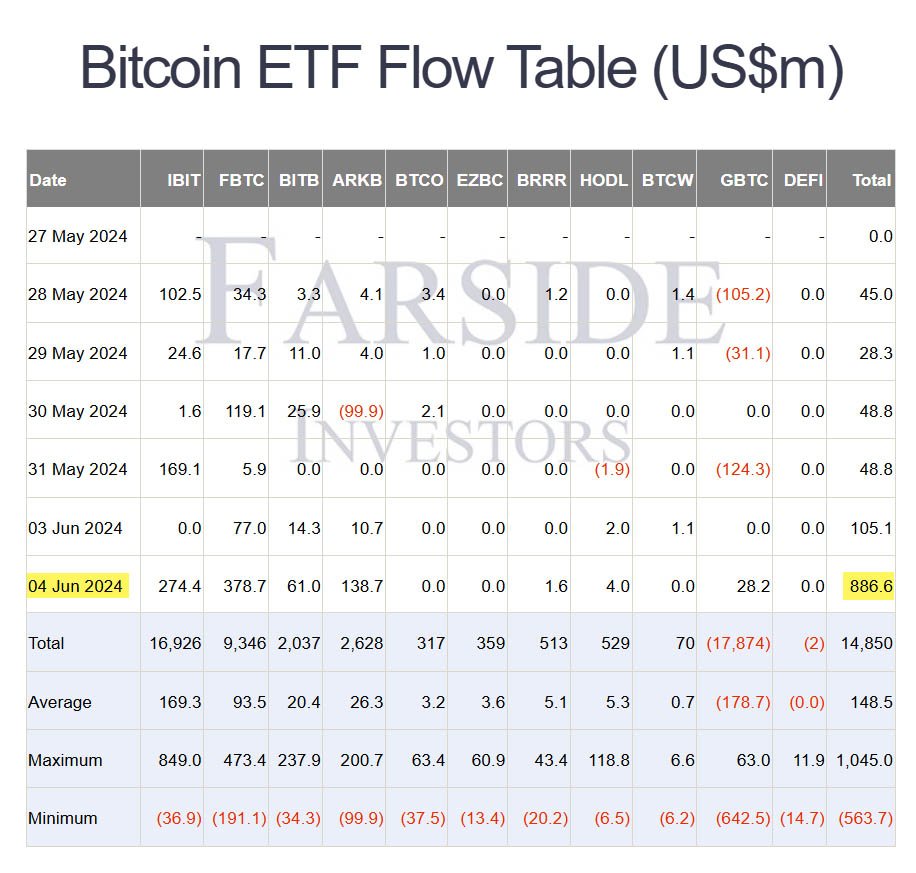

In a remarkable show of investor interest, U.S.-based spot Bitcoin exchange-traded funds (ETFs) have recorded their second-highest ever net inflow day.

Preliminary data indicates that these ETFs pulled in a staggering $886.6 million, underscoring a resurgence of confidence in the Bitcoin market. These Bitcoin ETF inflows are the highest since March 12, when Bitcoin ETFs collectively saw over $1.04 billion in net inflows.

At the forefront of this influx was the Fidelity Wise Origin Bitcoin Fund (FBTC), which attracted a significant $378.7 million.

Fidelity’s performance was closely followed by BlackRock’s iShares Bitcoin Trust (IBIT), which brought in $274.4 million. The ARK 21Shares Bitcoin ETF (ARKB) also performed well, netting $138.7 million.

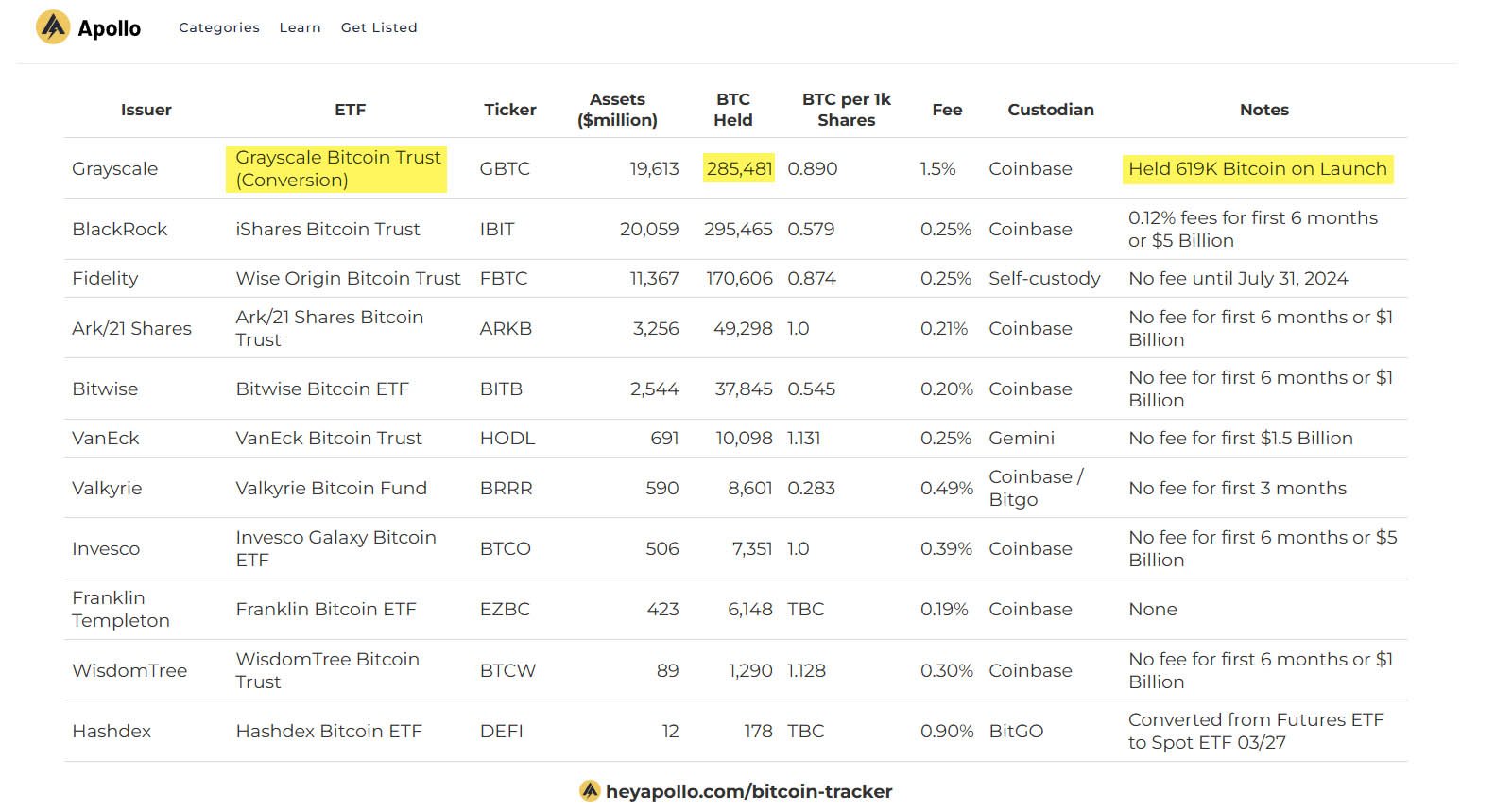

Interestingly, the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow day, pulling in $28.2 million. This marks only the seventh time GBTC has seen net inflows since its conversion from a closed-end fund to a spot ETF in January.

GBTC has historically faced significant outflows, with over $17.8 billion in net outflows attributed to its high management fee of 1.5%, compared to lower fees of competitors like BlackRock, which charges just 0.25%.

Grayscale’s Bitcoin fund originally contained 620,000 BTC when the spot Bitcoin ETFs were introduced, but it has now decreased to 285,481 BTC, valued at $19.6 billion, as reported by Apollo.

This surge in Bitcoin ETF inflows coincides with a broader bullish trend in the Bitcoin market. Bitcoin itself rose to over $71,000 during Asian trading hours, adding 3% in the past 24 hours.

Industry experts have been vocal about this renewed investor interest.

Nate Geraci, president of The ETF Store, addressed skeptics on social media platform X, saying:

“I was told several months ago that all of the ‘degen retail’ investors who wanted to buy had already done so [and] there was nobody left. How can this be?”

Eric Balchunas, a senior ETF analyst at Bloomberg, highlighted that the ETFs have taken on $3.3 billion in the past four weeks, bringing their net year-to-date inflows to over $15 billion.

He described this trend as a “third wave” turning into a “tidal wave,” reflecting the substantial and growing interest in these investment vehicles.

Balchunas added:

“Big-time flows all around today for The Ten […] The ability to bounce back with renewed interest after a couple of nasty selloffs is rare for hot sauce-type strategies. [It] shows staying power.”

Farside Investors and HODL15Capital provided the detailed figures behind this massive influx.

The data shows that not all Bitcoin ETFs saw the same level of interest. While Fidelity’s FBTC and BlackRock’s IBIT led the pack, other ETFs from issuers like Invesco Galaxy, Franklin Templeton, WisdomTree, and Hashdex did not see any demand, with no net inflows recorded for June 4.

The recent inflows mark a significant turnaround for Bitcoin ETFs, which had experienced a period of flat to negative flows following an initial phase of enthusiasm earlier in the year.

According to data from Bloomberg Intelligence, U.S.-listed spot Bitcoin ETFs added $2.4 billion in assets over the past month. This resurgence was largely driven by BlackRock’s IBIT, which crossed the $20 billion mark in assets under management for the first time.

Since May 16, net inflows for Bitcoin ETFs have averaged $140 million per day. This figure is about 4 times the average daily mined bitcoin. BlackRock’s IBIT led the charge, pulling in $1.1 billion during this period.

This steady inflow suggests a strong and growing interest in Bitcoin ETFs among investors, a sentiment echoed by experts across the industry.

Some believe the ongoing U.S. presidential campaign has fostered a favorable environment for digital assets, contributing to this renewed investor interest in Bitcoin ETFs.

This surge in March led to bitcoin reaching an all-time high of $73,679 the following day. The current inflows, while slightly lower, still represent a significant vote of confidence from investors.