U.S. Bitcoin exchange-traded funds (ETFs) have experienced a dramatic period of outflows, with nearly $1.2 billion pulled from these funds over just eight days up to September 6.

This represents the longest run of daily net outflows since their launch at the start of 2024, reflecting growing unease among investors as global markets face economic uncertainty.

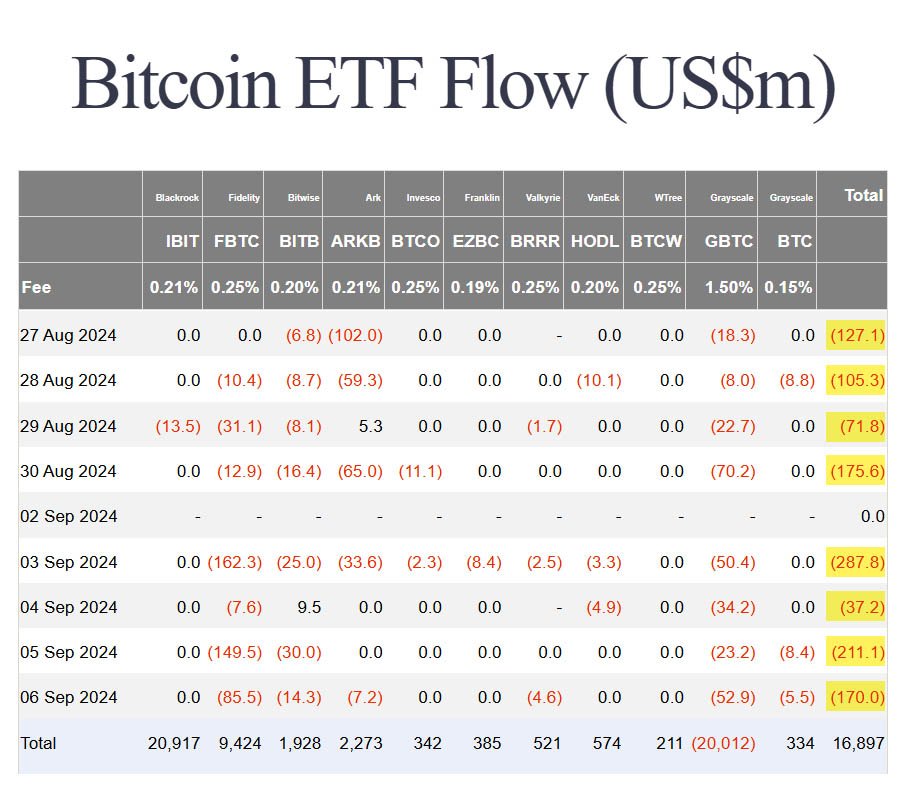

The outflows from the 12 U.S. Bitcoin ETFs, including funds managed by well-known financial giants like Fidelity, Grayscale, and Bitwise, have spooked many in the bitcoin market.

The largest withdrawals included $211 million in just one day, with Fidelity’s Bitcoin ETF, FBTC, seeing $149.5 million of outflows in one session. Grayscale’s GBTC also reported heavy losses, with $53 million in outflows on September 6.

Overall, Grayscale’s flagship product has seen a staggering $280 million in withdrawals since August 27. This marks one of the largest sets of withdrawals since May, indicating growing panic among investors.

The decline in these ETFs isn’t happening in a vacuum. It comes amid a broader retreat from riskier assets, with market participants wary of mixed economic signals, including fluctuating jobs data in the U.S. and deflationary pressures in China.

The impact of these factors has been felt across global markets, and bitcoin, known for its volatility, has not been spared. As the correlation between digital assets and traditional stock markets strengthens, bitcoin’s price has mirrored fluctuations in equity markets.

September has proven to be a challenging month for bitcoin, which has posted a loss of approximately 7%. Although there was a slight recovery over the weekend, with bitcoin climbing about 2% to $56,200 by Monday morning, the overall sentiment remains cautious.

Related: Investors Face “Extreme Fear” as Bitcoin Drops Below $54,000

Sean McNulty, Director of Trading at Arbelos Markets, attributes the modest rally to some prominent market influencers closing out their short positions.

He cited a social media post from Arthur Hayes, co-founder of BitMEX, as a sign of traders’ attempts to manage risks in an uncertain environment.

Adding to the uncertainty is the political climate in the US. An improved showing by Donald Trump, a pro-Bitcoin Republican nominee for the upcoming presidential election, in recent polls and prediction markets may have provided some relief to bitcoin’s downward trend.

McNulty explained that, interest in options hedges has surged in anticipation of Tuesday’s debate between Trump and Democratic nominee Kamala Harris, who has not yet stated her position on Bitcoin.

The spike in ETF outflows can be attributed to several factors.

Global economic challenges, including concerns about slower growth, inflation fears, and geopolitical tensions, are making investors wary. The U.S. Federal Reserve’s stance on interest rates, particularly any signals toward future rate cuts, also plays a role in shaping investor behavior.

Bitcoin’s year-to-date rally has slowed, with its price now hovering between $53,000 and $57,000.

Caroline Mauron, co-founder of Orbit Markets, a provider of liquidity for digital-asset derivatives, noted that bitcoin will likely trade in its recent range until the U.S. releases consumer price data on Wednesday.

These upcoming inflation figures could significantly impact expectations for future monetary policy and market sentiment.

The significant outflows from Bitcoin ETFs have sparked debates among analysts and investors. Some see this as a sign of a possible downturn, while others argue it could present a buying opportunity.

The market, they say, has seen similar downturns before that were followed by strong recoveries.

From a technical standpoint, bitcoin may be setting up a ‘death cross,’ a pattern often associated with further declines in price. However, another perspective suggests that this current period of market volatility might actually offer a good entry point for long-term investors.

The current environment is difficult for bitcoin.

As market sentiment remains fragile, investors and traders alike are keeping a close eye on economic data and political developments. The next few weeks could be critical for bitcoin and other digital assets as the market digests new information and looks for direction.

The global economic outlook remains uncertain, and Bitcoin ETFs continue to face significant volatility. For now, it seems the market will remain in a wait-and-see mode until clearer signals emerge from macroeconomic indicators and the evolving political landscape in the US.