The U.S. debt is higher than ever. Could a default scenario be beneficial for bitcoin?

Because the U.S. dollar is the world’s reserve currency, it’s critical to comprehend the consequences of the U.S. debt crisis for the global financial system’s survival.

Furthermore, while everyone is concerned about the highest inflation rate since 1981 (8.6% in May), the bigger picture is how inflation will help the U.S. government as well as solve the problem of all problems,

Will the U.S. default on its debt?

U.S. Debt Default & Debt Ceiling

To comprehend why the U.S. government can default on its debt, we must first examine and define two terms:

1. Debt default

The term refers to a borrower’s inability to repay a debt. It can be an individual default — when one person is unable to repay debt or a sovereign default — when the entire country is unable to repay its debt.

2. Debt ceiling

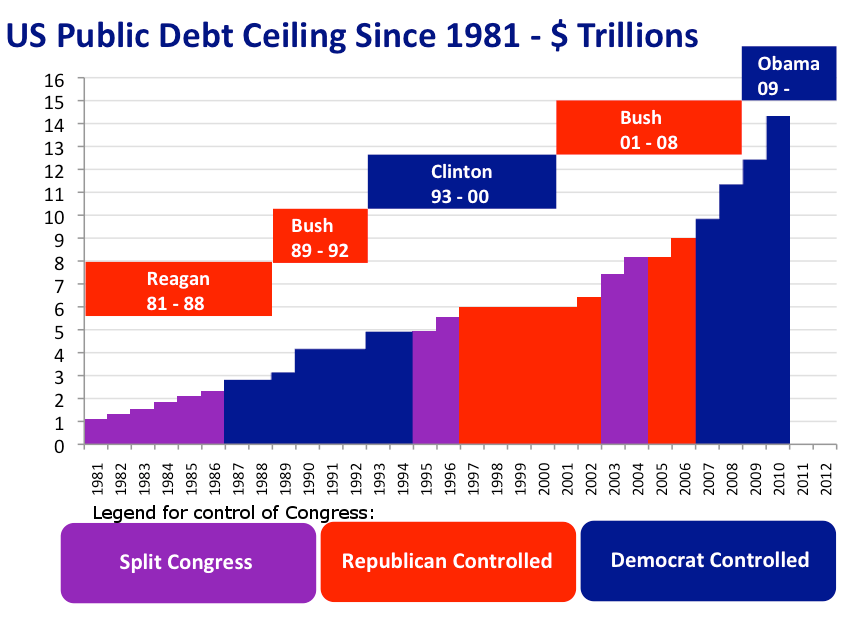

The debt ceiling refers to the amount of money that the U.S. Congress permits the U.S. government to borrow from the Federal Reserve Board (aka U.S. central bank). Simply put, the debt ceiling is a piece of paper that specifies the amount of money that the U.S. can use to pay down its debt. As a result, the debt ceiling must be raised from time to time to accommodate the growing debt.

The raising of the debt ceiling is often referred to as a crisis for the U.S. government. However, it’s a political show because the debt ceiling is always lifted, regardless of which administration is in power.

U.S. Debt

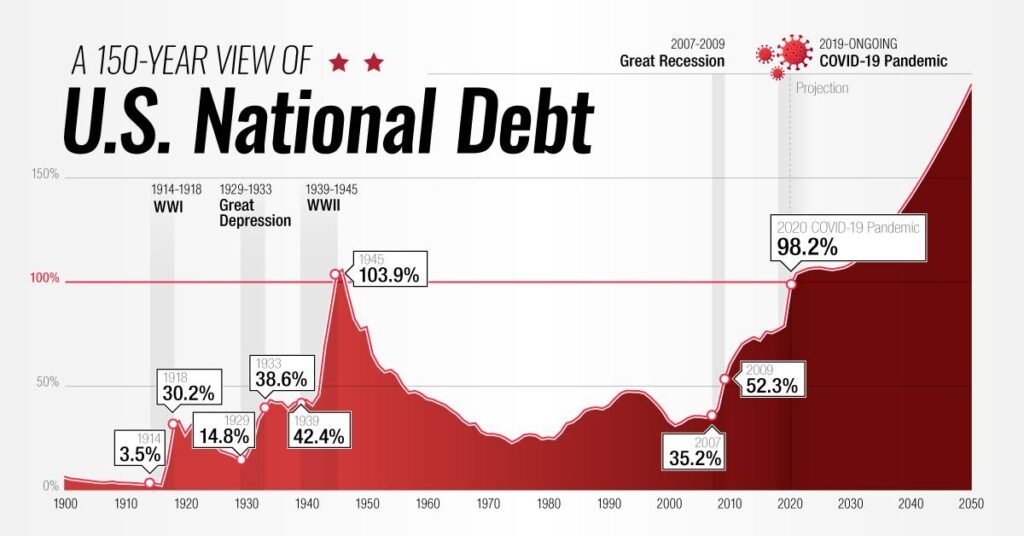

Since the U.S. abandoned the gold standard in the 1970s, the country’s debt has skyrocketed.

Main culprits as to why it has increased parabolically are:

- Money printing by the Federal Reserve (QE) to help the economy recover from various crises (GFC, Repo Crisis, COVID-19, etc.).

- Due to a scarcity of foreign investors (Russia, China, etc.), the Fed is monetizing the U.S. government’s debt.

- Excessive expenditure by the U.S. government — spending money that one does not have (e.g., government bills, military, Social Security, etc.).

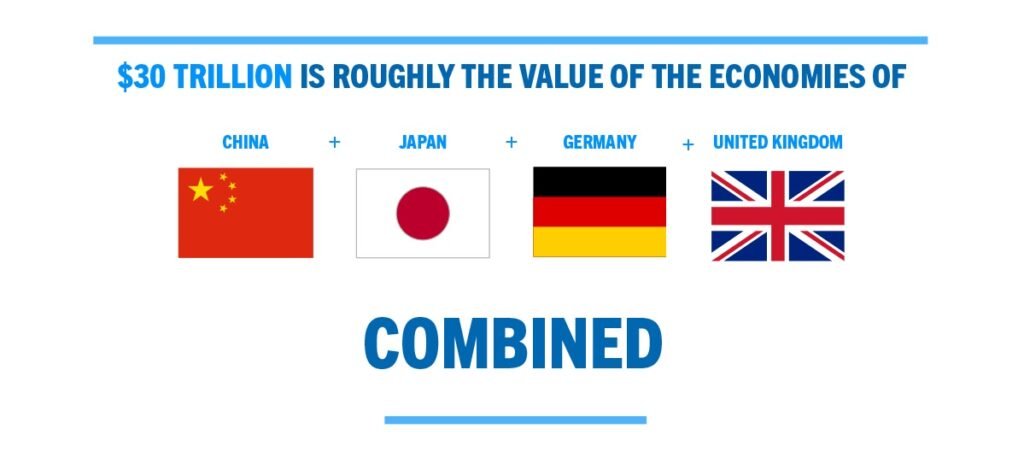

The debt-to-GDP ratio, which is simply a comparison of revenue and expenses, is a more worrying statistic. The U.S. debt to GDP ratio is 125% at the time of writing. Once a country’s debt-to-GDP ratio exceeds 130%, it approaches a point of no return. A government may struggle to cope with the expense of its debt, as the key threshold line between sustainability and unsustainability is razor-thin.

Debt Spiral Scenarios

The U.S. government has three options as a result of the aforementioned circumstances:

- Hard default – the U.S. will not pay its debt in full.

- Austerity measures – the U.S. would have to begin living within its means.

- Soft default – the U.S. would default on its debt, but in the long run.

Hard Default

This would be devastating for investors, as U.S. Treasurys are recognized for being a low-risk consistent cash flow investment. However, countries have defaulted on their obligations in the past:

- Spain has defaulted numerous times, despite importing large amounts of gold at a time,

- Russia defaulted in 1999 due to deteriorating productivity and a chronic budget imbalance,

- Argentina defaulted in the early 2000s due to rising inflation, and

- Greece defaulted in the mid-2010s as a result of failing austerity policies implemented in the aftermath of the GFC.

Because the U.S. economy is highly leveraged and financialized, a severe default would be disastrous for the global financial system. A global currency hard default would almost likely result in a stock market crash, reduced consumer spending, lower tax revenue, and eventually economic catastrophe, starvation, and war.

Because the global financial system is “too big to fail,” the U.S. must roll over its debt, ruling out a hard default.

Austerity Measures

Government actions that reduce the national debt by reducing expenditure or raising taxes are known as austerity measures. Government spending in the U.S. accounts for more than 30% of GDP, which, if reduced, would have a significant impact on the people. Changes in government spending include:

- limiting unemployment benefits,

- raising the retirement and health-care eligibility age,

- lowering government employees’ salary and benefits,

- decreasing social welfare programs for the poor, and

- tax reforms.

Austerity measures have the greatest impact on low-income individuals, as spending cuts have a negative impact on social safety nets. These policies would result in bloodshed, social unrest, riots, and other negative consequences. Unless it is a dictatorial state, the political regime would have to call off the bluff or risk being overthrown by its own people. The U.S. must continue to prop up its spending in order to maintain numerous government services for its citizens. As a result, the second alternative is extremely unlikely to become a reality.

Soft Default

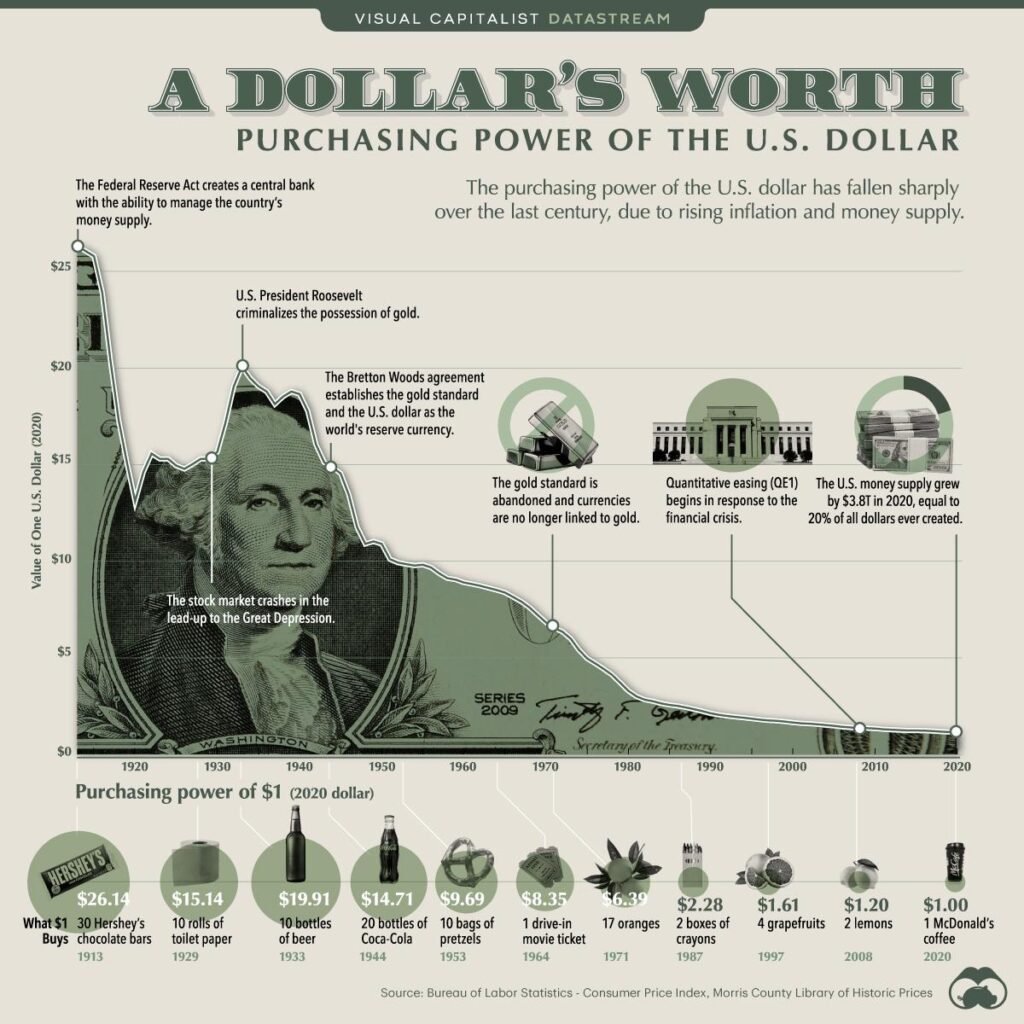

A more plausible possibility, known as a soft default, is for the U.S. to depreciate its own currency in order to repay its debt. Money printers (quantitative easing) are one way to achieve this, as they induce inflation, or a loss of purchasing power, which means that goods and services cost more while your income is worth less.

Inflation is a form of hidden taxation which is almost impossible to measure.

John J. Beckley

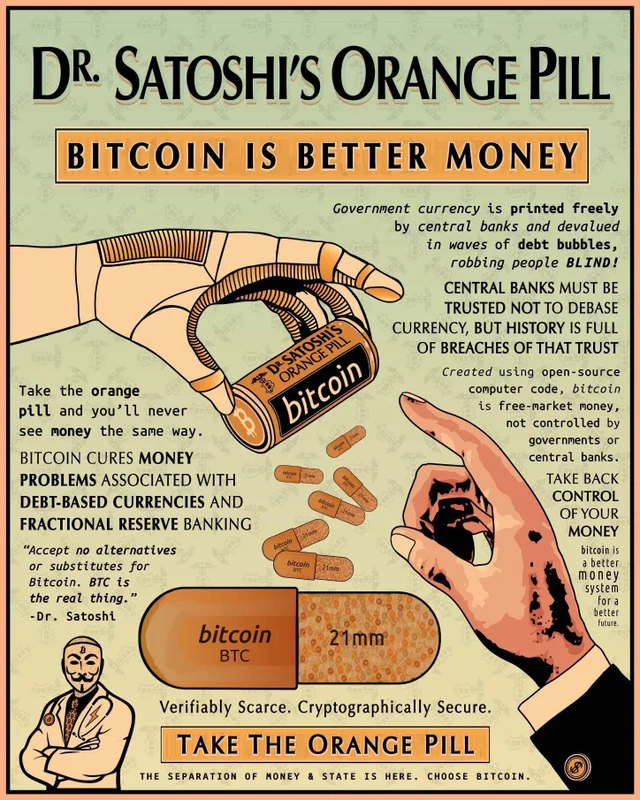

The U.S. dollar’s declining purchasing value over the last century suggests that the U.S. has been soft defaulting since 1913. Thus, you must hold scarce hard assets (trophy assets) in order to protect your wealth and weather the soft default.

Also, as recent news indicates, the U.S. has no wish to lose its global role as a global power by defaulting – destroying the dollar will never happen.

The @federalreserve Chairman Powell: “Looking forward, rapid changes are taking place in the global monetary system that may affect the international role of the dollar… FedNow service will be coming online in 2023… a US central bank digital currency would improve upon…” pic.twitter.com/q5jPwCIMbd

— Bitcoin (@Bitcoin) June 17, 2022

Maintaining the dollar as the world’s reserve currency while also building the digital dollar (CBDC), as I have discussed, will give the U.S. even more control and influence over international affairs.

Conclusion

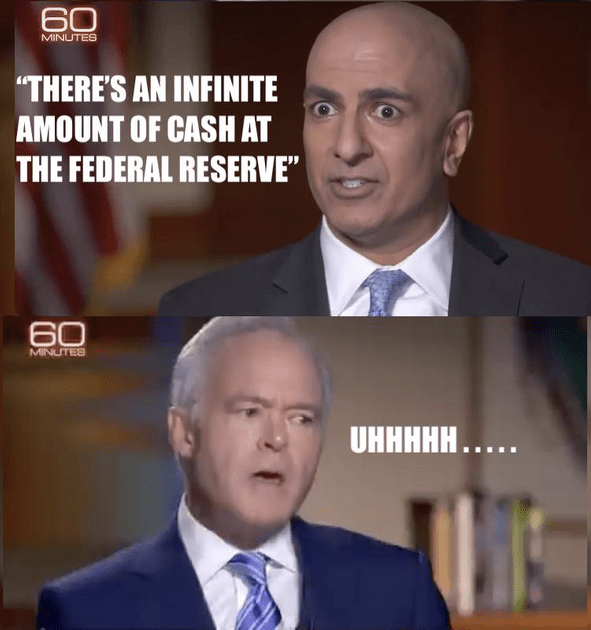

The U.S. will never default on its debt because doing so would result in instability, anarchy, rioting, and, eventually, war. However, because of how indebted and financialized the U.S. economy is, the U.S. government is unable to curb spending or raise interest rates, taxes, or other austerity measures. Instead, the U.S. will declare a mild default. The FED will continue to buy U.S. treasuries (U.S. government’s debt) with its magic printing machine, while gradually depreciating the dollar. According to Jerome Powell, the current chairman of the Federal Reserve, and verified by Neel Kashkari on 60 Minutes, the soft default is immune to criticism and also happens to be a simpler solution.

The Cantillon effect in the 18th century meant that the closer you were to the king and the affluent, the more you benefited, and the further you were from them, the more you suffered. Thus, due to the Cantillon effect, the wealthy will get even wealthier. Today, the FED’s quantitative easing benefits hedge funds and private equity firms, while hurting others in the process.

Let them eat cake if they don’t have any bread.

Marie Antoinette

The harsh red-pill reality about the current monetary and financial system, promotes Bitcoin as a monetary revolution that will improve the world. The orange-pill reality, Bitcoin system, will allow for the creation of a more equitable and simply better world for all. While the U.S. dollar and all other fiat currencies have an infinite supply, Bitcoin has a finite supply — the total number of BTC in circulation will never exceed 21 million. The monetary policy of Bitcoin is automated in the source code, making it predictable and independent of arbitrary human decisions.