According to a report by analytics firm K33 Research, there has been a surge of interest from U.S. investors in bitcoin, coinciding with increased institutional activity.

Institutional Investors Drive Bitcoin’s Price Up

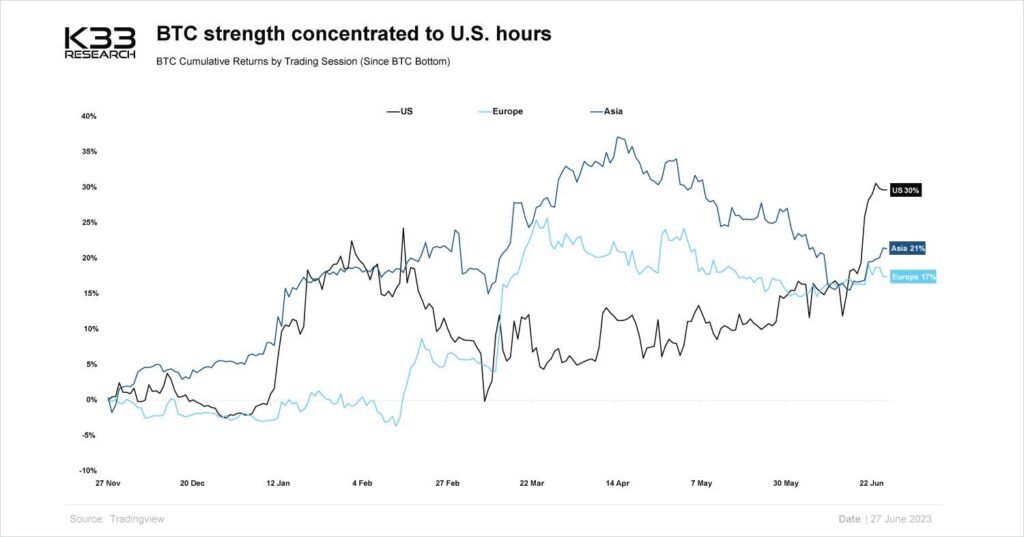

The surge of interest among U.S. investors has propelled the price of the largest digital asset by market capitalization to reach its highest level in 2023. Remarkably, recent data from K33 Research suggests that the price gains and trading volume of bitcoin have been predominantly concentrated during U.S. market hours, establishing them as the primary catalysts driving its strength.

According to data from TradingView, bitcoin has experienced an impressive 90% increase this year, surpassing the performance of the majority of the digital asset market. This surge in price coincides with notable involvement from influential financial players such as BlackRock, Fidelity, and Citadel, which has generated optimism among investors regarding bitcoin’s prospects.

Source : TradingView

However, smaller digital assets have faced challenges due to growing regulatory scrutiny surrounding their classification as unregistered securities. Consequently, trading platforms have taken precautionary measures by limiting the availability of these tokens to mitigate potential risks.

Related reading : According To SEC, Bitcoin Commodity, Cryptos Securities?

Related reading : U.S. Chamber of Commerce Slams SEC for Regulatory Uncertainty

K33 Research Report

According to the recent data by K33 Research, bitcoin’s cumulative returns by trading session has witnessed substantial cumulative gains of around 30% during U.S. market hours since its bottom at $16,000, surpassing the performance of Asian and European trading sessions.

The surge in bitcoin trading activity within the U.S. market was triggered by the recent filing of a spot bitcoin ETF by BlackRock, a prominent asset management firm, on June 14.

Source : K33 Research

K33 highlighted that bitcoin’s recent surge has occurred together with a notable decoupling from the performance of U.S. equities — including the S&P 500 and Nasdaq indices. According to K33, the 30-day correlation between bitcoin and these indices turned negative last week, marking the first time since January 2021.

The introduction of BlackRock’s initiative has sparked renewed institutional activity in the bitcoin market. The data suggests that open interest on the Chicago Mercantile Exchange futures market, which is a preferred platform among sophisticated investment firms, has been approaching its record-high levels.

According to a report by CoinShares, digital asset funds experienced significant inflows of $199 million last week, marking the highest amount in nearly a year. Notably, funds focused on bitcoin received the majority share of these inflows, accounting for 94% of the total.

This recent surge in activity indicates a turning point in the institutional adoption of bitcoin, as highlighted by Samir Kerbage, the Chief Investment Officer at Hashdex, a digital asset management firm.

He stated:

In short, we may be at a generational moment in time for individual crypto investors. The current institutional interest we are witnessing is far from the opportunistic FOMO we have seen in the past that can push prices up in the short term. These institutions move slowly and deliberately and invest for the long term—once they are in, they are in.