In a significant milestone for the Bitcoin market in Australia, the Australian Securities Exchange (ASX) is set to launch its first spot Bitcoin exchange-traded fund (ETF) on June 20, 2024.

The issuer of this pioneering product is VanEck, the global investment management firm. This development marks a pivotal moment for Australian investors and the broader acceptance of digital currencies in mainstream financial markets.

The VanEck Bitcoin ETF (VBTC) will debut on ASX, offering investors direct exposure to bitcoin. Unlike derivative-based digital-asset ETFs, this spot Bitcoin ETF will hold actual bitcoin.

This provides a secure and regulated avenue for investing in the digital asset, addressing common concerns about the volatility and cybersecurity risks associated with direct bitcoin investments.

The blog announced that VanEck bitcoin ETF, set to launch on the ASX on June 20, will be “the lowest cost bitcoin ETF in Australia.”

Arian Neiron, CEO and Managing Director at VanEck Asia Pacific, expressed the firm’s excitement about the launch, stating:

“The demand for access to Bitcoin via a listed vehicle traded on ASX has been increasing, and many of our clients have told us that their clients are already positioned to have an allocation ready to invest.”

He emphasized the significance of the launch, highlighting availability of the investment vehicle as a regulated financial product on the ASX.

Despite the polarizing nature of bitcoin investing, Neiron acknowledged that bitcoin is an emerging asset class that attracts interest from many advisers and investors.

The approval of the VanEck Bitcoin ETF by ASX follows a successful trend observed in other major markets. In the United States, 11 Bitcoin ETFs have been listed since January 2024, and Hong Kong has also introduced Bitcoin ETFs, albeit with limited success due to the smaller market size.

Related: Bitcoin Adoption in Hong Kong, A Financial Revolution

The ASX’s decision to approve a Bitcoin ETF reflects a broader acceptance of digital currencies in the global financial sector. Andrew Campion, ASX’s General Manager of Investment Products, attributed the previous delay in approving Bitcoin ETFs to the 2022 bear market.

He explained: “[…] But with the recovery of cryptocurrency prices, we’ve had a fair bit of interest over the last 12 months, and that’s culminated in the approval.”

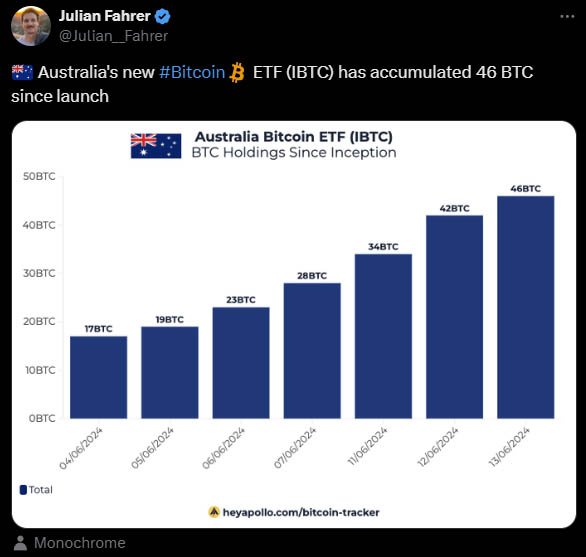

While VanEck’s Bitcoin ETF is the first to be listed on ASX, it is not the first Bitcoin ETF in Australia. The country’s second-largest exchange, Cboe Australia, listed the Global X 21 Shares Bitcoin ETF (EBTC) in April 2022 and the Monochrome Bitcoin ETF (IBTC) on June 4, 2024.

These products provided initial exposure to bitcoin for Australian investors, but the listing on ASX is expected to bring greater visibility and credibility to bitcoin investments.

The launch of VanEck’s Bitcoin ETF on ASX has generated significant excitement among investors. Both retail and institutional investors are expected to show strong interest.

For retail investors, the ETF offers a simplified entry point into the world of digital currencies, eliminating the need for navigating the complexities of Bitcoin wallets and exchanges.

Institutional investors will benefit from a regulated and liquid investment vehicle, making it easier to include bitcoin in their portfolios while ensuring compliance with regulatory standards.

Neiron emphasized the growing interest in Bitcoin, saying:

“Bitcoin has remained an emerging asset class that many advisers and investors want to access. VBTC also makes Bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects […] is no longer necessary.”

The approval of the VanEck Bitcoin ETF by ASX is expected to have a significant impact on the Australian financial market.

The ASX handles the majority of equity trading in Australia, and its endorsement of a Bitcoin ETF lends greater legitimacy to digital asset investments in the region.

This move is anticipated to attract more investors to the Bitcoin market, further integrating digital assets into Australia’s financial ecosystem.

The Australian Securities and Investments Commission (ASIC) played a crucial role in the approval process. VanEck acknowledged the challenges faced in bringing Bitcoin ETF to the market, including regulatory and exchange framework hurdles.

Despite these challenges, the launch of the ETF signifies a cautious yet progressive step in the acceptance of the scarce digital asset.

“Despite hurdles to clear in Australia, including regulatory and exchange framework challenges, along with ASIC approval, VanEck intends to lead the way in bringing the first Bitcoin ETF to ASX investors,” the blog noted.

The launch of VanEck’s Bitcoin ETF on ASX follows similar developments in the United States and Hong Kong, where Bitcoin ETFs have been met with varying degrees of success.

In the U.S., Bitcoin ETFs have amassed $57 billion in assets, highlighting strong investor interest. In contrast, Hong Kong’s spot Bitcoin ETFs have attracted a more modest $1.09 billion.

Analysts are comparing the potential impact of Bitcoin ETFs to that of gold ETFs, which spurred a bull market in gold prices following their introduction in 2004.

Bitcoin is often likened to gold as a store of value and an inflation hedge, and the launch of Bitcoin ETFs could similarly drive up bitcoin prices over time.