Renowned investment manager VanEck’s spot Bitcoin Exchange-Traded Fund (ETF) recently witnessed an unprecedented spike in trading volume shortly after filing a notice to reduce its fees.

This development marks a notable shift in the competitive landscape of bitcoin ETFs. VanEck HODL ETF has faced challenges in keeping pace with market leaders such as BlackRock, Fidelity, and Grayscale, which have dominated daily trading volumes since the introduction of new financial instruments last month.

In a strategic move to potentially enhance competitiveness, VanEck filed a notice with the Securities and Exchange Commission (SEC) on February 15, which signaled a fee reduction from 0.25% to 0.20%, effective February 21. Notably, both BlackRock and Fidelity impose a 0.25% fee on their offerings, with partial waivers for early investors.

VanEck HODL ETF: Surge in Trading Volume

Within less than a week of VanEck announcing a fee reduction for its spot bitcoin ETF, the fund experienced a staggering surge in trading volume. As of 1:50 p.m. ET on Tuesday, HODL surpassed $300 million in trading volume, exceeding its previous best day’s performance by more than tenfold.

Notably, the bitcoin-based ETF initially hit its highest daily trading volume of $25.5 million on its launch day, January 11, according to market data.

Eric Balchunas’ Insights

Bloomberg senior ETF analyst Eric Balchunas expressed his astonishment at HODL’s remarkable performance, noting a 14x increase in volume over its daily average.

He highlighted that the surge was not attributed to a single large investor but rather resulted from an extraordinary 32,000 individual trades. This represents an impressive 60x increase over the average individual HODL trades.

Balchunas discussed the potential reasons for the surge. He raised questions about whether the ETF was added to a new platform over the weekend. The ETF analyst noted that generally, when the daily volume surpasses an ETF’s total assets, it suggests a significant creation event, emphasizing the uniqueness of the situation.

Surge in Volume in Broader ETF Space

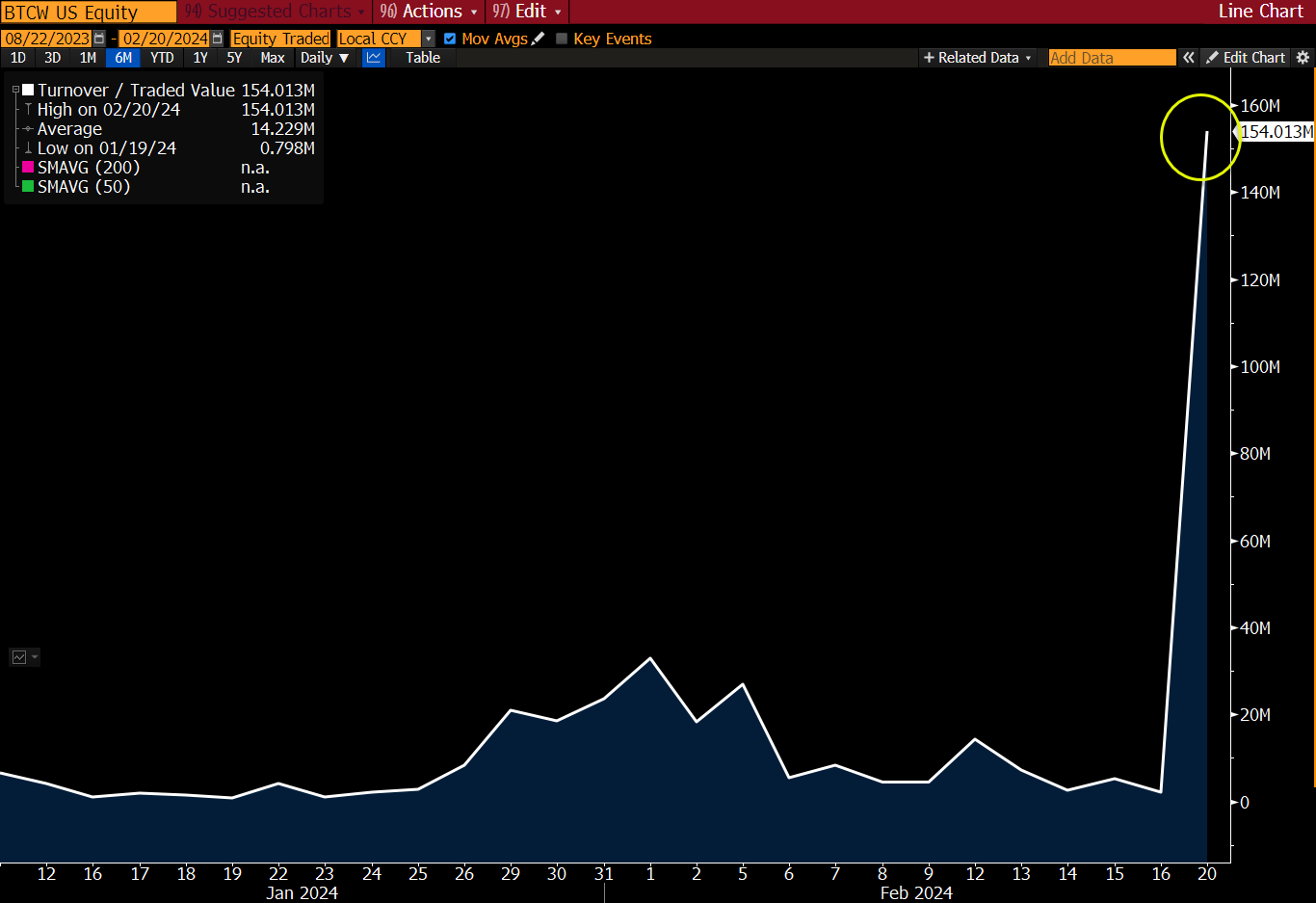

Balchunas expanded his observations to include other ETFs in the bitcoin space, highlighting that WisdomTree Bitcoin Fund (BTCW) also experienced a surge in trades from an average of $14.2 million to $154 million on February 20.

Interestingly, WisdomTree’s fund experienced an impressive 23,000 individual trades on Tuesday, up from a mere 221 on Friday.

It is important to note that Balchunas dismisses notions of a sell-off due to bitcoin price fluctuations and emphasizes the need for caution amid high expectations, stating:

“To the ‘bruh volume must be selling bc btc is dumping’ crowd: a) that makes no sense given how little these ETFs had in existing aum/shareholders b) plus you never you see ton of outflows in brand new ETF that is in rally mode c) there are so many other holders of btc besides ETFs! d) how can you call it “dumping” when it is down 1% after a 20% rally in two weeks?”

As VanEck’s spot bitcoin ETF competes with industry giants, its recent trading explosion and performance in terms of volume have left analysts intrigued.