In the rapidly evolving landscape of finance, Vanguard, a colossal asset management firm overseeing a whopping $7.7 trillion in assets, finds itself at the center of a debate concerning its view of Bitcoin Exchange-Traded Funds (ETFs).

Vanguard Bitcoin stance has been unlike other asset managers, as the asset management giant has decided not to launch its own Bitcoin ETF, and has also chosen not to provide access to such investment vehicles from other issuers to its customers.

This clash between traditional financial philosophies and the burgeoning world of Bitcoin unfolds as Vanguard’s decisions spark reactions from industry leaders and investors alike.

Vanguard Bitcoin Stance

Vanguard Group CEO Tim Buckley had already stated in a CNBC interview in November 2023, that his firm does not have any plans for providing Spot Bitcoin ETF to its customers.

Vanguard’s resolute refusal to offer Bitcoin ETFs has ignited a heated discussion within the investment community. The company’s strategy, deeply rooted in a conservative approach, stands in stark contrast to the industry trend of embracing Bitcoin.

Cathie Wood, the influential CEO of Ark Invest, has openly criticized Vanguard’s decision In an interview with Yahoo Finance, labeling it as “terrible” and accusing the firm of depriving investors of a historic opportunity.

Investor Exodus and Social Media Backlash

Vanguard’s anti-Bitcoin stance has not been without consequences. Frustrated customers have begun to flock away, deleting their accounts and seeking alternatives that provide access to the booming Bitcoin market. Social media platforms have witnessed a surge in the hashtag #BoycottVanguard, reflecting the discontent and disappointment among users.

Despite the current resistance, some analysts believe that Vanguard’s position on Bitcoin ETFs may not remain rigid. Eric Balchunas, a senior ETF strategist at Bloomberg, suggests that Vanguard’s focus on alternative investments, like its foray into private equity, might signal a potential change in strategy. The pressure from competitors and the growing popularity of digital assets could force Vanguard to reconsider its stance.

Balchunas said:

“Vanguard’s anti-bitcoin ETF stance is totally on brand and would’ve made Bogle proud. That said, I think they will soften in the coming years as they build their advisory biz, they’ll need to have access to alts. They recently got into PE for this reason.”

Vanguard’s MicroStrategy Investments

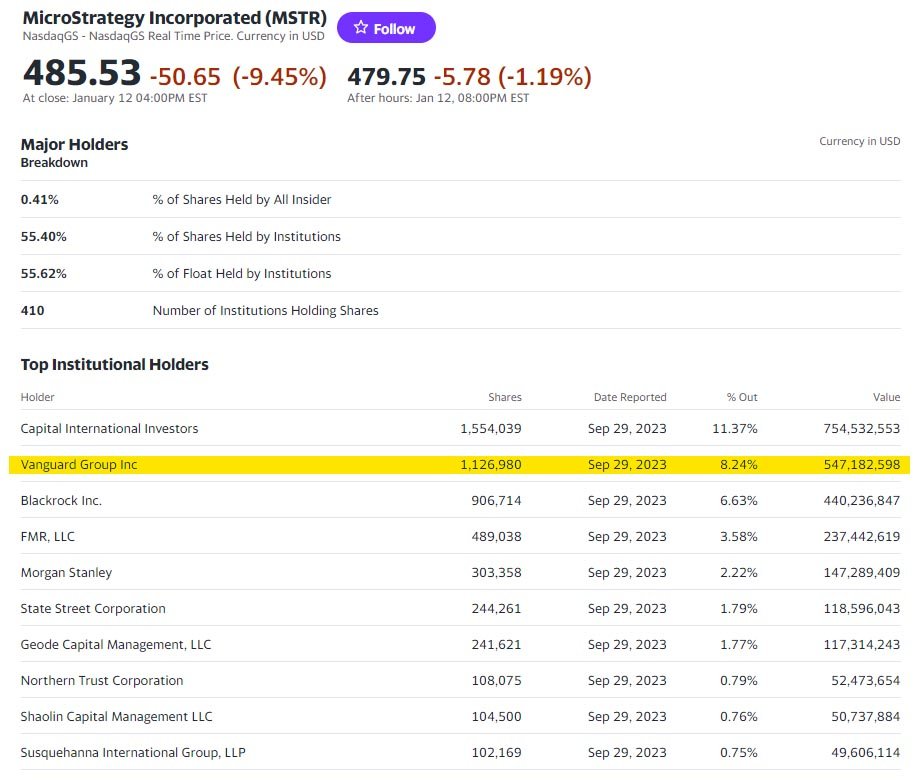

While Vanguard refrains from directly offering Bitcoin ETFs, it has indirectly exposed itself to Bitcoin through its substantial stake in MicroStrategy. Holding over 1 million MSTR shares, Vanguard is the second-largest institutional shareholder, reflecting an 8.24% ownership. This intricate relationship raises questions about the ripple effects of Bitcoin market dynamics on traditional investment portfolios managed by major asset management firms.

Spot Bitcoin ETF Launch and Vanguard

As the SEC greenlit the launch of Spot Bitcoin ETFs, excitement buzzed through the financial markets. However, Vanguard, along with several other investment firms, chose to block its customers from trading these newly approved products.

Vanguard’s decision to distance itself from spot Bitcoin ETFs does not shield it completely from Bitcoin influences. Investors frustrated with the lack of options have redirected their funds to other platforms. Vanguard’s indirect exposure through its MicroStrategy holdings means that fluctuations in Bitcoin prices could impact its mutual funds and MSTR shareholdings.

The Broader Industry Landscape

Vanguard’s cautious approach is unlike other asset manager. Other major players, including BlackRock, have taken a divergent path by embracing Bitcoin ETFs. While Vanguard’s decision has evoked mixed reactions, the robust trading volumes in newly launched Bitcoin ETFs indicate a strong market interest. This trend highlights the growing appetite among investors for exposure to digital assets, prompting a broader industry debate over the role of Bitcoin in traditional investment portfolios.

Vanguard’s journey through the Bitcoin ETF landscape showcases the delicate balance traditional asset managers must strike amid the rise of this new asset class. As the financial industry continues to evolve, asset managers face the challenge of harmonizing conservative principles with the accelerating influence of digital assets.

Vanguard’s decisions serve as a microcosm of the larger debate on how traditional finance can navigate the disruptive forces of the digital asset era. The outcome of this ongoing dialogue will shape the future landscape of investments, leaving investors and industry players alike on the edge of their seats.