Wealth is a complex topic that most people avoid dwelling on altogether. The vast majority of US citizens slowly grind at their 9–5 until they can retire, if ever. Some of them can earn enough to buy a family home, maybe squeeze in a rental property as well, and even less start a small business.

The stock market has been available to all US citizens for decades, now as easy as downloading an app, but it’s largely been a game for wealthy Americans that can afford to gamble.

We haven’t seen stock exposure for Americans at the lowest income brackets, but that could change with millennials and gen-z. Younger American generations are supposed to be building wealth now, but this is increasingly out of reach as home prices soar and incomes remain below their inflation adjusted rate. They rightly feel uncertainty about the stability of our institutions and the welfare of our nation. Other wealth building options have emerged in the last decade, and my hope is that this short essay will alert you to an asset that has outperformed most everything else during its lifetime.

Marc Andreesen famously noted that “Software is Eating the World’’ in 2011, and that has indeed become a reality in the last decade. Our society is developing a culture of economic partnering, sometimes referred to as the share-economy. This works through third party apps that connect people to places and services. Think about how Uber and Airbnb have changed the way you vacation. These apps function seamlessly at this point, enabling people to use their physical assets to gain wealth over time by connecting with everyone else digitally. If you haven’t been paying attention to the evolving digital economy, you should definitely give an hour of your time to read up on how it might interlace with the physical economy you’ve grown up with.

Looking forward, changes and upgrades will be made to these services. What would be possible in a digitized economy where everyone is connected? You’ve probably heard of the NFT craze, or “crypto” by that annoying friend of a friend. Long story short, people are paying for pictures, art, videos, and other things on the internet. They are claiming the “rights” to digital art by buying a “token’’, often known as a cryptocurrency, that is tracked through a public ledger called a blockchain.

Think of the blockchain as a list that organizes transactions through time and space. These transactions are validated by “miners” that compete to solve complex computations through proof of work. Once a winning miner has emerged the ledger is stored and shared openly by computers across the world.

This allows anyone to see the “proof” that you’ve purchased this product/token through the blockchain, and that you can transfer ownership by selling the same token that you bought for a price determined by the market at that time. NFT technology is still in its early days, with many problems to solve, and investors are highly skeptical that an investment in digital pictures or art will retain value or go up in value over time. At this time it is solely the underlying technology, the Bitcoin blockchain and monetary network, that is worthy of consideration.

Bitcoin is absolutely the most secure blockchain on the market. It was launched to the public by Satoshi Nakamoto on January 3rd, 2009. At that time there were just a handful of people engaged with the “protocol”, but today there’s more than 100 million people that use/own it globally. The price of one Bitcoin has likewise appreciated in value from less than a penny to ranging near $67,000 per Bitcoin in 2021. By all standards Bitcoin is the most widespread and decentralized blockchain in use today, and the network is open for anyone to use around the globe as long as you can access the internet.

Bitcoin is now adopted by more people than you would imagine, with the network effect and price growing faster than the early internet. Bitcoin has been likened by some to digital real estate, such that it is compared to buying New York city property in the early 1900s.

However it comes with the unique property of not being controlled by a particular jurisdiction, but global, which in the most recent example has helped Ukrainian fighters against the Russian incursion. Likewise those in Russia that disagree with the war can escape the country with their digital wealth without confiscation, or making it much more difficult to do so.

Bitcoin has also helped the Freedom convoy in Canada against the draconian leaders when the crowdfunding platform seized the funds following government orders. Bitcoin is freedom of speech and freedom of transaction.

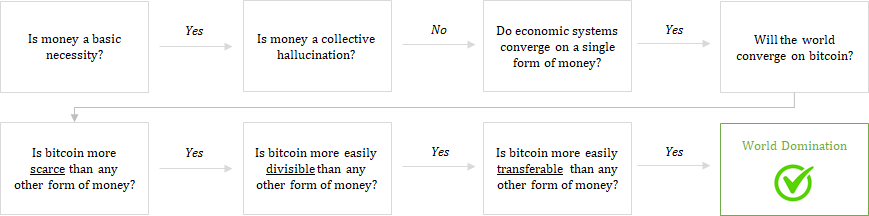

A very important thing to take away from this developing technology is that people will be able to collectively “share” ownership of hard assets in the future. If someone can “own” a digital piece of art, why can’t 10 people own and rent an autonomous vehicle? Why can’t the entire global population all share the same native internet currency, Bitcoin? This type of “Fractionalization” or shared ownership was mainly seen in stocks, where you own a small percent of a publicly traded company, or in home ownership between siblings or spouses. However it wasn’t realistic, and maybe not possible, for 100 complete strangers to align on an investment strategy to buy a house. My belief is that Bitcoin changed the trajectory of digital and physical ownership forever. I believe Bitcoin is a digital tool that enables humanity to transcend how nation states define our lives. It’s incredibly difficult to envision how Bitcoin could change the world, but it will.

Developers are hard at work building the infrastructure needed to transact and use Bitcoin in more efficient ways than our current financial system allows. It is still difficult to purchase a house directly with Bitcoin today, but recent developments have led payment providers to adopt the technology.

Some countries have even opened innovation hubs to build Bitcoin infrastructure. The easiest way to participate in Bitcoin is to buy the asset, which is on the layer 1 blockchain. What does that mean? You can buy Bitcoin (BTC), which is denominated in a unit called “Sats”, short for Satoshi’s. There are 100,000,000 Sats in 1 Bitcoin, and you can purchase any quantity of them that you want at one time. The protocol was created this way so that an individual with lesser means can still access and hold Bitcoin in small quantities. The outcome being that any hodlers, big or small, will see the value of their BTC grow at the same rate as everyone else on the network.

Bitcoin is going to be the hard money that eats the world

The total number of Bitcoin that will ever be allowed to circulate on the protocol is 21 million. This was set by the creator(s) of the blockchain and is one of the core tenants of the system. By limiting the amount of Bitcoin that can be created, it forces the “monetary policy” to remain constant and incorruptible. This is much different than other blockchains that came after such as Ethereum, which has a monetary policy that has changed on a whim.

You might not realize it’s happening, but the US can also print more money if they need to pay for war or future spending rather than tax citizens directly. Eventually we can see the negative consequences of corruptible monetary systems, they are tamper evident. Bitcoin on the other hand is tamper proof, it’s immutable.

Inflation is unhealthy for future generations, bad for building wealth, and dangerous for the world. I am extremely hopeful that Bitcoin is part of the solution, and that it will democratize over the next decade. In fact, we already see some game theory of BTC adoption playing out today. This asset gives hope to the little guy during a time when many are looking for it.

Although I can’t offer financial advice directly, I hope that I have exposed you to how the future might be brighter with Bitcoin. Buying BTC might seem expensive now, or volatile, but imagine what it would feel like to ignore it while it becomes the next global money. I personally believe that volatility is a small price to pay for asymmetric upside potential. If you still feel uncertain about a large allocation to this asset, that’s understandable, but you should realize that 0% exposure was not a smart choice historically.

Bitcoin is going to be the hard money that eats the world.

‘