Renowned analyst Willy Woo has recently explained his strategic vision for Bitcoin, suggesting three bold scenarios that could see the digital asset soar to unprecedented heights of $4.8 million per BTC.

In his recent post on X, Woo delves into his extensive analysis of Bitcoin investment strategy, drawing upon his 11-year journey in the market. Central to his analysis is the comparison of bitcoin’s potential future value relative to traditional assets like gold and the U.S. dollar.

Woo’s assessment of the risk/reward ratio of investing in BTC indicates a greater than 50% chance that bitcoin will outperform gold. This assertion underscores his belief that investing in bitcoin presents an attractive risk-return opportunity that “doesn’t come around very often”.

Willy Woo and Potential Gains Ranging from 10x to 70x

He outlines three possible scenarios for bitcoin’s future valuation: hyperbitcoinization leading to a coin value of $4.8 million, Bitcoin matching the size of the U.S. dollar at $1 million per coin, or displacing gold with a value of $690,000 per coin.

These projections, offering potential returns ranging from 10x to 70x, have captured the attention of investors seeking guidance in the volatile bitcoin market. However, Woo advises investors to conduct their own assessments of Bitcoin’s likelihood of success and adjust their investment strategies accordingly.

‘Danger Zone’ in 2 Days?

On the other hand, the looming Bitcoin halving, scheduled to occur in less than 30 days, has intensified scrutiny of bitcoin’s price movements. While Bitcoin experienced a record high of $73,750 recently, it has since seen fluctuations, dropping to as low as $65,000 recently.

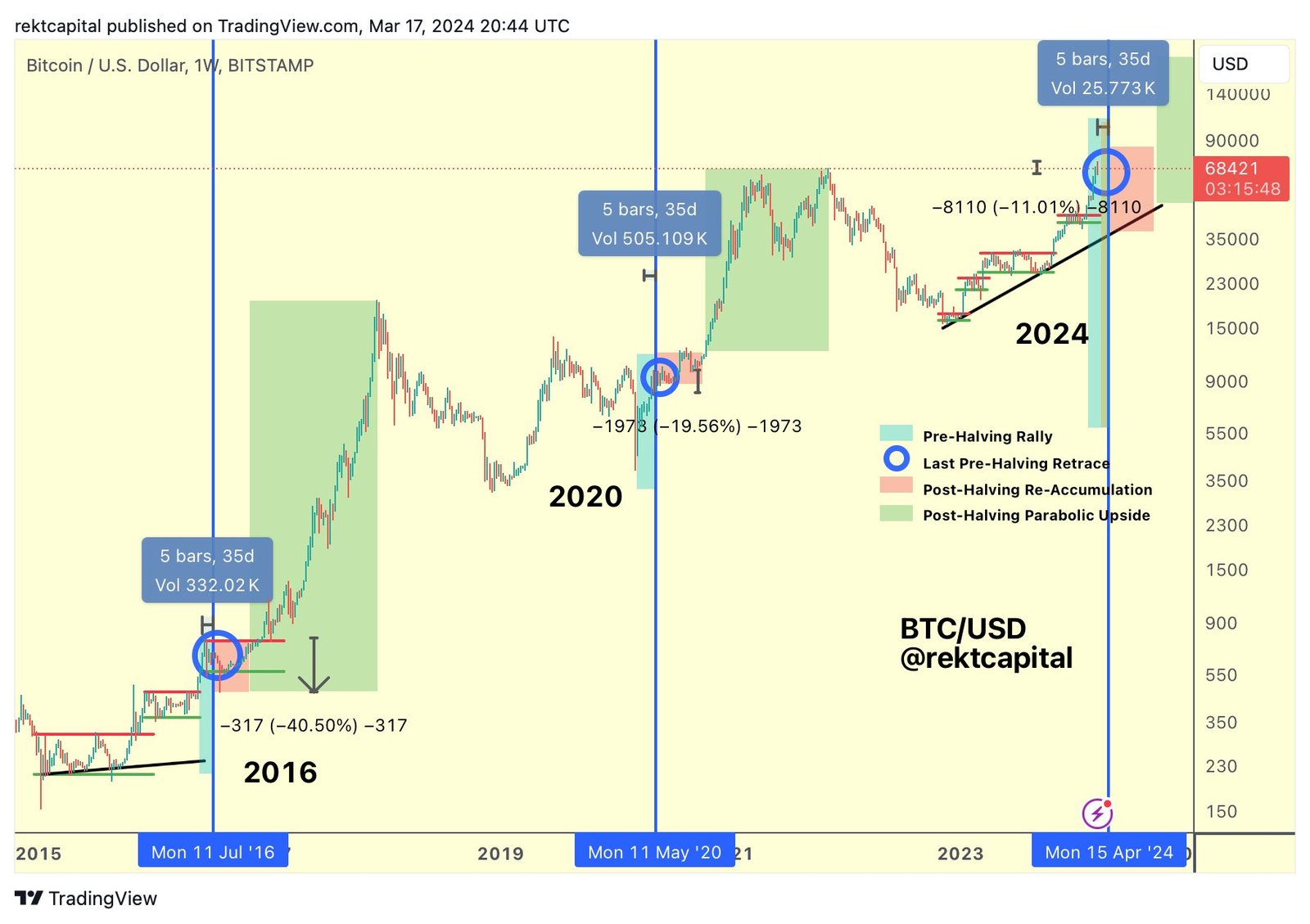

Adding to the uncertainty surrounding bitcoin’s price trajectory, a recent tweet by Rekt Capital has raised concerns within the bitcoin community. Rekt Capital highlights bitcoin’s transition from the ‘Pre-Halving Rally’ phase to the ‘Pre-Halving Retrace’ phase, signaling a potentially turbulent period ahead.

The analyst’s notes the bitcoin’s typical nature of undergoing corrective price changes in the 14-28 days leading up to the halving event, with past cycles experiencing retracements of up to 40%.

Notably, Bitcoin is currently just 30 days away from Halving and experienced a -11% pullback last week. The analyst emphasized:

“In just 2 days, Bitcoin will enter the ‘Danger Zone’ (marked in orange), historically signaling the onset of Pre-Halving Retraces.”

4 Phases of the Bitcoin Halving

Rekt Capital outlined four key phases associated with bitcoin halving. Beginning with the “Pre-Halving Rally,” typically occurring around 60 days before the event, bitcoin experiences a surge in price, setting the stage for the subsequent phases.

As the halving approaches, bitcoin enters the final “Pre-Halving Retrace” phase, characterized by significant pullbacks in price, historically ranging from -38% in 2016 to -20% in 2020.

As per the historical data, following the retrace, bitcoin enters the “Re-Accumulation” phase, lasting up to 150 days, where investors may face boredom and impatience amidst sideways price movement.

Finally, Bitcoin enters the “Parabolic Uptrend” phase, marked by accelerated growth and a potential shortened duration in the current market cycle due to an accelerated cycle.

Optimistic Prediction

However, despite the apprehension surrounding the ‘Danger Zone’ preceding the halving, there are bullish sentiments within the market. Analysts at Standard Chartered predict bitcoin will reach $150,000 by year-end, citing increasing institutional interest driven by the approval of spot Bitcoin ETFs in the United States.

As Bitcoin enthusiasts and investors brace themselves for the volatility ahead, these market analyses offer valuable insights into the potential future trajectory of the leading digital asset.