In the ever-evolving landscape of bitcoin investments, the emergence of Spot Bitcoin Exchange-Traded Funds (ETFs) has garnered significant attention. Bitcoin spot ETFs, backed by actual bitcoin holdings, offer investors a regulated and accessible way to gain exposure to the volatile yet lucrative world of bitcoin trading. This article delves into the dynamics of this market, exploring insights from recent report shared by CoinGecko.

Bitcoin Spot ETF Market Overview

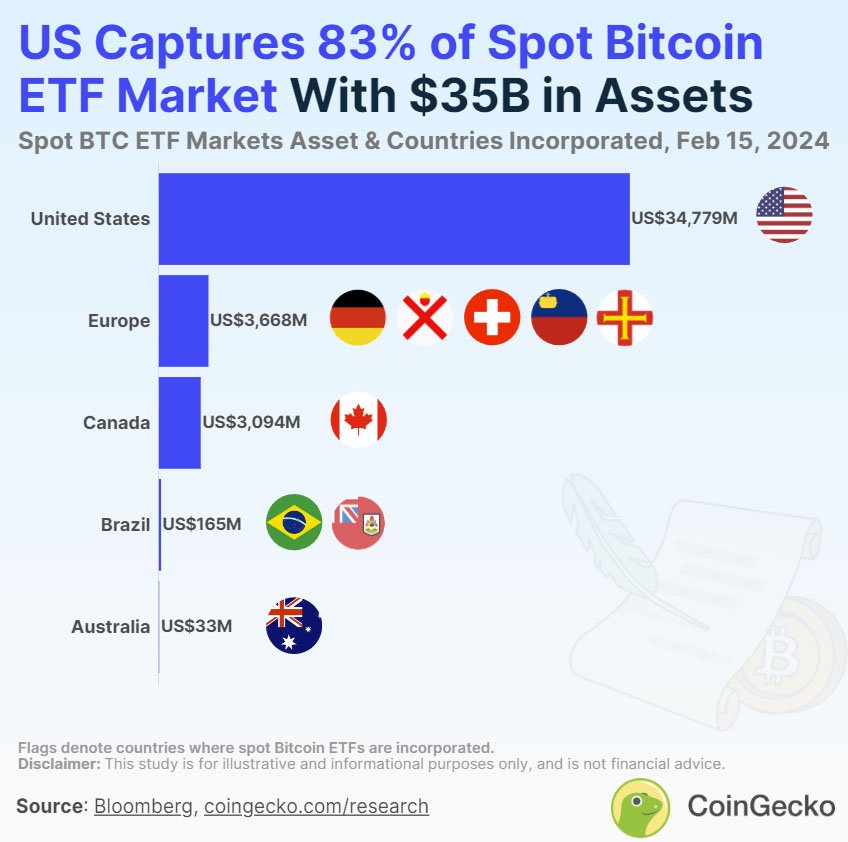

The global spot Bitcoin ETF market has witnessed a seismic shift, with the recent approval of bitcoin ETFs in the United States. According to CoinGecko’s recent update, the US now captures a staggering 83% of the spot Bitcoin ETF market, outstripping its closest competitor, Canada.

Grayscale Bitcoin Trust (GBTC) reigns supreme as the largest spot Bitcoin ETF, commanding over half of the global market share. However, its dominance faces challenges amidst ongoing net outflows. Notably, the top 10 spot Bitcoin ETFs collectively hold a whopping 92.7% of the market, with prominent contenders like iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) making significant strides.

Spot Bitcoin ETFs are incorporated in 11 countries worldwide, including G20 nations like the US, Canada, Germany, Brazil, and Australia. Europe emerges as a key market, boasting the most number of spot Bitcoin ETFs and a substantial asset size.

Here are the active spot Bitcoin ETFs in each country and their total assets in USD on February 15, 2023:

Here are the top Bitcoin ETFs globally, ordered by total assets in USD as of February 15, 2023:

| Rank | Spot Bitcoin ETF | Total Assets (USD) |

|---|---|---|

| 1 | Grayscale Bitcoin Trust BTC (GBTC) | $22,833.25 million |

| 2 | iShares Bitcoin Trust (IBIT) | $5,189.52 million |

| 3 | Fidelity Wise Origin Bitcoin Fund (FBTC) | $3,926.90 million |

| 4 | Purpose Bitcoin ETF (BTCC) | $1,600.00 million |

| 5 | ETC Group Physical Bitcoin (BTCE) | $1,251.19 million |

| 6 | ARK 21Shares Bitcoin ETF (ARKB) | $1,131.99 million |

| 7 | Bitwise Bitcoin ETF (BITB) | $930.98 million |

| 8 | CoinShares Physical Bitcoin (BITC) | $698.75 million |

| 9 | 21Shares Bitcoin ETP (ABTC) | $604.68 million |

| 10 | CI Galaxy Bitcoin ETF (BTCX) | $504.11 million |

| 11 | WisdomTree Physical Bitcoin (BTCW) | $413.70 million |

| 12 | VanEck Bitcoin ETN (VBTC) | $359.13 million |

| 13 | 3iQ The Bitcoin Fund (QBTC) | $347.11 million |

| 14 | Invesco Galaxy Bitcoin Etf (BTCO) | $336.24 million |

| 15 | Fidelity Advantage Bitcoin ETF (FBTC) | $264.29 million |

| 16 | 3iQ CoinShares Bitcoin ETF (BTCQ) | $221.98 million |

| 17 | VanEck Bitcoin Trust (HODL) | $187.55 million |

| 18 | Invesco Physical Bitcoin (BTIC) | $168.00 million |

| 19 | Evolve Bitcoin ETF (EBIT) | $156.65 million |

| 20 | Valkyrie Bitcoin Fund (BRRR) | $136.54 million |

| 21 | Hashdex Nasdaq Bitcoin ETF (HBTC.BH) | $102.90 million |

| 22 | AMINA Bitcoin ETP (SBTCU) | $100.37 million |

| 23 | Franklin Bitcoin ETF (EZBC) | $80.05 million |

| 24 | QR CME CF Bitcoin Reference Rate FDI (QBTC11) | $62.25 million |

| 25 | 21Shares Bitcoin Core ETP (CBTC) | $43.25 million |

| 26 | Global X 21Shares Bitcoin ETF (EBTC) | $33.26 million |

| 27 | WisdomTree Bitcoin Fund (BTCW) | $26.41 million |

| 28 | DDA Funds Physical Bitcoin ETP (XBTI) | $12.76 million |

| 29 | AMINA Bitcoin CHF Hedged ETP (SBTCC) | $10.53 million |

| 30 | Global X Bitcoin ETP (BT0X) | $3.57 million |

| 31 | Jacobi FT Wilshire Bitcoin ETF (BCOIN) | $2.06 million |

| 32 | Valour Bitcoin Carbon Neutral (1VBT) | $0.22 million |

Launch Trends and Market Expansion

The inception of spot Bitcoin ETFs dates back to 2020, with Germany’s ETC Group Physical Bitcoin leading the charge. Subsequent years witnessed a surge in ETF launches, notably in 2021, signaling increasing investor interest. The highly anticipated US approvals in 2024 ushered in a new wave of ETF offerings, indicating further market expansion.

Despite initial skepticism, spot Bitcoin ETFs have demonstrated resilience, with total assets surpassing $41 billion USD as of February 2024. These ETFs collectively hold around 4% of the maximum bitcoin supply, reflecting growing investor confidence in digital assets.

Outlook and Future Prospects

As regulatory frameworks continue to evolve, the future of spot Bitcoin ETFs remains dynamic. The possibility of new launches in emerging markets like Hong Kong presents promising opportunities for global expansion. However, challenges such as regulatory scrutiny and market volatility underscore the need for cautious optimism.

Spot Bitcoin ETFs have revolutionized the landscape of bitcoin investment, offering investors a regulated and accessible avenue to capitalize on the potential of Bitcoin. With the US emerging as a dominant player and market expansion on the horizon, the journey of spot Bitcoin ETFs is poised for continued growth and evolution.

The rise of spot Bitcoin ETFs exemplifies the intersection of traditional finance and digital innovation, paving the way for a new era of investment opportunities in the realm of Bitcoin.