On May 17, Antpool, the second-largest Bitcoin mining pool, mined seven consecutive blocks. This unusual event has raised significant concerns within the Bitcoin community about the centralization and security of the Bitcoin network.

Antpool successfully mined seven blocks in a row, covering block heights from 843,898 to 843,904. This sequence confirmed 20,686 transactions and generated over 23 BTC in revenue, which is roughly equivalent to $1.52 million.

The event lasted for one hour and 38 minutes. The revenue that the pool secured consisted of 1.283 BTC in fees, and 21.875 BTC from block subsidies.

In the world of Bitcoin, the proof-of-work consensus mechanism is designed to ensure that different, independent miners compete to add new blocks to the blockchain.

This decentralization is crucial for the security and integrity of the network. When a single mining pool like Antpool mines several blocks consecutively, it raises fears about centralization, which can undermine the fundamental principles of Bitcoin.

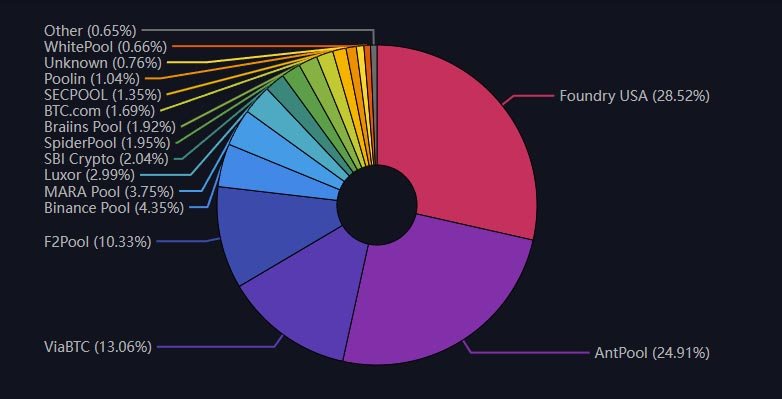

Foundry USA, the largest Bitcoin mining pool, mined the block immediately before Antpool’s sequence and the two blocks following it.

This means that 10 consecutive blocks were mined by just two entities. According to data from mempool.space, Foundry USA holds 28.52% of the network’s hash rate, while Antpool accounts for 24.91%. Together, they control 53.43% of Bitcoin’s hash rate.

This level of concentration poses risks to the network. The more power a few entities hold, the greater the potential gets for activities like double-spending and transaction censorship.

TOBTC Trading LLC highlighted the risk on X, stating:

“Such power concentration poses an existential threat to Bitcoin’s decentralized nature and its foundational principle of trustlessness.”

Bitcoin experts have voiced their concerns about this development. One Bitcoin developer suggested that transactions should wait at least two hours before being considered secure to mitigate the risk of a “chain reorg.”

A chain reorg occurs when the blockchain is reorganized, potentially reversing confirmed transactions. This scenario becomes more likely when a few entities control a significant portion of the network’s hashrate.

Notably, Bitcoin mining pools like Antpool and Foundry USA aggregate the computational power of multiple miners. The pool coordinator manages this hash rate, adds transactions to blocks, broadcasts the blocks to the network, and distributes rewards to contributing miners.

Although these pools consist of many miners, they act as single entities in the network. This structure can lead to centralization if a few pools dominate the mining landscape.

It’s worth mentioning that Antpool is a subsidiary of Bitmain Technologies, a leading manufacturer of Bitcoin mining hardware based in Beijing.

The company has a history of making headlines. For instance, in November 2023, Antpool controversially refunded an 83 BTC fee paid in mistake, sparking debates within the Bitcoin community.

The Bitcoin community must remain vigilant and proactive in addressing these centralization issues.

Potential solutions could include encouraging more independent miners to join other pools and developing new technologies to enhance decentralization.