In a strategic move aimed at optimizing its operations, renowned mining firm Bit Mining Limited announced the sale of its mining pool division associated with Btc.com for $5 million. The transaction, involving the Hong Kong-based Esport-Win Limited, is expected to impact the company’s equity positively, depending on certain closing conditions.

On December 29, the bitcoin mining and blockchain infrastructure company announced the divestiture of its Btc.com mining pool business through a document shared with the Securities and Exchange Commission (SEC). Esport-Win Limited, a Hong Kong limited liability company, emerged as the acquiring entity in this strategic transaction. The filing reads:

“The sale of the business is expected to result in an increase of approximately $16 million in the total shareholders’ equity of BIT Mining, since the business has approximately $11 million in cryptocurrency net liability. The sale does not include or affect any of BIT Mining’s other businesses.”

Operating Loss of $2.6M

As per Bit Mining’s 2022 annual report, its mining pool division reported revenue of $593.2 million from total block rewards. However, nearly 99.7% of this figure ($591.5 million) was categorized as a cost of revenue, distributed to miners affiliated with its pool service. This resulted in a meager gross margin of less than 1%.

According to the mining company’s recent announcement, its pool business recorded a net loss of $2.6 million in 2022, factoring in additional relevant expenses.

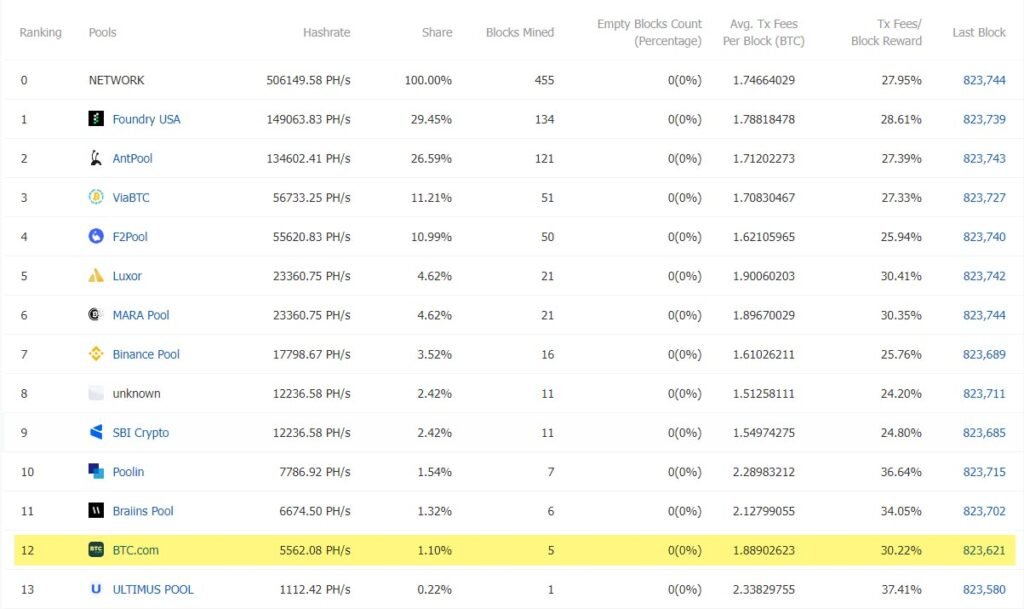

It is important to note that when Bit Mining initially acquired Btc.com from Bitmain in February 2021, the mining pool was a significant player in the Bitcoin mining industry. It used to command over 10% of the total hashrate and ranked among the top five globally. However, as of December 30, 2023, Btc.com’s hashrate share has dwindled to just 1% of the network’s total hashrate, placing it as the 12th largest mining pool.

Bit Mining to Explore New Areas

According to the announcement, Bit Mining aims to enhance profitability and fortify its cash position by parting ways with the loss-making mining pool business. Xianfeng Yang, Chief of Bit Mining, expressed optimism regarding the strategic move, stating:

“By selling the loss-making mining pool business, we will be more resilient, with our core resources focused on advancing the research and development of our existing businesses.”

Yang further emphasized that the cash proceeds from the transaction, coupled with an improved profitability outlook, will strengthen his company’s position “to explore new areas with greater potential and room for future expansion.”

“Moving forward, we will strive to unlock considerable synergistic potential across our existing business segments, propelling our company’s technology-driven growth and creating long-term value for our shareholders,” he added.

While Bit Mining has sold the Btc.com mining pool venture, it retains ownership of the internet domain btc.com and its blockchain explorer services.

The successful execution of this divestiture could potentially pave the way for Bit Mining to explore new avenues and emerging opportunities in the evolving blockchain and digital asset industry.