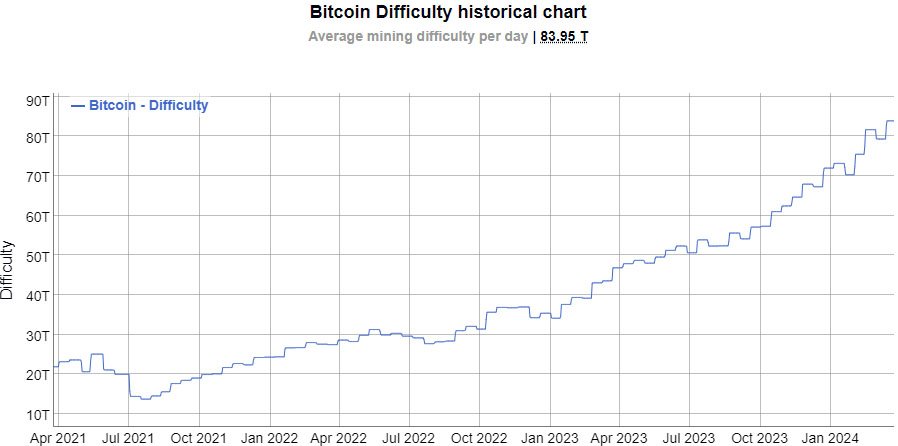

In latest news regarding bitcoin’s evolving market, the mining difficulty of the leading digital asset has hit a new all-time high (ATH), reaching a staggering 83,9T. This new record in Bitcoin difficulty comes as the digital asset world braces itself for the highly anticipated Bitcoin halving event, scheduled to occur in less than 26 days. This article delves into the implications of this increase, and what it means for investors.

Rise in Bitcoin Difficulty: A Sign of Growing Interest

The surge in Bitcoin mining difficulty indicates a significant uptick in interest among miners. This metric measures the complexity of solving cryptographic puzzles required to confirm transactions and mint new bitcoin. Data from BitInfoCharts.com shows a continuous rise in mining difficulty, reflecting not only increased miner participation but also a sense of optimism regarding potential price surges for bitcoin.

Preparation for the Halving Event

With just 26 days left until the halving event, miners are ramping up their efforts to accumulate as much bitcoin as possible before the block reward is halved. The reduction in block rewards from 6.25 BTC to 3.125 BTC may initially slow down mining activity. However, miners are preparing for this eventuality, with many investing in newer, more efficient mining technology. Miners strive to amass remaining bitcoin before the reward decrease by intensifying their mining activities. The halving event has the potential to trigger a substantial surge in the price of bitcoin.

Related reading: Bitcoin Mining Energy Consumption Hits Record Highs

Impact on Bitcoin Price Predictions

The impending halving has sparked various predictions about bitcoin’s future price trajectory. Some analysts, such as those at QCP Capital, believe that bitcoin could surpass its previous all-time high of $73,000. Others, like Robert Kiyosaki, famous author and investor, are even more optimistic, predicting a price of $300,000 by the end of 2024.

Tether co-founder William Quigley expressed optimism about bitcoin’s future price on CNBC’s ‘Squawk on the Street’, citing growing institutional and retail interest. He projected bitcoin to potentially soar to $300,000, considering fundamental factors and investment inflows.

However, amidst these bullish projections, some analysts caution that a retest of $50,000 is possible, especially if there is a slowdown in bitcoin accumulation by major ETF issuers.

The Role of Spot Bitcoin ETFs

The introduction of spot Bitcoin Exchange-Traded Fund (ETF) products adds another dimension to the situation. These ETFs provide institutional investors with regulated and accessible avenues to invest in bitcoin. While the reduction in block rewards may initially affect mining revenue, the long-term implications could be positive, potentially driving the value of bitcoin higher due to anticipated supply shortages.

Related reading: Bitcoin Shortage Looms Post-Halving as ETFs Eat Up Mined Supply

Notably, Bernstein, a top research firm, recently upped its bitcoin price projection from $80,000 to $90,000. It anticipates bitcoin hitting $150,000 by 2025, buoyed by sustained upward trends, notably following SEC approval of spot Bitcoin ETFs.

Miners’ Response and Adaptation

In response to the increasing mining difficulty and the impending halving event, miners are making strategic moves to stay competitive. Many are investing in the latest mining equipment to maintain their edge in the market. Additionally, some mining companies are relocating older computers to regions with lower energy costs, such as Africa and South America.

Notably, according to a post by Bloomberg, around 600,000 S19 series mining machines, are being relocated from the US to Africa and South America, after being refurbished by SunnySide Digital.

Conclusion: Navigating the Future of Bitcoin Mining

As Bitcoin mining difficulty reaches a new all-time high and the halving event looms closer, miners and investors alike are preparing for potential shifts in the bitcoin landscape. While bullish price predictions abound, the market remains unpredictable, with factors such as ETF adoption and miner adaptability playing crucial roles in shaping Bitcoin’s future.

As we move forward, one thing is certain: the world of Bitcoin continues to evolve, presenting both challenges and opportunities for those involved in Bitcoin mining and investment.