The United Nations (UN) recently released a new report about Bitcoin in which they claim their research reveals a “staggering carbon, water and land footprints of the global Bitcoin mining network”.

While most provided findings were negative, there were some positive points. Let’s go over the major findings from the report, and discuss some Bitcoin facts.

The Positives

The substantial growth in bitcoin price, evidenced by a 400% increase from 2020 to 2021, indicates a robust and potentially lucrative market. Bitcoin mining can also provide income opportunities in countries with inexpensive electricity.

The Negatives

Bitcoin mining has severe environmental repercussions, including significant CO2 emissions that could push global warming beyond the limits set by the Paris Agreement.

The majority of the electricity consumed for Bitcoin mining comes from fossil energy sources, particularly coal, exacerbating its carbon footprint. The environmental impact extends beyond carbon emissions to include a substantial water footprint and land use, affecting natural resources and ecosystems.

Caveats To Note

There’s a contention among experts regarding the accuracy of the energy usage data cited in the UN study.

Regardless of whether the study is overestimating the energy consumption of the Bitcoin network or not, it’s important to acknowledge that if Bitcoin achieves widespread success, its energy consumption will increase significantly. This is a good thing.

The rise of Bitcoin could usher in an era of honest money, free from state interference and debasement. It could finally offer humanity a monetary system which does not favor a select few at the expense of everyone else.

Related reading: Is Bitcoin Mining Really That Bad for the Environment?

Current CO2 Levels

CO2 levels are currently around 415 parts per million, meaning that out of every 1 million air molecules, only 415 are CO2, which is just 0.0415% of the atmosphere, while the remaining 99.9585% is made up of other gasses like (78%), oxygen (21%), and argon (1%).

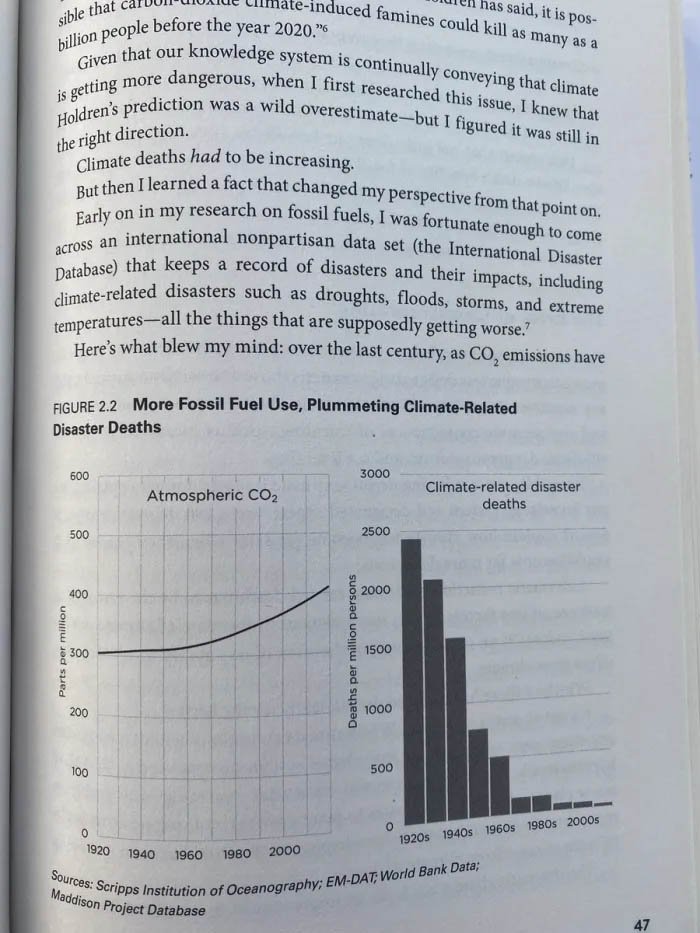

As the consumption of fossil fuels has led to a rise in CO2 emissions, there’s been an observable decline in climate-related deaths. A significant factor behind this trend is the enhanced capability for individuals to heat their homes, combatting one of the major climate-related threats: freezing temperatures.

Whether concerns regarding CO2 emissions are factual or not, the complex issue of environmental sustainability has many facets worth thoughtful consideration.

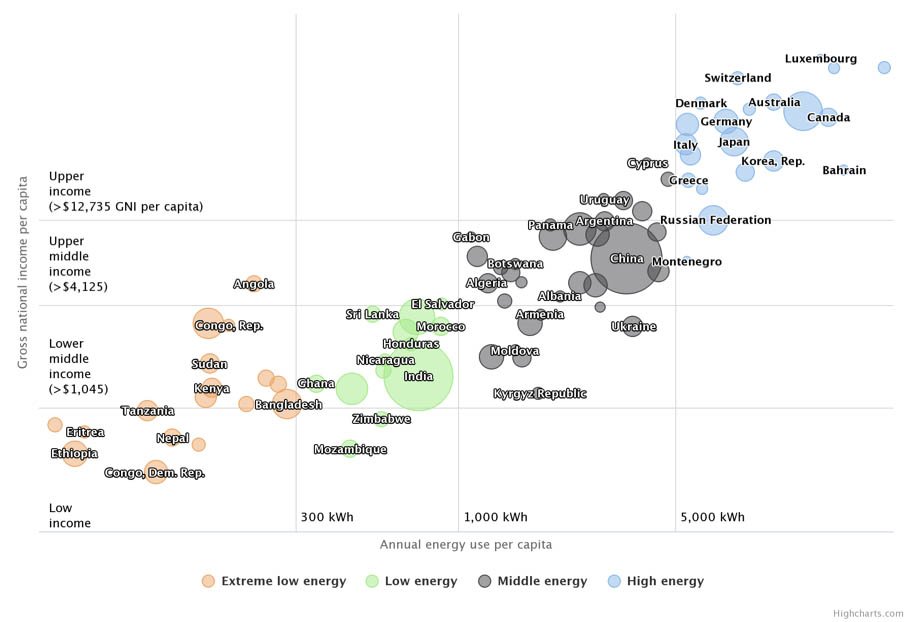

Everyone desires a healthy environment with clean air and fresh water, but access to reliable energy is also essential for human well-being and prosperity. Balanced approaches to environmental improvement must prioritize dependable energy sources, which are vital for alleviating poverty. It’s incredibly rare to find wealthy countries that lack sufficient energy resources.

Bitcoin Facts: Bitcoin Fixes Negative Spot Market Energy Pricing

Securing the necessary capital to develop energy infrastructure is challenging, largely because of issues like negative pricing in energy spot markets.

This problematic pricing pattern emerges mainly when there’s a significant imbalance, with electricity supply far exceeding demand, especially during times of rigid power generation and minimal consumption.

Bitcoin mining can act as a counterbalance in these situations. Its round-the-clock operations present a 24/7 demand for surplus electricity. Moreover, it offers flexibility as it can be shut down when needed, helping to consume excess energy and restore balance to the market.

Bitcoin Can Create Energy Abundance By NOT Switching To Proof Of Stake

While the importance of environmental stewardship is widely recognized, especially when it comes to developing energy grids, it’s crucial to remember that energy serves as the foundation of society.

The UN report suggests that Bitcoin could reduce its environmental impact by transitioning to a proof-of-stake (PoS) model; however, this perspective is fundamentally flawed. Adopting PoS would undermine Bitcoin’s intrinsic value, akin to the U.S. dollar abandoning the gold standard in 1971.

The proof-of-work (PoW) mechanism anchors Bitcoin to reality, ensuring its role as a permissionless, decentralized, peer-to-peer network. Eliminating the proof-of-work mechanism would reduce Bitcoin to a Rube Goldberg machine, stripping it of its essential functionalities. PoW is pivotal for allowing Bitcoin to lead humanity into a future of energy abundance.

Related reading: