Transaction fees on the Bitcoin network have dropped significantly, reaching a record low as Layer 1 transaction volumes continue to decline. This reduction in bitcoin fees has raised concerns among market participants and miners about the broader implications for the digital asset.

According to a recent post by on-chain data provider IntoTheBlock on X, transaction fees have dropped to their lowest level in three months.

This week, the network recorded a weekly transaction fee total of $12 million, marking a substantial 45% decline from the previous week.

Data reveals that the aggregate amount of BTC across all transactions completed on the network dropped by 5% between May 11 and May 17.

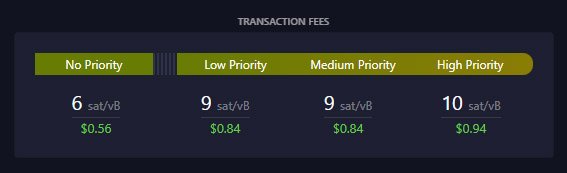

Consequently, the average fee paid per transaction also decreased due to reduced demand on the network. According to mempool.space, the average fees of executing a transaction on the Bitcoin network has dropped by 17% in the meantime, now standing at $0.84.

The decline in network fees has significantly impacted miners, who rely on these fees as a part of their revenue.

The percentage of miner revenue derived from transaction fees reached a year-to-date high of 75% following a post-halving event rally on April 20. But this figure has since plummeted.

Currently, only 4% of miner revenue comes from transaction fees, marking a dramatic 95% decline from the year-to-date high.

Faced with low revenue, some miners have resorted to selling their bitcoin holdings to mitigate losses. This behavior is often driven by high operational costs, the desire to take profit, or a lack of confidence in the digital currency’s future price appreciation.

As a result, Bitcoin miners’ reserves, which measures the amount of coins held in miners’ wallets within a specified period, has also decreased. According to the latest data, they currently stand at 1.81 million, having dropped by 1% since late-April.

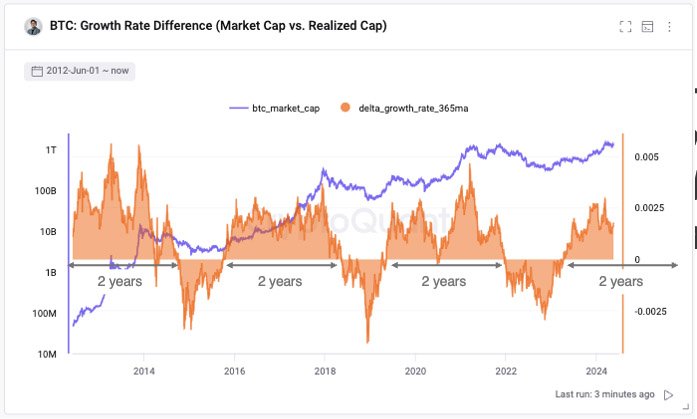

Despite the current challenges, Ki Young Ju, head of blockchain analytics platform CryptoQuant, remains optimistic about bitcoin’s long-term prospects. He points out that BTC’s market cap is growing faster than its realized cap, a trend that typically lasts around two years.

The realized cap metric records the price of bitcoin when it last moved and aims to gauge how many holders are in profit or at a loss. Young Ju predicts that if this pattern continues, the bull cycle might end by April 2025.

Meanwhile, CryptoQuant reports that the demand from long-term holders and large investors is stabilizing, but it needs to accelerate to break out of the ongoing consolidation phase.