The Bitcoin network has recently achieved a remarkable milestone. On September 3, 2024, the total computing power used to mine Bitcoin, known as the “hashrate,” soared to an all-time high 737 exahashes per second (EH/s), according to data from Mempool.space.

This new record underscores Bitcoin’s robust and secure infrastructure, but it also brings several challenges and concerns to the forefront.

The Bitcoin hashrate measures the total computational power used by miners to validate transactions on the Bitcoin network.

A higher hashrate means more machines are working harder to solve complex cryptographic puzzles, making the network more secure and less vulnerable to attacks. In simpler terms, the higher the hashrate, the stronger the Bitcoin network.

However, an increase in hashrate also means that mining becomes more competitive and energy-intensive. This requires miners to invest in more powerful and efficient equipment, as well as better and larger energy deals, leading to higher operational costs.

The recent surge in hashrate has made it harder and more expensive to find new blocks. As of early September, the difficulty rate was close to 90 trillion, which indicates the escalating computer power needed to mine new blocks.

Some reports indicate that the cost of mining one bitcoin recently reached around $74,000, while the average market price hovers around $57,000. This price gap puts a significant strain on miners, forcing them to sell off some of their bitcoin reserves to cover operational costs.

A recent report from JP Morgan highlights this strain. It found that listed miners like Marathon Digital and Riot Platforms were facing some of the highest costs per bitcoin mined at an industrial scale, at around $55,700 and $62,000, respectively.

The increased costs and reduced revenues are pushing many mining companies to explore other ways to raise funds, such as issuing shares or shifting their focus to artificial intelligence applications.

Related: VanEck Believes Bitcoin Miners Should Explore AI and HPC Opportunities

As the financial pressure mounts, some mining companies are looking to renewable energy as a potential solution.

Marathon Digital, for example, is experimenting with converting methane gas from landfills into usable energy. The company has also signed an agreement with the Kenyan government to develop the country’s renewable energy infrastructure.

Bitcoin mining forces companies to use energy as efficiently as possible. By turning to renewable energy sources, miners can reduce their costs and improve their public image amid growing concerns about the environmental impact of Bitcoin mining.

The rising hashrate has not only affected miners but has also had an impact on bitcoin’s market dynamics.

Since the start of September, Bitcoin miners have sold off 3,000 BTC to cope with rising production costs and falling revenues. This sell-off, according to analysts, could place additional downward pressure on bitcoin prices in the short term.

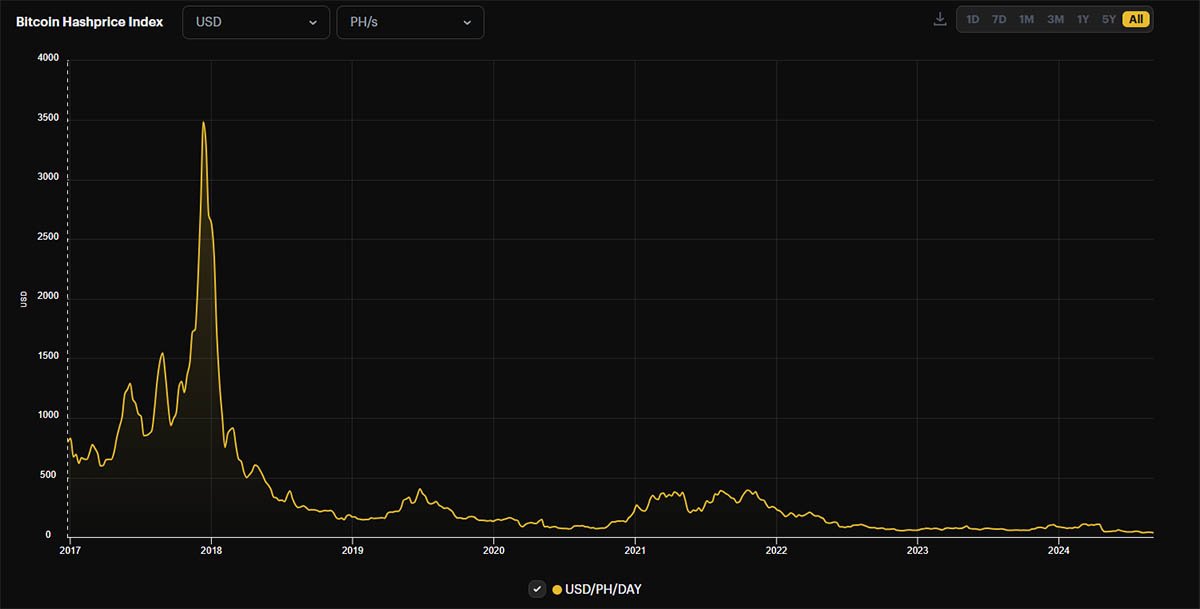

The strain on miners in also evident in Bitcoin’s “Hashprice Index“, a metric coined by Luxor Technologies. Hashprice Index refers to expected value of 1 PH/s of hashing power per day, which currently stands at 46.24 USD/PH/day.

This is the lowest rate ever recorded since the inception of the metric.

Despite these challenges, the hashrate has continued to climb, demonstrating the resilience of the mining community. If bitcoin prices recover, the hashrate could soon break its previous record.

The increased hashrate and the reduced time needed to mine blocks could trigger further adjustments in mining difficulty, making it even harder for miners to keep their operations profitable.

Yet, the determination of miners to push through these obstacles shows a commitment to keeping the network secure and operational, and an optimistic sentiment about future rises in bitcoin prices.

The Bitcoin network’s recent performance reflects both its strength and its vulnerabilities. On the one hand, the increasing hashrate demonstrates the security and robustness of the network. On the other hand, it exposes miners to economic pressures that could lead to further sell-offs or even closures.

The key to sustaining Bitcoin mining operations may lie in innovation and efficiency.