Bitcoin miners are facing a difficult post-halving operating landscape, as the reduction in block rewards negatively impacts their profitability.

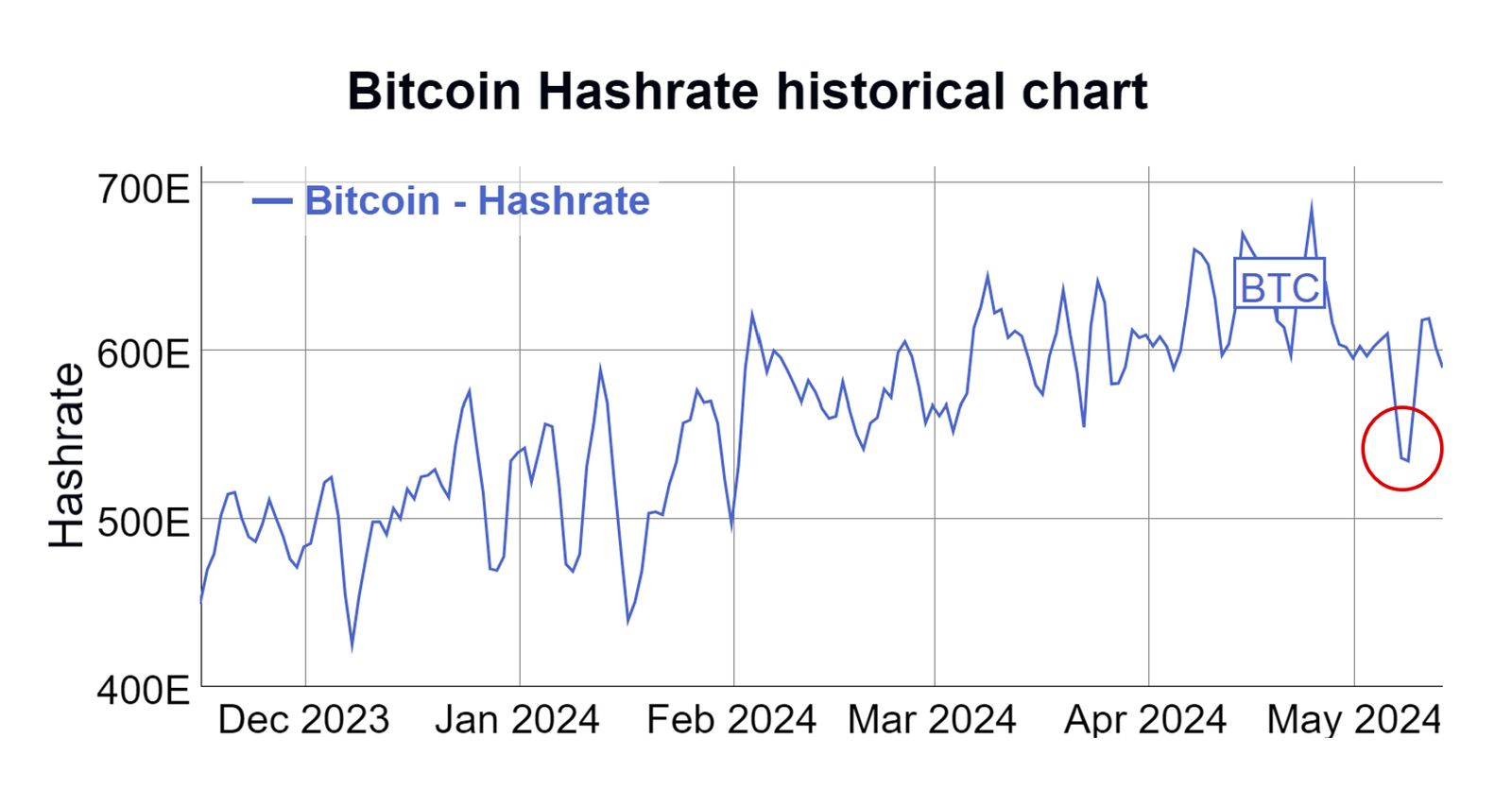

The Bitcoin hashrate has experienced wild fluctuations since the recent fourth halving.

According to data from BitInfoCharts.com, the Bitcoin network’s hashrate dropped to its lowest level in two months, reaching 575 exahashes per second (EH/s) on May 10. It has subsequently recovered, currently at 586 EH/s.

Miners Switch Off Machines

This decline in hashrate is attributed to miners turning off unprofitable rigs according to James Butterfill, the head of research at CoinShares. This adjustment comes as a response to reduced rewards of Bitcoin mining resulting from the halving, coupled with rising electricity costs.

The reduction in hash rate was anticipated, with CoinShares predicting a temporary drop but also expecting the hashrate to surge in the coming years.

The report states:

“Our model forecasts the hashrate rising to 700 exahash by 2025, although after the halving, it could fall by up to 10% as miners turn off unprofitable ASICs.”

Nazar Khan, the co-founder and COO of TeraWulf, emphasizes the importance of energy efficiency in navigating these challenges. He states:

“If you are a firm that just owns a bunch of machines and you are not profitable, you will be challenged. If you are a company that owns quality infrastructure that can deliver low-cost power, that’s a real asset.”

TeraWulf, one of the world’s largest Bitcoin mining companies, worth over $670 million, plans to expand its operations despite the reduction in block rewards.

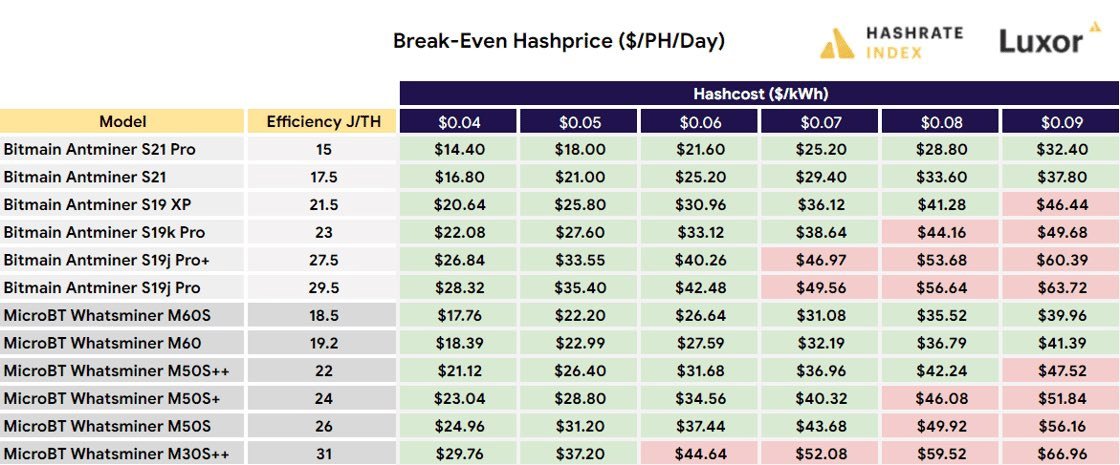

Given the profitability of mining operations depends heavily on the cost of electricity, older ASIC models such as the S19 XP and M50S++ now operate at a loss when electricity costs exceed certain thresholds. A Hashrate index report notes that even newer models like the S19j Pro+ and M30S++ face challenges with rising electricity costs.

Amidst these challenges, Bitcoin miners are also facing fluctuations in mining difficulty. There has recently been a notable 6% decline in Bitcoin mining difficulty, marking the most substantial drop since the bear market of 2022.

This adjustment reflects broader market dynamics post-Bitcoin halving, with higher-cost mining rigs being phased out due to escalating costs and lower bitcoin prices. The reduction in mining difficulty is seen as beneficial for miners with lower operational costs.

Analysts Gautam Chhugani and Mahika Sapra suggest that this adjustment allows lower-cost miners to increase their market share. Companies like Riot Platforms and CleanSpark, known for their low production costs, are expected to benefit from this shift.

Despite the challenges, analysts do not foresee a significant downturn in bitcoin prices. They predict Bitcoin will remain range-bound in the short term, with the potential for an upward breakout as institutional investors show interest through the next wave of spot exchange-traded funds (ETFs).

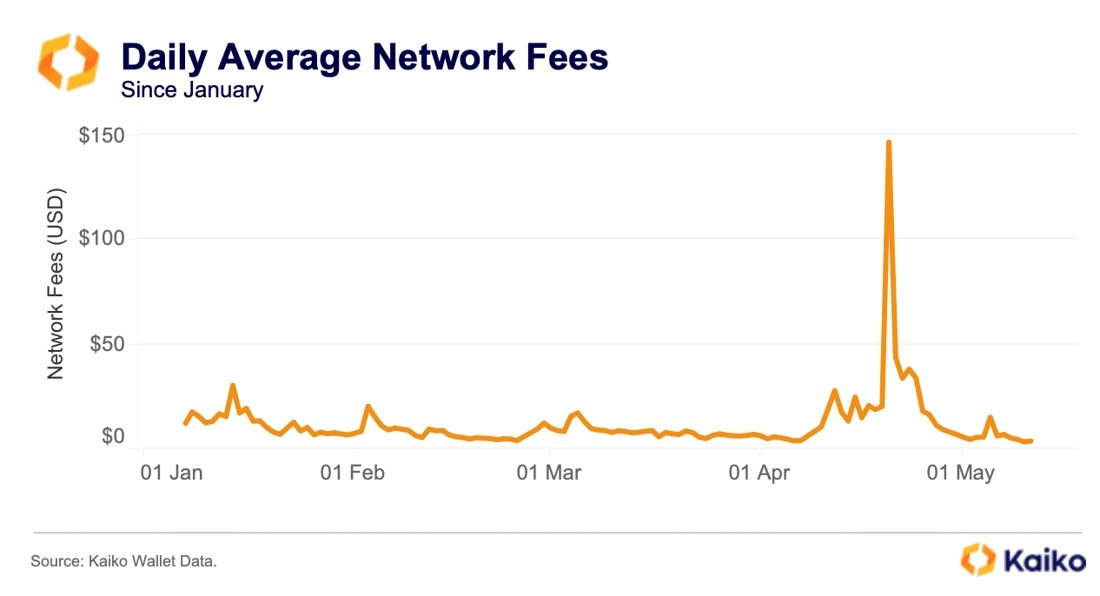

The recent halving event has also introduced selling pressure among Bitcoin miners. Kaiko notes that daily average network fees surged initially but have since declined, potentially leading to selling pressure from miners. This pressure arises as creating new blocks involves substantial electricity costs, which miners cover by liquidating their bitcoin holdings.