The Bitcoin mining community celebrated a milestone on November 12, as Bitcoin miners earnings reach an annual all-time high of over $44 million in block rewards and transaction fees. This resurgence follows a challenging period marked by a prolonged bear market and regulatory obstacles.

However, a turnaround in 2023, driven by Bitcoin entrepreneurs, rising market prices, and increased public interest, fueled a year-long surge in mining revenue.

Bitcoin Miners Earnings Hit Record Annual ATH

Notably, Bitcoin miners primarily earn from the rewards for confirming transactions and creating new blocks using advanced computer equipment called mining rigs. Since the last bitcoin halving in 2020, they have received 6.25 BTC for every successful block creation.

Aligning with this upward trend, renowned bitcoin miner Marathon Digital Holdings recently reported a staggering 670% year-on-year revenue surge in Q3 2023. This is an impressive five-fold increase in its Bitcoin production.

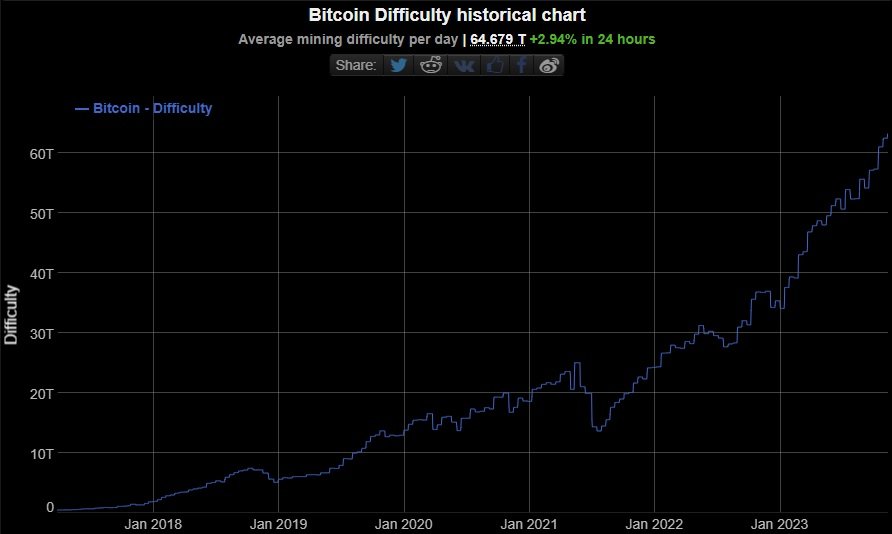

Bitcoin Mining Difficulty Reaches New Maximum

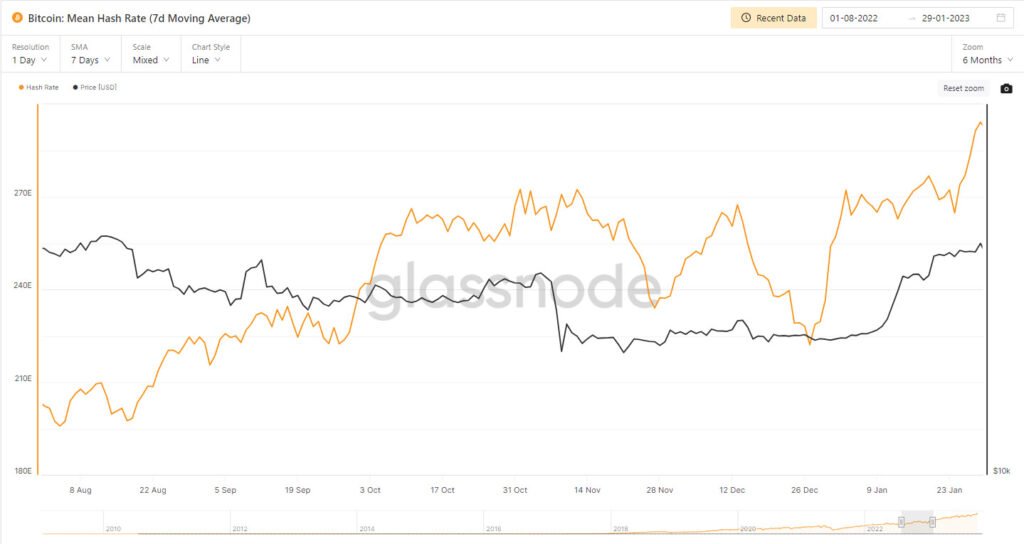

Meanwhile, Bitcoin’s mining difficulty also showed a new maximum. It has increased by 3.55% to 64.68 T, indicating the network’s robust security measures. The average hashrate stands at 479 EH/s, with a median time of just over 9.5 minutes between blocks.

According to the latest data by Glassnode, the 7-day moving average surged to 475.9 EH/s on November 5. The indicator has corrected itself to stand around 454.9 EH/s at the time of writing.

The new ATH for hash power emphasizes the network’s resilience and growth. The evolution from CPU to GPU mining and ASICs after that, and the dominance of industrial-scale operations, exemplified by Marathon Digital and Riot Platforms, underscore the maturity of Bitcoin mining infrastructure.

Marathon’s Q3 average hash rate of 14.2 EH/s, representing 4% of the network’s total, highlights its significant contribution, while Riot’s efficient operations in Texas showcase innovative approaches to electricity usage. Despite concerns of overvaluation, both companies have achieved notable efficiency gains, showing the adaptability of large Bitcoin miners in negotiating favorable electricity contracts.

According to Marathon Digital’s CEO, Fred Thiel, initiatives like its hydroelectric mining facility in Paraguay make his company “the most energy-efficient Bitcoin mining operation globally.”

Governments Have Entered the Game Too

It is important to note that the positive trend extends beyond companies, as several governments have actively participated in securing the Bitcoin network through mining activities.

For instance, Bhutan engages in Bitcoin mining using hydropower, aiming to expand operations through a partnership with Bitdeer. The government is aiming to secure 100 megawatts of power for mining data centers to potentially increase the country’s mining capacity by 12%.

Bitcoin Difficulty Adjustments and Hashrate Increase

The fluctuations in hash prices are the result of the upcoming recalculation, scheduled for November 28, 2023. The latest difficulty adjustment happened on November 12, increasing the difficulty by 3.55%. Notably, an increase in mining difficulty increases the efforts necessary to create a block and adjusts the time between block findings.

Next adjustment is scheduled to happen in approximately 14 days, around November 28. Since, at the time of writing, there are more than 1800 blocks left to that adjustment, and it is rather difficult to guess how the adjustment will go.

Bitcoin Network Stronger Than Ever

The recent Bitcoin network’s statistics depict a thriving mining ecosystem, marked by record-breaking revenues, increased difficulty levels, and a soaring hash rate. The industry’s resilience and adaptability in the face of challenges bode well for its sustained growth and continued integration into global financial landscapes.

It is interesting to note that the recent spike in BTC prices, exceeding $37,000, reflects the interconnected nature of mining and market dynamics.