In the wake of a stormy period for Bitcoin miners, a recent report by Bloomberg indicates a renewed surge in mining activities and investments, driven by the ongoing bull run and the impending halving event in April.

$1B Invested on Expansion

According to Bloomberg, 13 leading mining companies have collectively invested over $1 billion in specialized computers since February 2023. CleanSpark Inc. and Riot Platforms Inc. have emerged as major players, allocating substantial sums of $473 million and $415 million, respectively, for mining rigs.

Notably, the primary objective behind this massive investment is to enhance operational efficiency and secure favorable electricity rates. Miners, who use energy-intensive computers to validate blockchain transactions and earn bitcoin rewards, are constantly seeking cost-effective power sources.

Asher Genoot, CEO of Hut 8 Corp., states:

“Scale matters because you can get machines for better rates, bigger energy deals and drive down the cost of development. When you have scale, you have more marginal and growth profits and you can cover your big costs.”

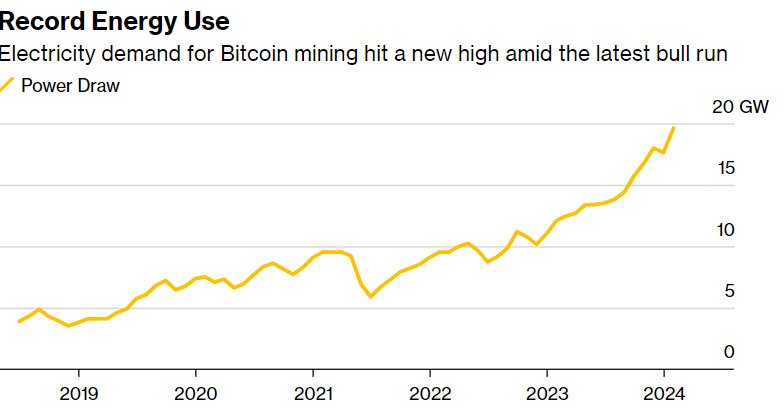

Bitcoin Miners’ Record-Breaking Energy Consumption

According to the Cambridge Centre for Alternative Finance, bitcoin miners consumed 121 terawatt-hours of power in 2023, similar to Argentina’s use.

However, the surge in mining activity this year is reflected in the record-breaking energy consumption by miners. Bloomberg cites CoinMetrics to state that miners drew a staggering 19.6 gigawatts of power in February 2024, a significant increase from the 12.1 gigawatts recorded in the same period in 2023.

This implies that the miners consumed around 13.64 TWh last month, equivalent to the electricity capacity required to power around 3.8 million homes in Texas.

Potential Risks Amid Substantial Gains

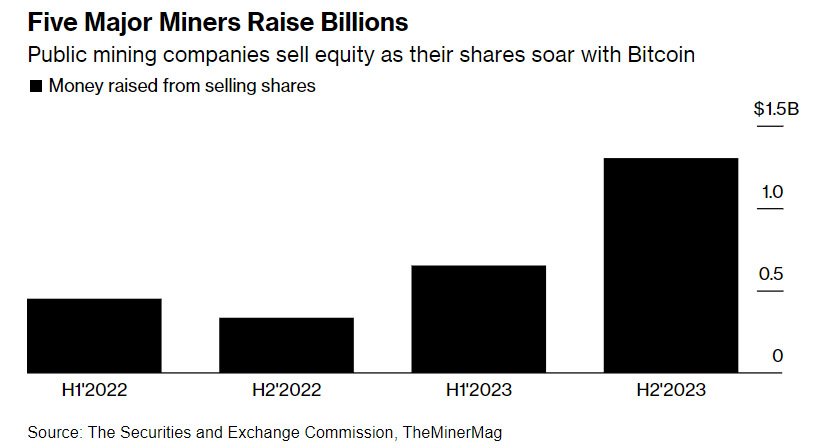

With Bitcoin reaching a record high of over $70,000 on March 8, mining companies have experienced substantial gains, as per the data by TheMinerMag. The rising value of bitcoin has allowed miners like Marathon, CleanSpark, Riot, Hive Digital Technologies, and Iris Energy Ltd. to raise over $2 billion since the market rebounded in June 2023.

Notably, on March 6, miner revenue skyrocketed to an impressive $75.9 million, marking the second-best day in the history of BTC mining.

Despite the current boom, the report highlights the risks associated with rapid expansion, drawing parallels with the bull run in late 2021. Some companies that went public during that period faced bankruptcy when the market crashed in 2022.

Challenges Halving Carries

Mining companies are in constant competition for rewards, with the impending halving event in April intensifying the challenges and potentially forcing miners into negative-margin territory. In general, after the halving, rewards for miners reduce, further limiting the supply of bitcoin.

Several market experts have alarmed miners for the potentially difficult times ahead. A recent report by CoinShares predicted that following halving, the hash rate would decrease to 410 EH/s six months later.

Moreover, Ethan Vera, COO at Luxor Technology, warns that some miners may face negative margins, leading to potential capitulation, stating:

“Some miners will capitulate, while many will find creative solutions to remain profitable.”

As Bitcoin miners navigate the challenges of rapid growth, the industry faces a critical juncture where strategic decision-making will determine the sustainability of operations.