Bitcoin miners’ reserves have plummeted to their lowest levels in over 14 years. This development has sparked widespread discussions among investors, analysts, and enthusiasts about its potential implications for the market.

This article breaks it down, explains what this means and why it’s significant.

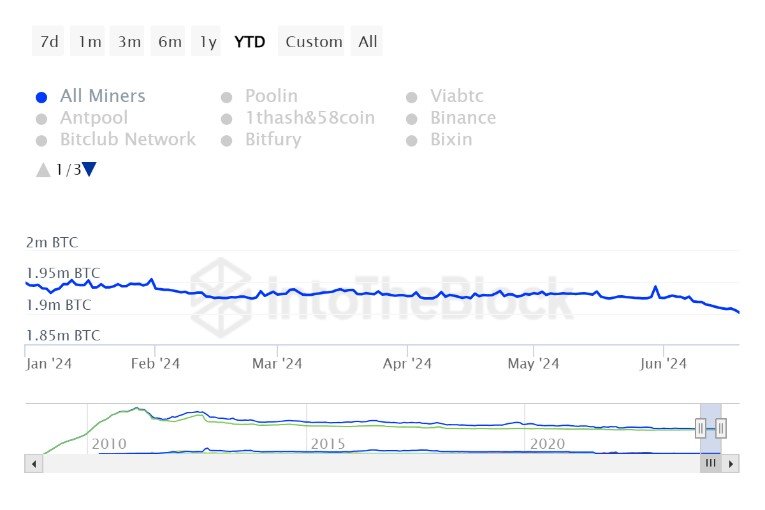

According to data from several sources including Glassnode and IntoTheBlock, Bitcoin miner reserves have dropped to approximately 1.90 million BTC as of June 19, 2024. This is the continuation of a trend seen in April, when the reserves hit a 12-year low.

This marks a decline from the 1.95 million BTC miners held at the beginning of the year. For context, this is the least amount of bitcoin miners have held since February 2010.

Lucas Outumuro, head of research at IntoTheBlock, explains that this trend is largely driven by the recent halving event that took place on April 20, 2024. This event effectively cut the mining rewards in half, reducing them from 6.25 BTC to 3.125 BTC.

Outumuro, mentioned that, over time, miners are likely to hold onto fewer bitcoin because the halving event squeezes their profit margins, pushing them to sell their reserves.

Despite the drop in the number of bitcoin held, the fiat value of these reserves has soared. Currently, the total value of these reserves in US dollars is hovering around an all-time high of approximately $135 billion.

This paradox can be explained by the recent surge in bitcoin’s price, which has risen to over $60,000 over the past few months.

Sascha Grumbach, CEO of Green Mining DAO, notes:

“It seems today’s miners have learned from past cycles. Gone are the days of overleveraging and holding onto too much Bitcoin, a strategy that backfired in the past.”

Essentially, even though miners are holding fewer bitcoin, the higher value per bitcoin means their balance sheets in dollar terms are healthier than ever.

He added: “[Miners’] focus seems to be on short-term financial stability rather than long-term, large-scale accumulation of Bitcoin. In other words, having less Bitcoin is normal in the market phase we are in.”

The decline in miner reserves has several potential implications for the Bitcoin network and the broader digital asset market.

One key concern is the effect on the Bitcoin hash rate, which measures the processing power of the Bitcoin network. A decrease in miner reserves could lead to a corresponding decline in the hash rate, as miners may reduce their mining activities due to lower rewards.

Moreover, with fewer bitcoin held by miners, the available supply in the market could become more constrained. This scarcity could potentially drive up the price of bitcoin even further, as demand from investors and traders outpaces the available supply.

Related: What Happens When There Is A Bitcoin Supply Shock?

CoinShares predicts that while there might be a dip in the hash rate post-halving, it is expected to surge again in 2025.

Mining companies have seen an influx of capital investments since the start of the year. Research firm BlocksBridge Consulting reports that approximately ten public miners together raised $2 billion through equity financing activities in preparation for the April halving.

The reaction from the market has been mixed. On one hand, stocks of Bitcoin mining companies have seen significant increases.

For instance, U.S.-listed Bitcoin mining stocks surged in the first half of June, with companies like Core Scientific, TeraWulf, and Hut 8 Mining leading the charge with impressive gains.

JPMorgan analysts noted that the market capitalization of bitcoin miners listed on U.S. exchanges hit an all-time high of $22.8 billion as of June 15, 2024.

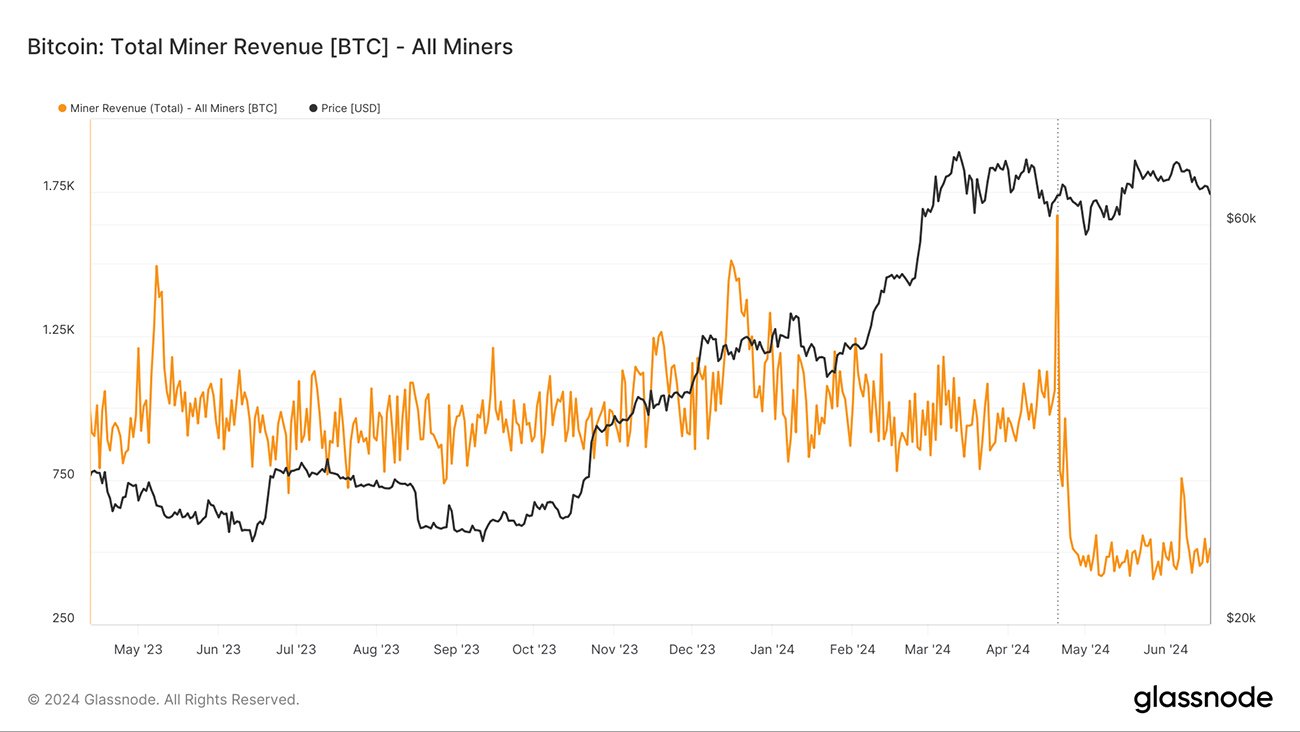

This surge in stock prices contrasts sharply with the declining miner reserves and revenues, which have been trending downward over the past few weeks.

Looking ahead, experts have varied opinions on what this trend means for Bitcoin’s future.

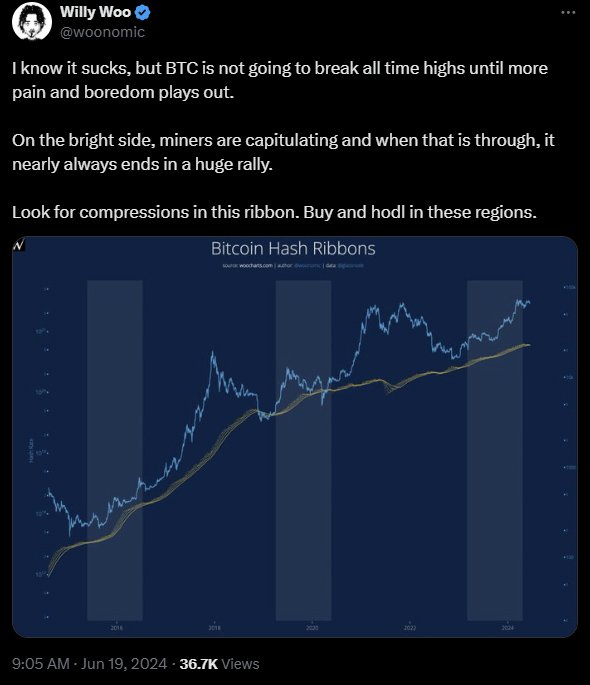

Willy Woo, a prominent on-chain analyst, suggests that bitcoin’s price might not see significant surges until the ongoing miner capitulation event is over, he explains, pointing to the need for more stability in miner activities before expecting major price movements.

On the other hand, analysts at Bernstein have made bold predictions, forecasting that bitcoin could reach $200,000 by 2025 and even $1 million by 2033. Such optimistic predictions are based on the assumption that demand will continue to rise while the supply remains constrained.

For investors, the decline in miner reserves coupled with the high fiat value presents a complex picture.

On one hand, the rising value of bitcoin and the constrained supply could mean potential gains. However, the ongoing sell-off by miners suggests that they might be hedging against future uncertainties.