Bitcoin miners have recently hit a significant milestone, breaking records with their highest-ever monthly revenue. This surge in bitcoin miners revenue comes just ahead of the anticipated halving event, which could pose challenges for miners in the near future.

Record-Breaking Bitcoin Miners Revenue

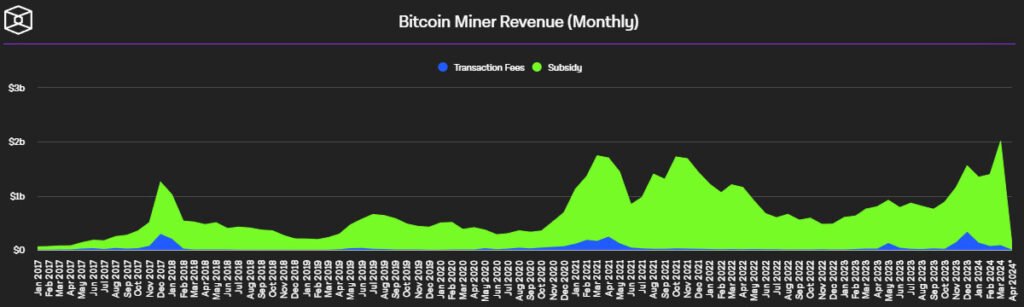

In March, bitcoin miners collectively earned a staggering $2 billion in revenue, a total of $1.93 billion was generated from the block subsidy, alongside an additional $85.81 million derived from transaction fees, marking a historic high for the industry.

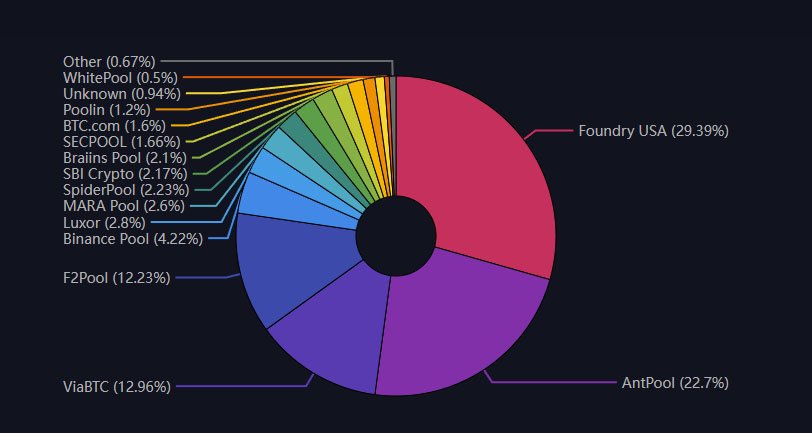

This figure, including earnings from both block rewards and transaction fees, reflects the growing profitability of bitcoin mining operations. In March, bitcoin mining pools mined 4,412 blocks. Foundry USA led with 1,312 blocks, representing about 29.74% of the total network blocks for the month. The Bitcoin network’s hashrate is stable at 606 EH/s, showing a 20 EH/s rise in the past month. The hashprice, valuing mining power, remained above $100 per PH/s daily.

According to reports, the previous record of $1.74 billion, set back in May 2021, has been surpassed by the recent surge in mining revenue. This substantial increase in earnings underscores the booming activity within the bitcoin mining sector.

Implications of the Halving Event

The upcoming halving event, scheduled for April, is expected to cut the block subsidy from 6.25 BTC to 3.125 BTC per block mined. This reduction in rewards could potentially halve the revenue generated by miners unless accompanied by a significant rise in the price of bitcoin. Bitcoin’s price typically rises weeks after halving, following recent market cycles. Law firm Holland and Knight suggests cash-strapped miners may feel the strain, possibly leading to strategic mergers among industry players.

The halving event prompts miners to intensify their efforts to maximize profits before their earnings potential diminishes. This sentiment reflects the industry’s awareness of the impending changes and the need to adapt to the evolving landscape.

Key Players and Market Dynamics

Leading the charge in bitcoin mining are prominent players such as Foundry and AntPool, which collectively captured over half of the monthly bitcoin supply. These mining pools play a crucial role in securing the network and facilitating the validation of transactions.

Additionally, the increase in bitcoin prices and higher network activity have contributed to miners’ bumper revenues in March. This combination of factors highlights the dynamic nature of the Bitcoin market and its impact on mining profitability.

Challenges and Opportunities

While miners are currently enjoying a profit bonanza, challenges lie ahead with the halving event on the horizon. The impending reduction in block rewards could lead to increased competition and potential difficulty increases in mining operations.

The increased challenges in mining could lead to higher costs for less efficient miners, prompting a consolidation within the industry. This scenario underscores the need for miners to optimize their operations and adapt to changing market conditions.

Looking Ahead

Despite the challenges posed by the halving event, there remains optimism within the industry for a potential bitcoin bull run in the future. Historically, the price of bitcoin has shown resilience in the face of such events, leading to renewed enthusiasm among investors and miners alike.

In conclusion, the recent surge in bitcoin mining revenue highlights the industry’s resilience and adaptability in navigating evolving market dynamics. With the halving event on the horizon, miners must remain vigilant and proactive in maximizing earnings while preparing for potential challenges ahead.