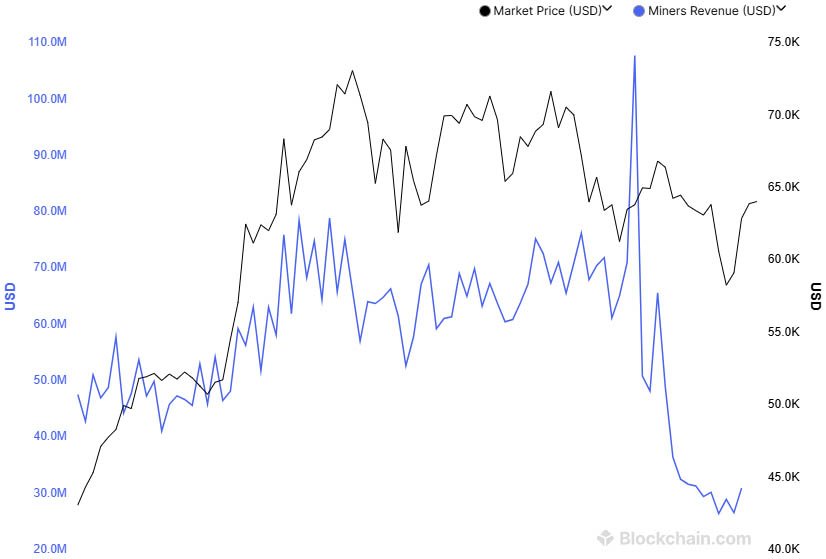

Bitcoin mining has experienced a notable decline in earnings since the fourth halving event, with May recording a significant drop in Bitcoin miners’ revenue despite the initial hype surrounding the event and the launch of Bitcoin Runes.

However, there are signs of recovery as total revenue earned from block rewards and transaction fees has started to rise after hitting a low of $26.3 million on May 1.

Before the halving, Bitcoin miners were earning an average of around $60 million per day, but this figure dropped post-halving, leading miners to re-strategize their operations to maintain profitability in the evolving Bitcoin economy.

To remain profitable under current conditions, bitcoin would need to hold above $80,000, as calculated by CryptoQuant CEO Ki Young Ju. He stated:

“Now [bitcoin miners] have two options: 1. Capitulation, or 2. Waiting for a rise in $BTC price. There are no signs of capitulation for now.”

Drop in Bitcoin Miners’ Revenue

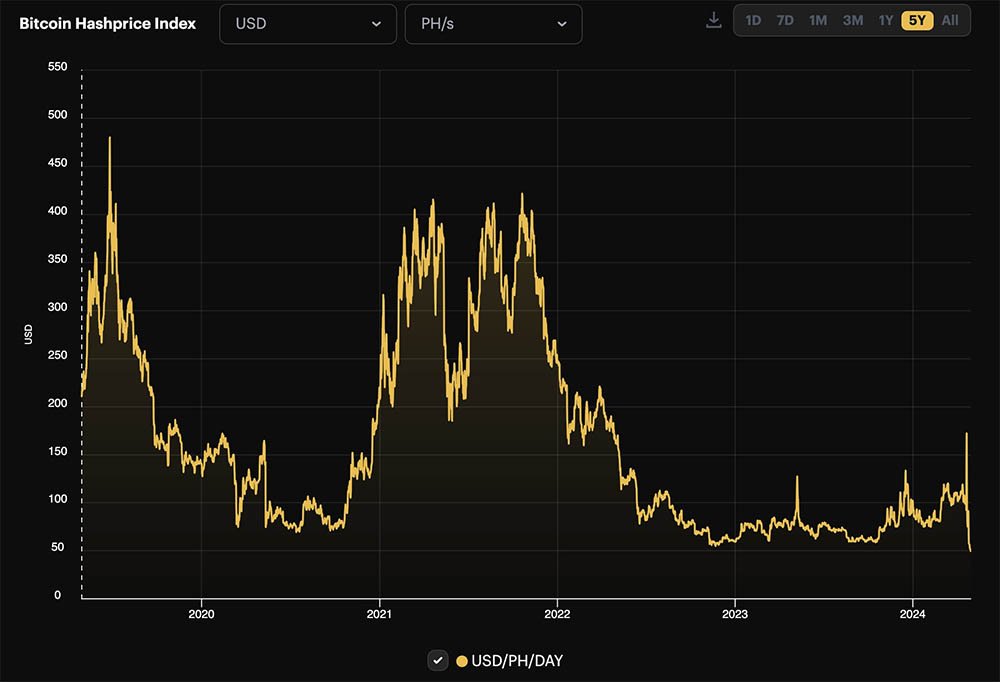

Meanwhile, the hash price of Bitcoin, which is the expected value of one peta hash of power per day, has rebounded from its all-time low of $46.55 on May 1.

However, the current price of $64,000 is not sufficient to prevent a difficulty drop at the next automated readjustment on May 9. As per the data, the second readjustment of the new difficulty epoch is currently expected to decrease it by around 3.63%.

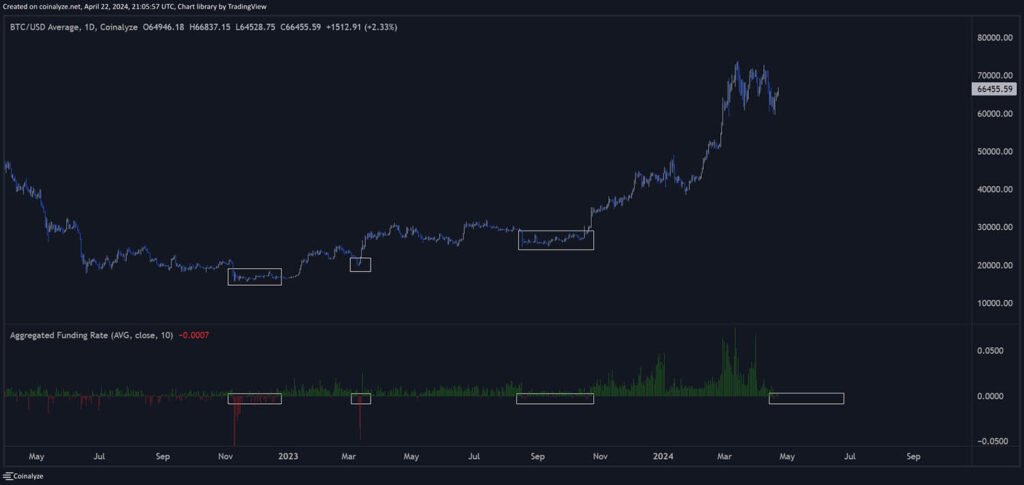

Meanwhile, Bitcoin’s market trend shows signs of recovery, with the digital asset trading around 15% above its two-month low of $56,500, reached on May 1. This recovery has been attributed to concerns over the stagflation of the U.S. economy, prompting investors to adopt a risk-off approach.

BTC is currently trading around $63,000, supported by the 50-day exponential moving average (EMA). A bullish weekly candle has been produced by BTC’s recovery, resulting in Bitcoin funding rates returning to a more neutral state after turning negative last week.

Notably, negative funding rates, although rare, are considered highly bearish indicators. A neutral funding rate signals a reset in trader positions, indicating mixed sentiment in the market.

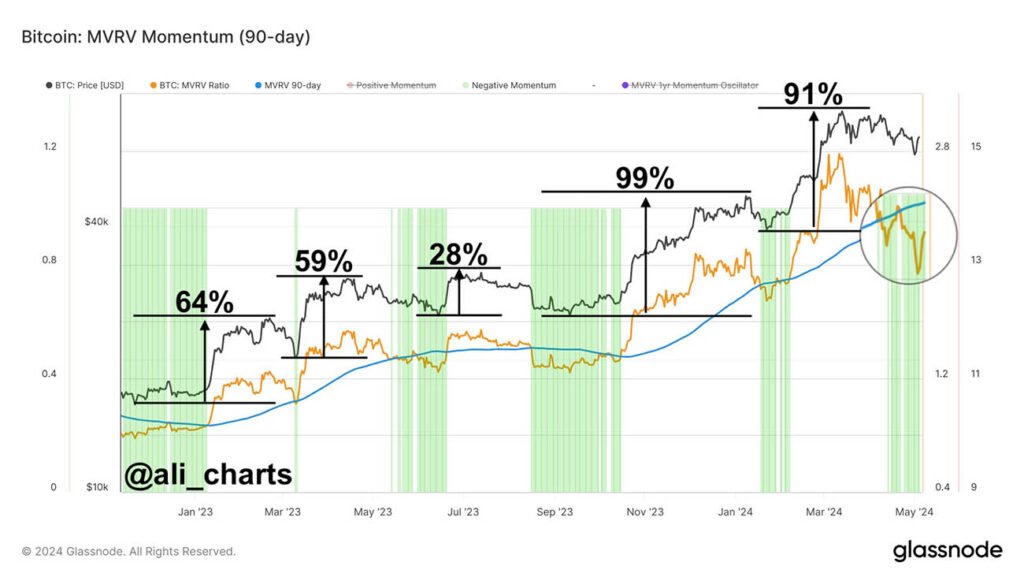

Despite bitcoin’s surge, the MVRV 90-Day Ratio suggests that bitcoin remains in a prime buy zone, making it an ideal point of entry into the asset.

Key support levels for bitcoin include the $57,000 to $64,000 demand level, embraced by the 50-day EMA.

As independent trader Ali Martinez explained in April, a situation where bitcoin trades around these levels makes it a prime buy zone for BTC. The recent drawdown in bitcoin saw the MVRV ratio drop below its 90-day moving average, indicating a buying opportunity.

According to recent data, Bitcoin whales are taking advantage of the recent market downturn from its peak. They have purchased more BTC at discounted prices, seeing it as an opportunity to “buy the dip.”

Overall, the Bitcoin market continues to evolve, with miners adjusting to the effects of the halving event and market fluctuations, while traders navigate key support levels to capitalize on market movements.