As the Bitcoin community eagerly awaits the upcoming halving event in April 2024, miners are ramping up their efforts to maximize profitability amidst increasing competition and declining transaction fees. Miners are actively exploring strategies to increase their earnings prior to the halving scheduled for April 2024.

According to a report from leading analytics platform, CryptoQuant, Bitcoin miners have significantly increased their selling activity in the lead-up to the halving. Daily sales to over-the-counter (OTC) desks peaked at 1,600 bitcoin in late March, marking the highest level since August 2023. This surge in sales reflects miners’ strategic efforts to boost their rewards before the anticipated reduction in block rewards from 6.25 to 3.125 BTC per block.

Challenges Amidst the Surge

Despite the surge in sales, miners are facing numerous challenges that threaten their profitability. Lower transaction fees and increasing competition are among the key concerns. The reduction in Bitcoin block rewards will slash miner revenues by 50%, necessitating higher BTC prices to sustain profitability. Continual obstacles such as reduced transaction costs, heightened competition in mining, and the demand for greater computational capacity are exerting strain on individuals engaged in Bitcoin mining.

CryptoQuant analysts explained:

“Indeed, transaction fees as a percentage of the total block reward (new Bitcoin issuance + transaction fees) are at low levels. Transaction fees represent ~3% of the total block reward, down from 37% in mid-December 2023. Fees were also around 3% prior to the previous halving in May 2020. Higher fees or Bitcoin prices are needed to compensate for the loss of block reward.”

Bitcoin Miners’ Intensified Competition and Rising Hashrate

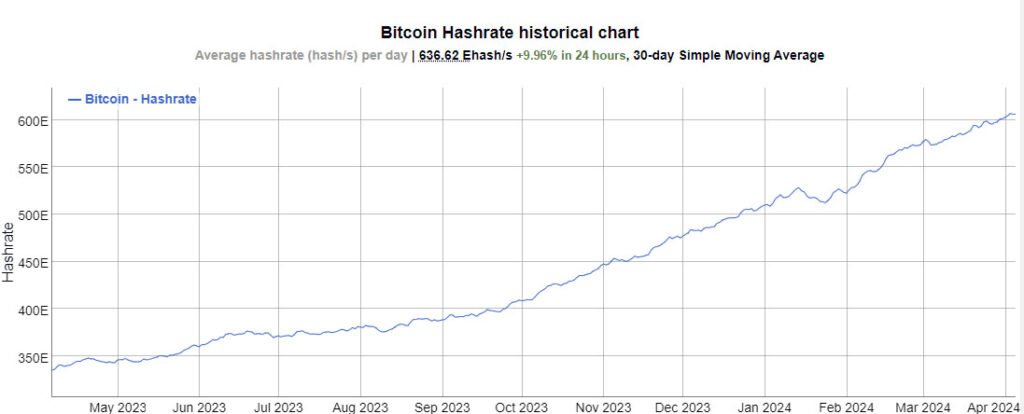

The recent surge in the Bitcoin network’s hash rate, specifically its 9.96% rise in the past 24 hours to over 630 EH/s, indicates intensified competition among miners vying for the same rewards. The hash rate, measured in hashes per second, reflects the total computational power dedicated to mining and securing the network. As the hash rate increases, it signifies a higher level of security and resilience against potential attacks. The rising hash rate signals more competition among miners for the same rewards, which in turn increases network security.

The upcoming halving event is poised to be the most significant in Bitcoin’s history in terms of the USD-denominated reduction of miner rewards. With rewards set to drop from 6.25 to 3.125 BTC per block, miners are expected to face a 3-7% reduction in active participation, while some reports even expect 20% of network hash rate to go offline post halving. The halving event will have a significant impact on miner rewards and profitability.

Amidst the challenges posed by the halving event, the continued adoption of Bitcoin Exchange-Traded Funds (ETFs) offers a glimmer of hope for miners. ETFs provide institutional and retail investors with exposure to bitcoin’s price movements without directly holding the underlying asset. This could help absorb selling pressure and contribute to a more stable demand for bitcoin. Bitcoin ETFs could play a crucial role in mitigating the negative impact of the halving event on miners’ profits.

Looking Ahead

As the Bitcoin community prepares for the upcoming halving event, miners are bracing themselves for significant changes in their operations. Despite facing challenges such as lower transaction fees and increasing competition, miners remain resilient in their pursuit of profitability. The role of Bitcoin ETFs in stabilizing demand and mitigating selling pressure highlights the evolving landscape of the Bitcoin market.

With the halving event on the horizon, all eyes are on Bitcoin miners as they navigate the challenges and opportunities that lie ahead.