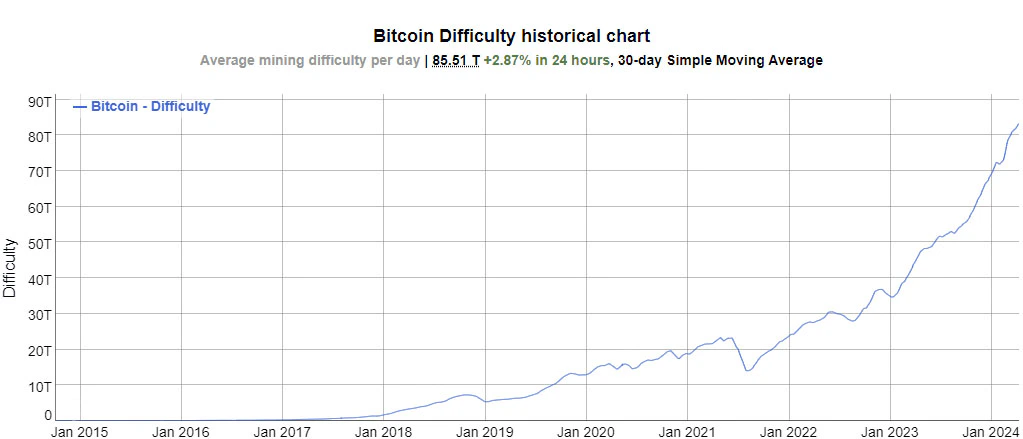

As the highly anticipated Bitcoin halving event draws near, the mining landscape witnesses a significant surge in complexity, with Bitcoin mining difficulty hitting a new all-time high of 85.51 trillion, as per data by BitInfoCharts.com.

The latest adjustment which occurred on April 10, reflected a 3.4% increase from the previous difficulty level of 83 trillion, set on March 28.

Analysts expect this adjustment to be the last one before the upcoming halving. The next Bitcoin mining difficulty adjustment is projected to happen in around 13 days, on April 24. Meanwhile, CoinMarketCap data indicates the Bitcoin halving is scheduled for April 19, just eight days away.

Hash Rate Soars Alongside Bitcoin Mining Difficulty

Bitcoin mining difficulty serves as a crucial metric, measuring the level of effort required to mine new blocks or find blocks with hashes within the target range, as instructed by Bitcoin’s proof-of-work (PoW) consensus mechanism. This adjustment, occurring roughly every 2,016 blocks or two weeks, aims to maintain a target block time of 10 minutes.

The surge in mining difficulty is closely correlated with the Bitcoin blockchain hash rate, representing miners’ computational power in generating new blocks and minting new bitcoin. Notably, the hash rate has experienced a substantial increase, soaring from around 619 exa hashes per second (EH/s) on March 28 to 696 EH/s on April 10.

Despite the difficulty reaching an all-time high, the hash rate previously peaked at 727.9 EH/s on March 24, according to BitInfoCharts.

A Difficult Time Ahead

Notably, analysts anticipate a significant impact on mining operations post-halving, citing potential efficiency reductions.

A February report by Galaxy Research speculates that post-halving, around 15% to 20% of Bitcoin’s current hash rate coming from eight types of application-specific integrated circuit (ASIC) models may go offline as miners deactivate rigs due to diminished profitability.

Similarly, a report by Bitfinex notes the challenges independent miners can face with the upcoming halving. It illustrates how Wall Street investment has reshaped Bitcoin mining incentives, favoring corporate profitability over decentralized ideals.

With the 2024 halving looming, independent miners face difficulties in negotiating energy deals or upgrading equipment. Bitfinex underscores the importance of innovation and collaboration for independent miners to thrive.

Bitcoin Price Recovers After Biden’s Comments

Meanwhile, Bitcoin experienced a slight recovery following remarks by the U.S. President Joe Biden hinting at a potential rate cut this year. Biden’s comments followed the release of March’s Consumer Price Index (CPI) report, indicating inflation is holding at 3.5%. During a press conference in Japan, the U.S. President stated:

“I do stand by my prediction that before the year is out, there’ll be a rate cut. This may delay it a month or so, I’m not sure of that. We don’t know what the Fed is going to do for certain, but look, we have dramatically reduced inflation from 9% down to close to 3%.”

The market responded positively. Bitcoin’s price is trading around $70,500 at the time of writing, marking a 2% increase following a brief dip post-CPI report, according to data from TradingView.