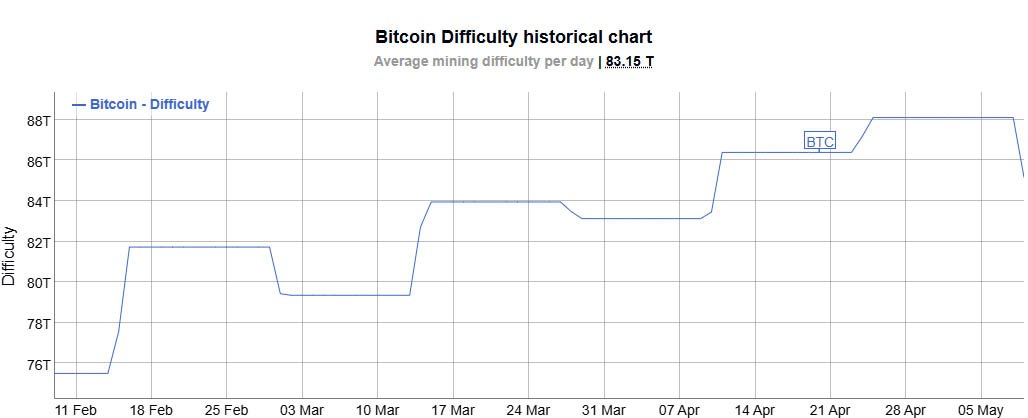

Bitcoin has recently witnessed a notable decrease in mining difficulty, marking the largest downward adjustment since 2022. This development has sparked discussions among miners, investors, and analysts about its implications for the market.

Bitcoin difficulty refers to the level of complexity involved in finding a specific nonce to validate transactions and create new blocks on the blockchain.

It is a crucial metric that adjusts approximately every two weeks to ensure a consistent block discovery time of around 10 minutes, regardless of changes in miner activity.

In its most recent adjustment, Bitcoin’s mining difficulty experienced a significant decline, dropping -5.6%. This adjustment is primarily attributed to fluctuations in the network’s hash rate, which measures the computational power dedicated to mining.

Bitcoin Difficulty Reduction: Analysis

The reduction in mining difficulty reflects broader shifts within the Bitcoin mining landscape.

The data also shows a notable decline in hash rate, which in turn led to the decrease in difficulty. According to data from BitInfoCharts, the network’s hash rate dropped from its all-time high of 650 Eh/s in mid-April to 570 Eh/s.

This information suggests that the miners who found the new block rewards unprofitable, might have switched off their machines. Therefore, factors such as the recent halving event, fluctuations in bitcoin’s price, and changes in miner behavior could have contributed to this adjustment.

The decrease in mining difficulty is expected to provide some relief for miners who have been grappling with declining revenues since the halving event. With lower difficulty levels, miners can mine blocks more efficiently, potentially improving their profitability.

After the halving, Bitcoin’s difficulty rose, partially due to the introduction of the Runes protocol by Casey Rodarmor. Runes improved token creation on Bitcoin, briefly boosting miner revenues through transaction fees.

However, the fees soon normalized, falling from $128.45 to approximately $1, as per Mempool records.

Nick Hansen, CEO of Luxor mining pool, explains:

“If there isn’t enough margin for miners to make a profit, they turn off, which causes the hash rate to go down.”

This sentiment is echoed by Scott Norris, CEO of Optiminer, who believes that the adjustment is a normal occurrence after a halving event and is healthy for the network.

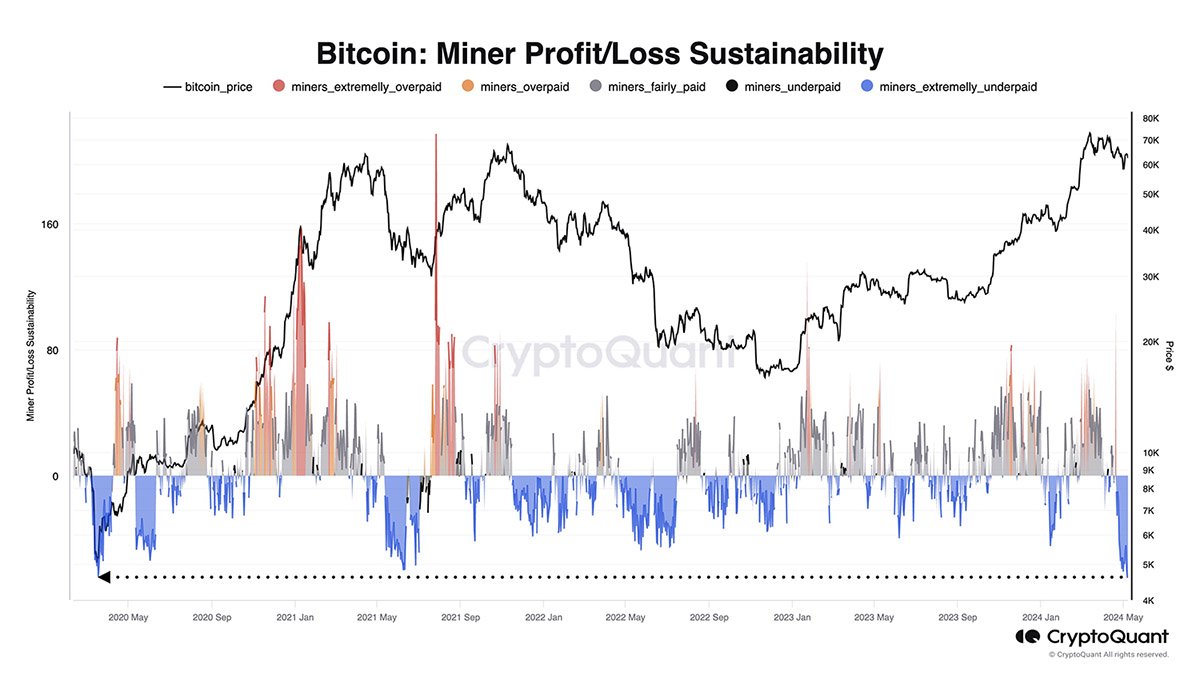

For investors, the drop in mining difficulty could have broader implications for the market. Julio Moreno, Head of Research at CryptoQuant, notes that miners are currently underpaid by the most since March 2020, indicating significant challenges in the sector.

He noted:

“As revenue has declined sharply after the halving, Miners are currently underpaid by the most since March 2020, the COVID crash.”

However, some analysts remain optimistic about the sector’s future growth. Norris suggests that miners who planned properly will adapt by upgrading their technology and finding cheaper energy sources. This adaptability could ultimately strengthen the network and attract more investors.

He added: “Either way, the network will continue to grow. It always happens this way. Historically, it’ll be late in the year before we see much price rise [for Bitcoin].”

Bitcoin’s price movements have also played a significant role in shaping mining difficulty.

The asset’s price has experienced volatility, reaching new highs before retracing to lower levels. This volatility, coupled with the halving event, has contributed to changes in miner behavior and network dynamics.

Despite the challenges posed by declining revenues and increased competition, miners continue to operate in the hope of future price appreciation.

Nishant Sharma, founder and CEO at BlocksBridge Consulting, a firm specializing in research and communication strategies within the Bitcoin mining sector, highlighted that this pattern is typical following a halving event, stating:

“After a Bitcoin halving, the drop in mining rewards leads less efficient miners to unplug their machines […] This self-adjusting feature favors leaner operations, as remaining miners receive increased rewards due to the reduced difficulty.”

Additionally, there has been limited trading in spot Bitcoin ETFs. Farside Investor’s data shows minimal net movement, with Bitwise Bitcoin ETF being the sole issuer to see inflows on May 8.

Despite recent hurdles, Ki Young Ju, CEO of CryptoQuant, notes no miner capitulation. He posits that miners’ post-halving profits may endure if bitcoin hits $80,000.

As Bitcoin continues to evolve, the dynamics of mining difficulty are likely to remain a focal point for miners, investors, and analysts alike.

The ability of miners to adapt to changing market conditions, coupled with investor sentiment and regulatory developments, will shape the future trajectory of the bitcoin market.