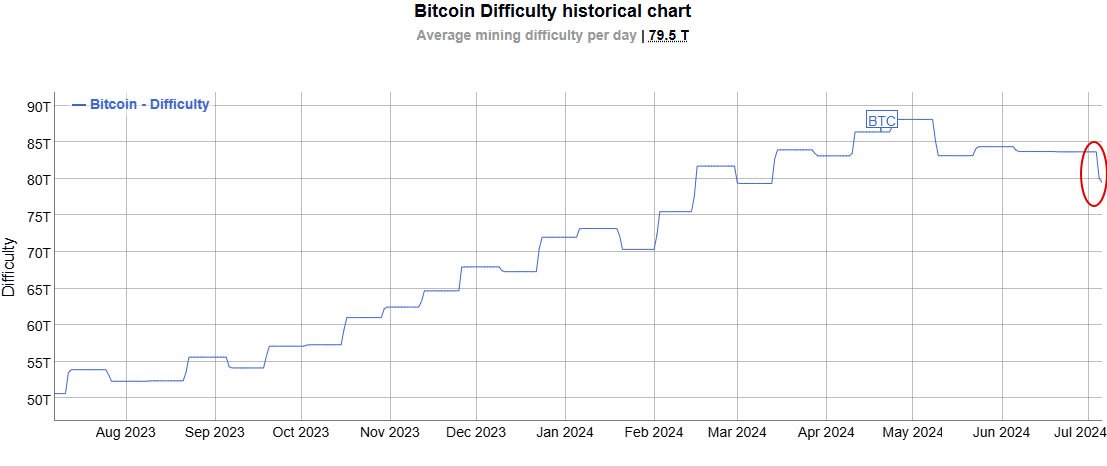

Recent reports highlight a dramatic drop in Bitcoin mining difficulty, reaching levels not seen since March. This article will delve into what this means for miners, investors, and the broader digital asset market.

Bitcoin mining difficulty recently fell by over 5% to 79.50 trillion, marking its lowest point since March.

Mining difficulty, a measure of how hard it is to mine a new block of Bitcoin, adjusts approximately every two weeks to ensure a consistent block time. This recent drop, the largest since March, is significant.

Between March and May, mining difficulty surged to an all-time high of 88.10 T. Since then, it has gradually declined to its current level. This fluctuation in difficulty affects miners’ profitability and operational strategies.

Mining difficulty is closely tied to hashrate, which measures the computing power used by the network to solve cryptographic puzzles.

As hashrate increases, so does difficulty, requiring miners to use more powerful and efficient hardware to stay profitable. Historically, hashrate has shown consistent growth, with notable jumps in late 2017 and recent years due to increased adoption and technological advancements.

The recent drop in mining difficulty brings mixed implications for miners.

On the positive side, reduced difficulty means that miners can solve puzzles more easily, potentially increasing their chances of mining new blocks and earning rewards. This can temporarily improve profitability, especially for smaller mining operations.

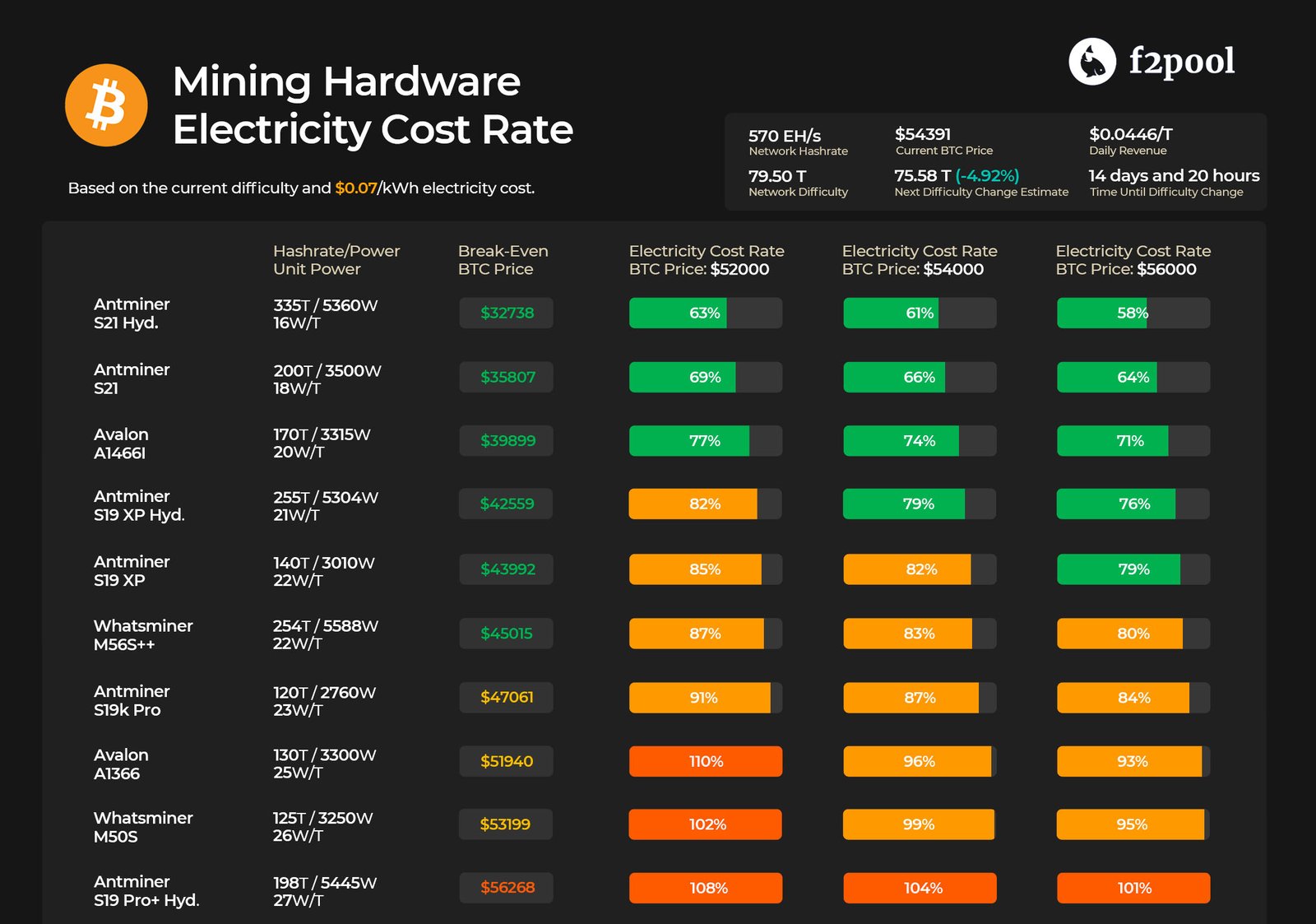

F2Pool, a prominent Bitcoin mining pool, estimates that under the current difficulty of 79.5 T, ASIC mining rigs with an efficiency rate of 26 watts per terahash or better can remain profitable if bitcoin’s price stays above $54,000 and electricity costs are around $0.07 per kilowatt-hour.

However, if bitcoin’s price falls below this threshold, miners will need more efficient rigs to maintain profitability. This situation underscores the delicate balance miners must navigate between hardware efficiency, operational costs, and bitcoin’s market price.

Despite recent fluctuations, market sentiment around nitcoin remains bullish.

According to on-chain analysis firm CryptoQuant, 50% of the long-term bitcoin supply is “inactive,” meaning there have been no movements or changes in holdings across tracked wallets.

This indicates strong long-term conviction among holders, suggesting confidence in bitcoin’s future value and potential for growth.

Long-term holders, often referred to as “holders,” and whales—investors holding large quantities of bitcoin—play a crucial role in the market. Their actions significantly influence price movements and liquidity.

Related: Bitcoin Whale’s Awakening Rocks The Market

During periods of market consolidation or downturn, these key players’ decisions can either exacerbate or mitigate market volatility.

Large institutions and corporations are also increasingly entering the market, bringing more significant scrutiny and analysis of market movements. This trend influences the strategies of miners and other key players.

Institutional investors’ participation can greatly influence market dynamics, particularly during periods of increased volatility. Recent outflows from U.S. spot Bitcoin exchange-traded funds (ETFs) highlight the cautious approach many institutional investors are taking amid current market conditions.

Another problem Bitcoin miners are facing is their shrinking treasuries. Miners are holding less bitcoin than ever before, marking a 14-year low in miner reserves. This significant drop is drawing attention to the evolving dynamics within the Bitcoin market.

CryptoQuant reports that the current supply of bitcoin held by miners is at its lowest since Bitcoin’s early days. Back then, Satoshi Nakamoto, Bitcoin’s mysterious creator, was still actively developing the project.

Several factors contribute to this decline. Rising mining costs, increased difficulty, and the need for technological upgrades force miners to sell portions of their bitcoin holdings.

Miners face substantial operational expenses, prompting them to liquidate their reserves to cover costs and reinvest in more efficient mining hardware.

The decline in miner reserves has implications for the Bitcoin market. As miner reserves dwindle, immediate selling pressure on the market decreases. This reduction in selling pressure can create a more stable price environment, as fewer bitcoin are available for sale from miners.

The future of Bitcoin mining will likely be shaped by advancements in technology and changes in market dynamics. Innovations in mining equipment and energy efficiency can help miners maintain profitability and adapt to evolving market conditions.

Additionally, the development of new mining strategies and business models will contribute to the sustainability of the mining industry.

Regulatory changes also play a significant role in shaping the future of Bitcoin mining as it continues to evolve.

Despite current challenges, the long-term outlook for bitcoin remains positive.

The digital asset has demonstrated resilience through previous market cycles and continues to attract interest from a wide range of investors.

As the market matures, the influence of long-term holders, whales, and miners will likely evolve, contributing to the ongoing development of its thriving ecosystem.

Understanding the factors that influence market sentiment, such as the actions of long-term holders and miners, is essential for making informed investment decisions.

Bitcoin’s recent drop in mining difficulty to 79.50 trillion and the accompanying changes in miner reserves underscore the complex dynamics of the market.

The evolving strategies of miners, the influence of institutional investors, and the actions of long-term holders all contribute to the market’s current state and future direction.