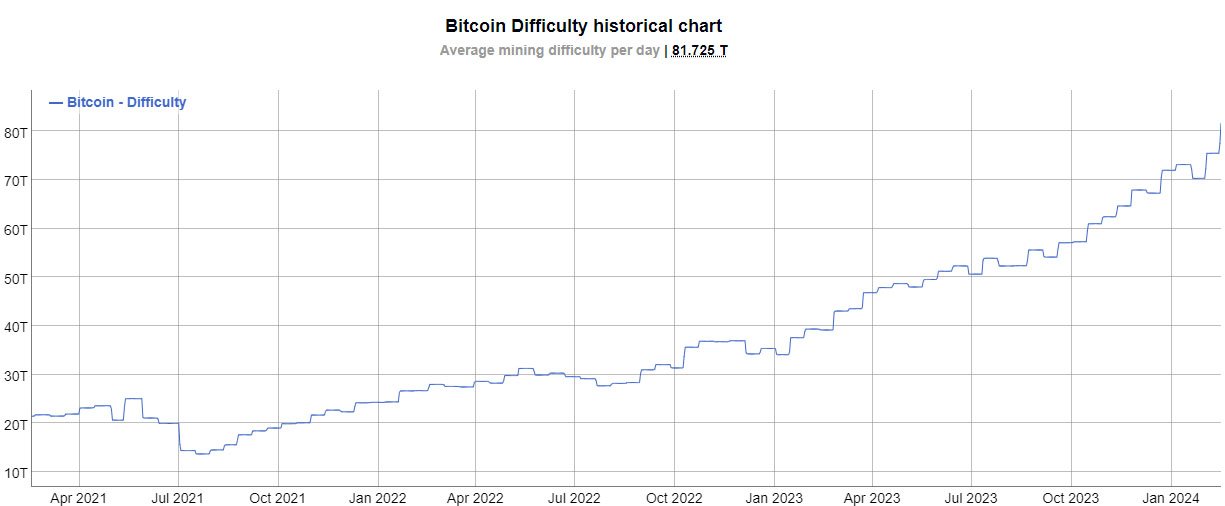

Bitcoin mining difficulty recently witnessed a significant milestone as it reached an unprecedented 81.73 trillion. This accomplishment coincided with the network’s hash rate hitting an impressive 583.92 exahashes per second (EH/s). Bitcoin hash rate indicates the total computational power employed by miners.

The data, sourced from BitInfoCharts, highlights the substantial growth in Bitcoin mining difficulty since January 2023, with projections indicating a potential surge to 100 trillion in the coming months.

Notably, Bitcoin’s mining difficulty is an integral aspect of its proof-of-work consensus mechanism. It signifies the complexity of solving cryptographic puzzles during the mining process. A higher difficulty implies that miners need increased computational power and energy to uncover the correct hash.

Over the past year, Bitcoin has experienced more than a doubling of its difficulty level, reflecting the ongoing evolution of the network. During the automated readjustment on February 15, Bitcoin mining difficulty witnessed a notable 8.24% increase.

This relentless upward trajectory of Bitcoin’s mining difficulty is driven by the expanding hash rate and the network’s commitment to maintaining a steady block production every 10 minutes.

Market Trend

Amid these developments, data from TradingView reveals that Bitcoin’s market value is keeping relatively steady, trading at around $51,700 at the time of writing. However, the digital asset has experienced a significant price surge in the last few weeks, with experts hinting at the dawn of a bull run.

Despite external market factors, Bitcoin demonstrated a robust position, showcasing its ability to weather macroeconomic fluctuations.

Looking ahead, the impending Bitcoin halving in April looms large over the digital asset market. Programmed into Bitcoin’s structure, the halving involves a reduction in mining rewards around every four years. In this upcoming event, new block rewards are set to decrease from 6.25 BTC to 3.125 BTC.

Bitcoin Mining Difficulty: Potential Impact on Miners

The reduction in mining rewards raises concerns about its impact on the hash rate. Less efficient miners may find it economically challenging to sustain operations, potentially leading to mining rigs going offline.

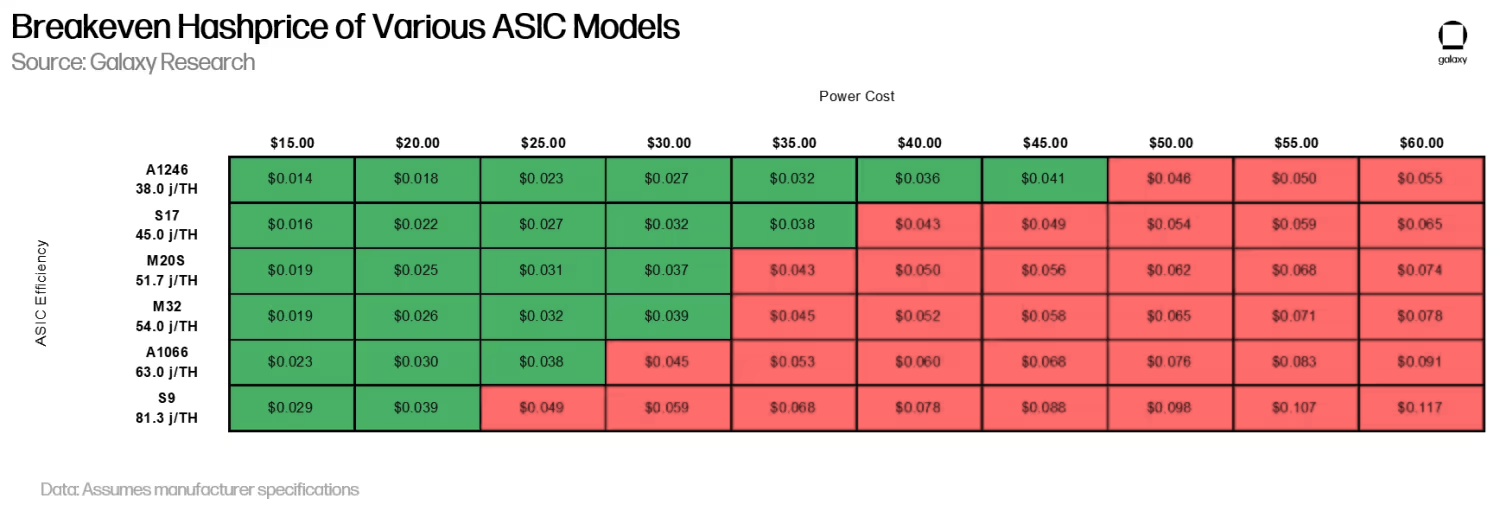

Notably, Galaxy Digital analysts predict that up to 20% of Bitcoin’s current hash rate could go offline post-halving, leaving only the most efficient mining rigs operational.

Galaxy states:

“Given how sensitive the breakevens are for the various ASIC models to bitcoin price and transaction fees as a percent of rewards we estimate that between 15 – 20% of network hashrate coming from the ASIC models presented below could come offline, which represents between 86 – 115 EH.”

On a similar note, a January report by financial services company Cantor Fitzgerald predicted that the upcoming halving could be unprofitable for nine out of the 11 largest publicly traded bitcoin mining companies.

Bitcoin enthusiasts are awaiting the halving event and closely monitoring the network’s performance and the impending adjustments in the reward structure. The coming months are poised to witness how Bitcoin navigates this shift and continues its journey as a pioneering force.