A recent report published by Ark Investment Management analyzes Bitcoin energy consumption and its environmental impacts, and concludes that bitcoin mining could be an ideal use of excess energy if done at oil and gas well sites.

Addressing Energy and Environmental Issues

The article states that bitcoin mining has the potential to address the issue of natural gas emissions effectively.

Related reading : Bitcoin Fixes The Energy Grid

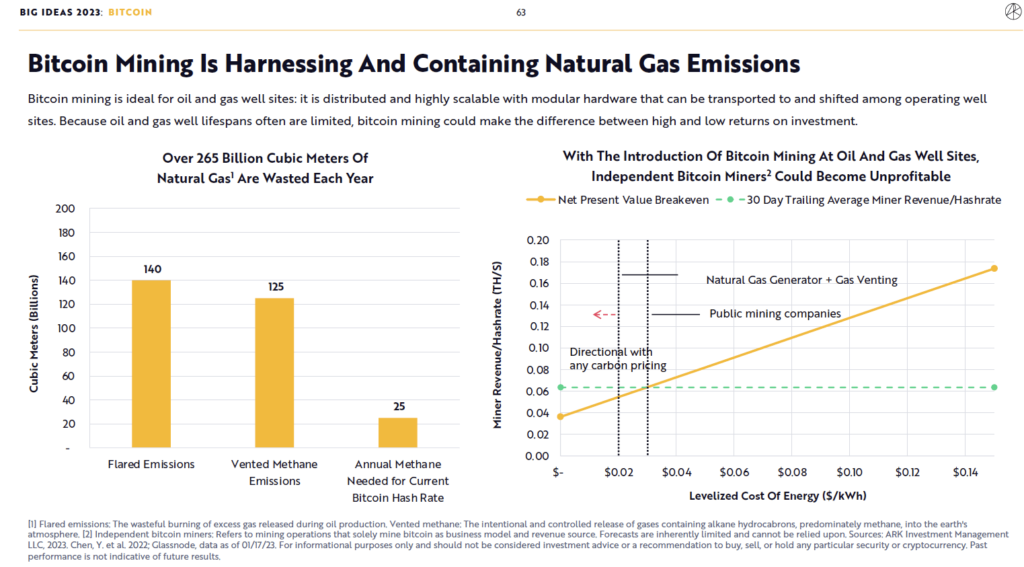

According to the report, more than 265 billion cubic meters of natural gas are wasted annually, but this can be mitigated through the utilization of bitcoin mining. This process proves particularly beneficial for oil and gas well sites due to its distributed and highly scalable nature.

The modular hardware used in bitcoin mining can be easily transported and deployed among different operating well sites. Given the limited lifespans of oil and gas wells, integrating bitcoin mining could significantly impact the returns on investment, potentially making the difference between high and low profitability.

However, the introduction of bitcoin mining at oil and gas well sites may adversely affect independent miners, rendering their operations unprofitable. This may also encourage a transition towards more environmentally friendly energy sources, such as green energy, or the utilization of otherwise wasted energy, thereby influencing the balance of sources of energy used for mining.

Related reading : Is Bitcoin Mining Really That Bad for the Environment?

Currently, approximately 140 billion cubic meters of natural gas are flared each year, accompanied by the venting of 125 billion cubic meters of methane. Remarkably, only 25 billion cubic meters of this wasted gas is sufficient to sustain the current hashrate on the Bitcoin network, eliminating the need for any other energy source.

Hashrate

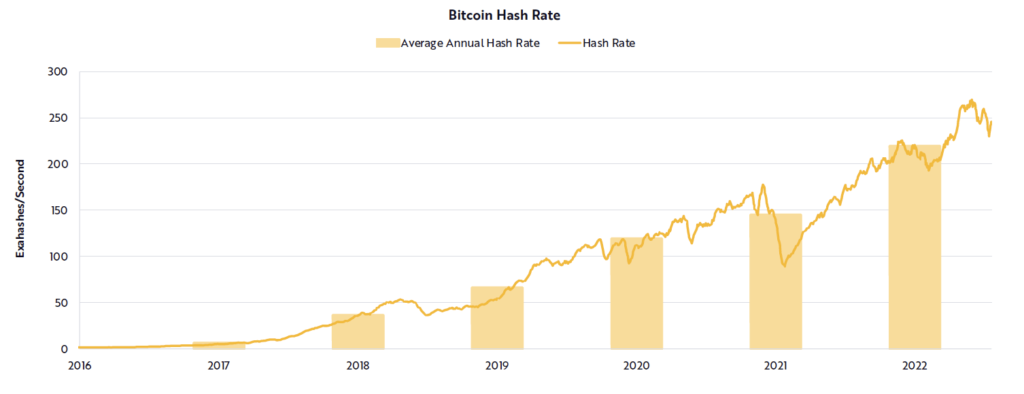

Bitcoin’s hashrate has been on a steady rise since its inception and is repeatedly setting new all-time highs. At the time of writing, the total network hashrate ATH was 377 Eh/s, and the mining difficulty has reached a historic value of 51 trillion.

Source : Ark Investment Management

This indicates that the race on mining the future blocks has intensified, and miners are competing with each other like never before.