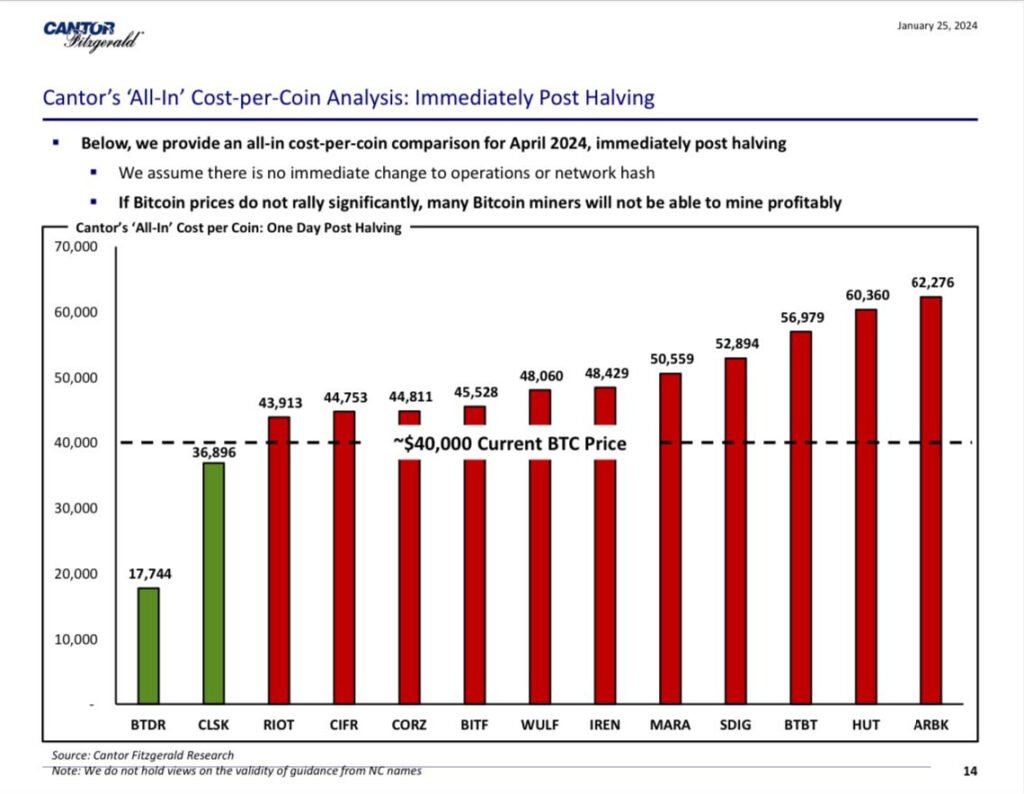

In a comprehensive report by financial services company Cantor Fitzgerald, it has been predicted that the forthcoming bitcoin halving the 28th of April could potentially render nine out of the 11 largest publicly traded bitcoin miners unprofitable, particularly if the bitcoin price hovers around $40,000.

Key Takeaways from Cantor Fitzgerald Report

- Post-halving profitability at risk: Up to nine of the 11 major publicly traded bitcoin miners could become unprofitable if the bitcoin price remains around $40,000.

- Miners most vulnerable: Argo Blockchain and Hut 8 Mining face the highest “all-in” cost per coin.

- Selling pressure: Miners are increasing their Bitcoin sales ahead of the halving, potentially impacting prices.

- Adaptability is key: Miners with lower operating costs and strategic responses are better positioned to navigate the challenges.

Which Miners Are Most at Risk?

The report underscores the vulnerability of major players in the mining industry, shedding light on the potential impact of the halving event on their profit margins and the network’s overall hashrate.

Cantor Fitzgerald’s analysis highlights several major publicly traded bitcoin miners facing significant profitability challenges post-halving. Among the most vulnerable are:

- Argo Blockchain

- Hut 8 Mining

- Marathon Digital

- Riot Blockchain

- Core Scientific

Cantor Fitzgerald Report: Analyzing All-In Cost Per Coin

The report delves into the “all-in” cost per coin immediately following the halving event in April 2024, assuming no immediate changes to operations or network hash. This metric considers various factors, including electricity costs, hosting fees, and other cash expenses associated with bitcoin mining.

According to the preview of the report, only Singapore-based miner Bitdeer and United States-based CleanSpark would maintain their profit margins, boasting cost-per-coin rates of $17,774 and $36,896, respectively.

Miner Responses and Predictions

CleanSpark recently reported holding a total of 3,002 BTC, worth around $126 million, as of December 2023. The executive chairman and co-founder, Matthew Shultz, shared Cantor Fitzgerald’s report on X, stating:

“No matter the department, the entire team at CleanSpark is committed to efficiency. EFFICIENCY of Uptime, Equipment, Capital, Operations, Community Engagement, Energy, Strategy, Growth, and other metrics.”

In contrast, the report identified Argo Blockchain and Hut 8 Mining as the most severely impacted, with an all in cost-per-coin rate of $62,276 and $60,360, respectively. Notably, Florida-based Hut 8 recently published its latest update on mining operations, reporting its total reserves standing at 9,195 bitcoin, worth around $386 million at the current market price.

Other prominent players such as Marathon Digital, Riot Blockchain, and Core Scientific are also likely to face significant challenges, with a cost-per-coin rate of 50,559, 43,913, and 44,811, respectively.

Market Dynamics and Selling Pressures

CryptoQuant, an on-chain analytics company, has highlighted a strategic move by bitcoin miners who are selling their reserves ahead of the anticipated Halving event, scheduled around April 22.

The report points out that the flow of bitcoin from miners to exchanges is currently three times higher than the movement from exchanges to miners, indicating significant selling pressure from the mining community.

It is important to note that with each halving event, the competition among miners strengthens. Therefore, these days, miners are aiming to realize profits before the halving event to handle operational costs and prepare for future investments amidst escalating competition.

Expert Insights

The Bitcoin halving, occurring every four years, is designed to control the supply of new bitcoin entering circulation. This supply contraction, coupled with changes in mining difficulty, has traditionally influenced bitcoin price predictions, making it a pivotal event in the digital asset market..

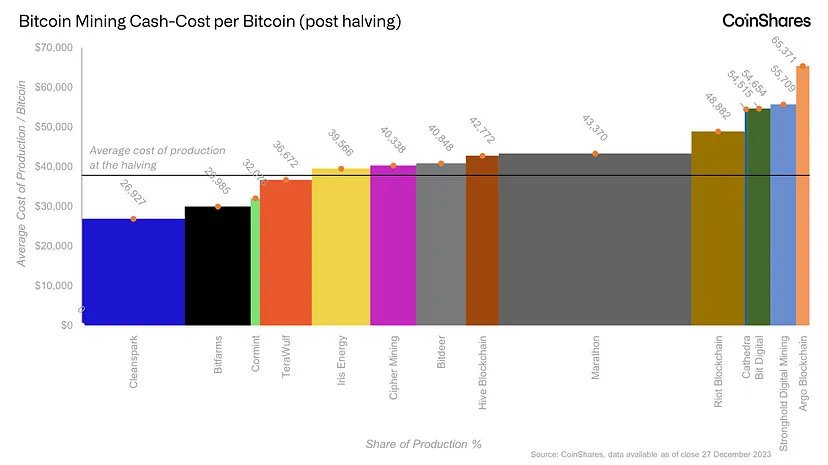

A recent analysis shared by James Butterfill, Head of Research at CoinShares, echoes a similar prediction. However, his company expects that the hashrate might decrease to 410 EH/s six months after the halving event. It states:

“Following that, the trend line forecasts a sharp increase in the hashrate to approximately 550 EH/s by the end of 2024.”

As the bitcoin halving event approaches, the intricate analysis presented in Cantor Fitzgerald’s report sheds light on the complex dynamics of the mining industry, emphasizing the need for miners to strategically navigate the evolving market conditions to sustain profitability in the face of increased competition.