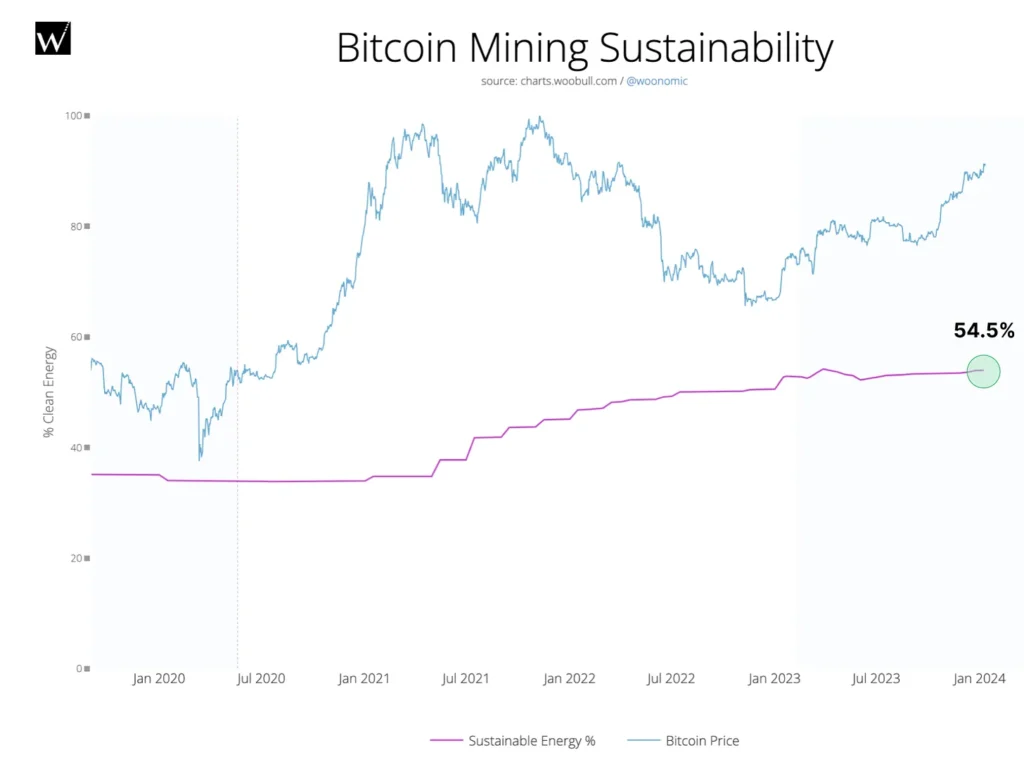

Bitcoin mining has recently witnessed a groundbreaking surge in sustainable energy consumption, reaching an all-time high of 54.5%. A recent report by Daniel Batten, co-founder of CH4 Capital, indicates that the strides made in reducing carbon footprints within the industry are substantial, marking it as a pioneer in global sustainability efforts.

Daniel Batten Report: A Beacon of Sustainability

In a noteworthy revelation, Daniel Batten, co-founder of CH4 Capital, reported that Bitcoin mining now stands as the only major global industry predominantly powered by sustainable energy. This marks a remarkable achievement, showcasing the industry’s commitment to environmental responsibility.

He stated:

“There are no longer any independent models or studies using contemporary data that support the thesis Bitcoin is mainly powered by fossil fuels.”

The Rise of Sustainable Energy in BTC Mining

The Bitcoin ESG Forecast reports a significant leap in sustainable energy use for BTC mining, climbing to 54.5% in 2023. The sector has witnessed a commendable 3.6% increase in sustainable mining throughout the calendar year.

Contrary to earlier perceptions, Bitcoin mining has become a leader in emissions mitigation without relying on offsets. A groundbreaking 7.3% of emissions are now directly mitigated, setting a new standard for sustainability in industries.

Batten added:

“[Bitcoin] can become the fastest industry to go greenhouse negative without offsets.”

Methane-Powered Off-Grid Mining Operations

In an innovative approach, Bitcoin miners are utilizing methane emissions for off-grid operations. This practice not only reduces environmental impact but also contributes significantly to emission mitigation. The vented methane is converted into electricity for Bitcoin mining, providing an eco-friendly alternative.

Global Shift to Greener Grids

The industry has undergone a transformative shift, particularly after the mining bans in China and Kazakhstan. Miners have strategically relocated to greener grids in North America and sustainable off-grid locations. This migration has not only increased the industry’s reliance on sustainable energy but has also contributed to a 29% reduction in emission intensity for on-grid Bitcoin miners compared to 2021.

Looking Ahead: The Bitcoin Halving Event

As Bitcoin miners prepare for the 2024 halving event, challenges loom on the horizon. As per a report by asset manager CoinShares, production costs will increase, with estimates suggesting a surge from $16,800 to $27,900 and cash costs per Bitcoin rising from $25,000 to $37,800. CoinShares’ report identifies Riot, TeraWulf, and CleanSpark as companies best positioned to weather the impending storm.

The report adds:

“[…] we think Riot, TeraWulf, and CleanSpark are best positioned going into the halving,”

Bitcoin mining’s remarkable transition to sustainable energy marks a pivotal moment for the industry. With record-high levels of emissions mitigation and a commitment to environmental responsibility, this industry is not just securing its future but also setting an example for global industries in the pursuit of a greener tomorrow.