Marathon Digital, a prominent player in the Bitcoin mining industry, has set ambitious goals to double its mining capacity by the end of 2024. This significant increase comes as the company leverages recent acquisitions and favorable market conditions to expand its operations.

Expanding Hash Rate Target

Marathon leads in Bitcoin mining with a hash rate of 24.7 EH/s, followed by Core Scientific at 16.9 EH/s and Riot Platforms at 12.4 EH/s, as reported by Hashrate Index. Marathon Digital has revised its hash rate target for 2024 from an initial range of 35-37 exahashes per second (EH/s) to an impressive 50 EH/s. This decision reflects a 100% growth from its current status, and underscores the company’s confidence in its ability to scale up its operations swiftly.

Acquisitions Fueling Growth

Recent acquisitions have played a pivotal role in Marathon’s expansion strategy.

The company acquired a 200-megawatt Bitcoin mining center from Digital Applied in March, followed by the purchase of two additional mining sites totaling 390 megawatts from Generate Capital in December. These acquisitions have provided Marathon with the necessary infrastructure to increase its mining capacity substantially.

Marathon’s CEO, Fred Thiel, emphasized the significance of these acquisitions, stating, “Given the amount of capacity we have available following our recent acquisitions and the amount of hash rate we have access to through current machine orders and options, we now believe it is possible for us to double the scale of Marathon’s mining operations in 2024 and achieve 50 exahash by the end of the year.”

He added:

“With our current liquidity position, this growth target is also fully funded and there is no need for us to raise additional capital to achieve our objective. By deploying state of the art equipment and our own proprietary technology, we also believe that we can improve our fleet efficiency and approach 21 joules per terahash as we grow to 50 exahash.”

Marathon Digital: A Fully Funded Expansion

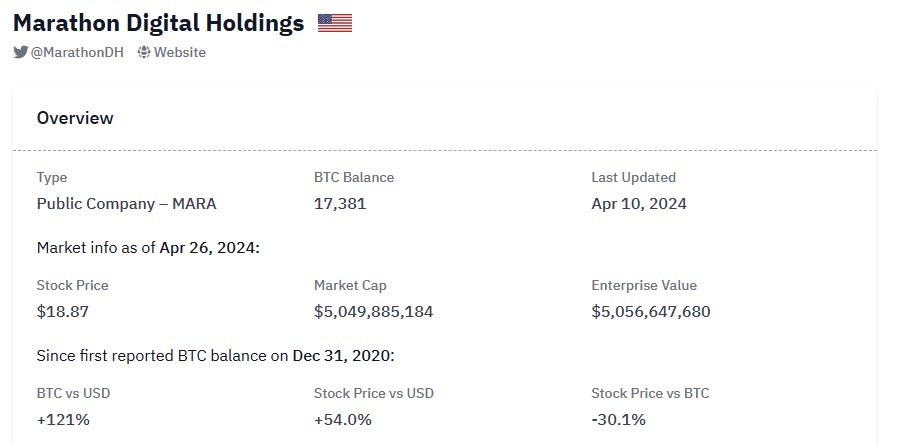

One notable aspect of Marathon’s expansion plans is that they are fully funded. Thiel reiterated that there is no need for the company to raise additional capital to achieve its objectives. This financial stability provides Marathon with a strong foundation to execute its growth strategy effectively. Based on information provided by Bitcoin Treasuries, the organization possesses over 17,000 BTC.

Market Response and Performance

The announcement of Marathon’s increased hash rate target has been met with positive market response. Despite a slight dip in stock price on April 25, Marathon’s shares rallied in after-hours trading, reflecting investor confidence in the company’s growth prospects. Marathon’s (MARA) stock dropped slightly to $19.01 on April 25 but surged 4.5% in after-hours trading post-announcement, per TradingView.

Industry Trends and Implications

Marathon’s ambitious goals mirror broader trends in the Bitcoin mining sector. As Bitcoin’s popularity continues to surge, mining companies are racing to expand their operations to capitalize on the growing demand for digital assets.

The recent Bitcoin halving event, which occurred at block 840,000 on April 20, resulted in a reduction of block subsidies to 3.125 BTC. However, miners have offset this reduction through record-setting transaction fees, underscoring the resilience of the mining industry.

Conclusion

Marathon Digital’s decision to double its Bitcoin mining capacity to 50 EH/s by the end of 2024 marks a significant milestone in the company’s growth journey. With strategic acquisitions and a fully funded expansion plan, Marathon is poised to solidify its position as a key player in the Bitcoin mining landscape.

As the industry continues to evolve, Marathon’s ambitious goals reflect its commitment to driving innovation and embracing opportunities in the dynamic world of digital assets.