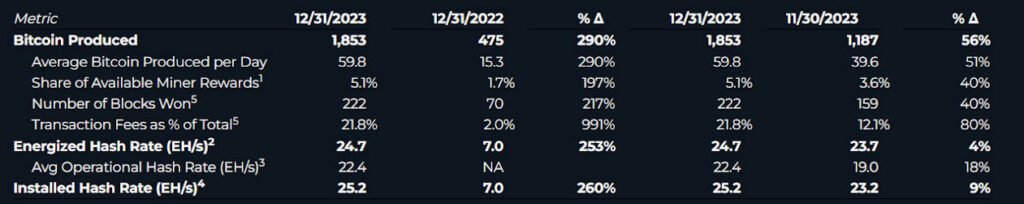

In a groundbreaking achievement, Marathon Digital Holdings, a prominent bitcoin miner based in Florida, has set an industry record by mining an unprecedented 1,853 bitcoin in December 2023. This remarkable feat represents a 56% surge compared to the previous month and an astonishing 290% increase from the same period in 2022.

The company proudly declares this as the highest monthly production ever recorded by a public Bitcoin mining entity, surpassing the previous record claimed by Core Scientific in January 2023, which produced 1,527 BTC.

Marathon‘s latest figures exceed this benchmark by more than 300 BTC, solidifying its position as a leader in the competitive Bitcoin mining sector.

Attributing this phenomenal achievement, Marathon’s Chairman and CEO, Fred Thiel, points to an 18.4% monthly increase in hash rate, reaching an impressive 22.4 exahashes per second. He highlights the significance of this boost in hash rate as a key factor in achieving the substantial increase in Bitcoin mining.

Marathon Digital Holdings and Sustainable Expansion

The company’s commitment to expansion is evident in its announcement on December 19, where it declared the acquisition of two mining centers for $179 million. This has impressively added 390 megawatts of mining capacity to its existing 584-megawatt output.

Thiel shares his ambitious plans for the future, stating, “We continue to target 30% growth in the energized hash rate in 2024, and with the recently announced acquisition of the two sites from Generate Capital, we expect to reach 50 exahashes in the next 18 to 24 months.”

Moreover, in a noteworthy move in November, Marathon took a strategic step towards sustainable energy practices by initiating a new pilot project in Utah to leverage green, off-grid energy sourced from landfill waste gas. This initiative underlined Marathon’s commitment to environmental responsibility within the realm of Bitcoin.

The company’s remarkable December performance is not only reflected in its mining capabilities but also in its stock market performance. On December 28, the company briefly claimed the top spot as the most-traded public company among mid- and large-cap firms on the U.S. stock market.

Notably, the company witnessed an extraordinary $3.3 billion daily trading volume, outpacing industry giants such as Tesla, Apple, and Amazon for the day.

Industry-Wide Trend

The timing of Marathon’s achievement aligns with an industry-wide trend as Bitcoin mining firms strategically expand operations, anticipating the potential approval of a Spot Bitcoin Exchange-Traded Fund (ETF) as early as January 8 and the upcoming Bitcoin halving scheduled for April.

It is interesting to note that Marathon’s rival mining firm, Riot Platforms, also made significant waves on December 5 by acquiring an additional $291 million worth of Bitcoin mining rigs. This move marked the largest increase in the hash rate in Riot Platforms’ history, highlighting the intense competition within the sector.

As Marathon Digital continues to set new records, expand operations, and lead the industry, the Bitcoin mining sector is poised for an exciting and dynamic year ahead, showcasing the evolving landscape of digital asset mining.