Paraguayan senators are now opting to pause the development of a proposed digital asset mining ban. They have shifted their focus towards the potential economic advantages of leveraging excess energy from the country’s Itaipu dam hydropower plant to fuel bitcoin mining operations rather than exporting it to neighboring Brazil and Argentina.

Initial Mining Ban Proposal

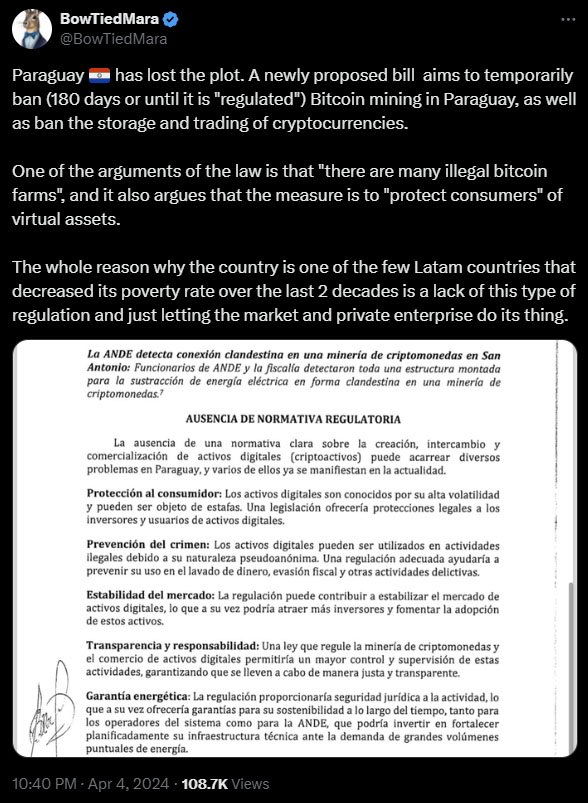

The decision to reassess the proposed ban comes just a week after lawmakers introduced a draft bill on April 4, suggesting a 180-day prohibition on Bitcoin mining. The rationale behind the ban stemmed from allegations of illegal digital asset mines silently consuming power and disturbing the country’s electricity supply.

If enacted, the initial proposal for a mining ban could significantly impact major industry players like Marathon Digital Holdings, which launched a 27-megawatt project near the Itaipu hydroelectric power plant in November 2023.

Itaipu Dam: Power Redirection to Miners

Senator Lilian Samaniego confirmed during an April 10 Senate session that a comprehensive debate will be convened in a public hearing scheduled for April 23. The hearing aims to delve into the intricacies of Bitcoin mining in the South American country, weighing its benefits against perceived drawbacks.

Notably, the Itaipu dam, one of Paraguay’s primary energy sources, generates a staggering 14 gigawatts of power, evenly distributed between Paraguay and Brazil. However, Paraguay currently utilizes only a fraction of this capacity, with the surplus sold to Brazil at a loss.

On April 8, Paraguayan lawmakers greenlit a declaration endorsing local and foreign investment infrastructure. Senator Salyn Buzarquis expressed optimism that this declaration would spur the Paraguayan Ministry of Industry to explore the economic potential of redirecting excess energy to Bitcoin miners.

Potential Economic Benefits

In a compelling letter addressed to Congress on April 8, Buzarquis highlighted the potential financial benefits associated with bitcoin mining operations. With 45 licensed digital asset miners projected to contribute $48 million to the National Electricity Administration (ANDE) by 2024, this figure is expected to soar to $125 million by 2025 as miners expand their operations.

Notably, Paraguay currently sells excess energy to Brazil at a subsidized rate of $10 per megawatt-hour (MWh). Buzarquis suggested that if the country instead sells this energy to local Bitcoin miners at a rate of $40 per MWh, ANDE could attain a remarkable 45% net profit margin. This translates to an annual revenue of $73 million and an additional $17 million in value-added tax for the Treasury.

The senator explained that embracing bitcoin mining could fortify ANDE’s financial stability, stating:

“This flow of funds is what is going to save ANDE from going bankrupt; to be able to invest more in infrastructure and not to raise the rate for Paraguyans.”

The potential benefits extend beyond financial gains, as digital asset mining could also catalyze job creation and bolster the local economy, emphasized Buzarquis during the senate session. This unfolding debate in Paraguay coincides with the imminent Bitcoin halving event scheduled for April 20, where miner rewards will be halved from 6.25 BTC to 3.125 BTC.