In this report, I analyze the latest 13F filings of numerous institutional investors who declared holding Bitcoin ETFs and examine the largest holders. Key insights revealed from the analysis include:

- A total of 782 institutions invested ~$10B into the Bitcoin ETFs

- That represents an approximate 80/20 split between retail and institutional investors across all Bitcoin ETF holdings.

- The largest institutional holders include Millennium Management, Horizon Kinetics and Schonfeld Strategic Advisors.

What Are 13F Filings?

Form 13F filings are quarterly reports required by the U.S. Securities and Exchange Commission (SEC) for large institutional investment managers with assets over $100M. These filings provide a detailed account of the securities held by major institutional investors.

The form must be filed within 45 days after the end of each calendar quarter via the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. For Q1 (ending March 31), the filing deadline was May 15, which just passed, and the reports are in. Let us take a look.

Institutional Bitcoin Spot ETFs Holdings: A Deep Dive

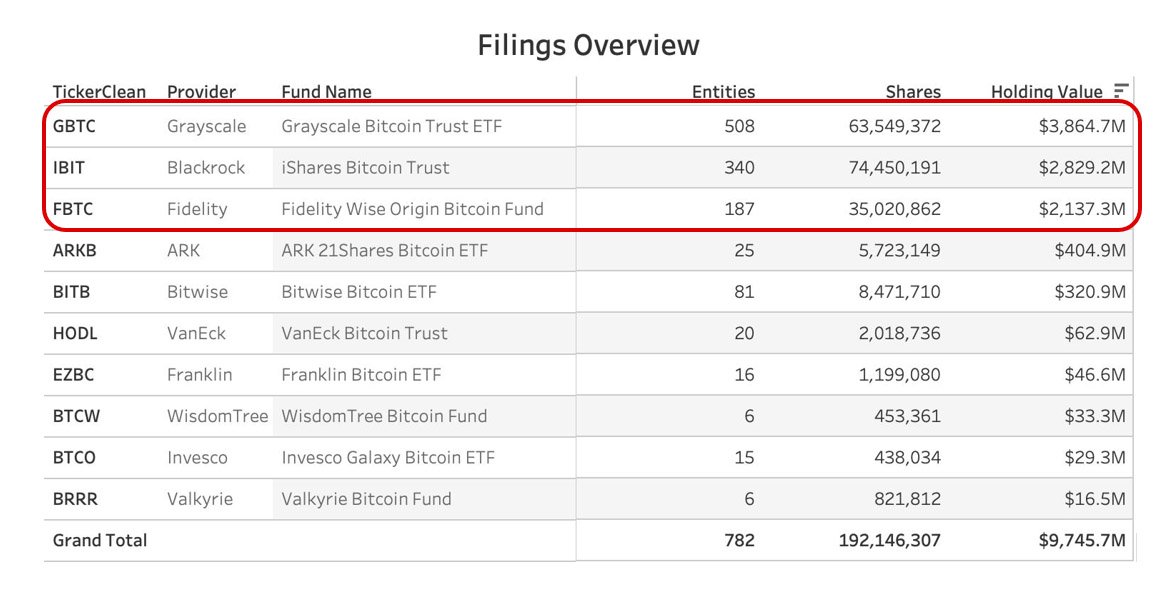

Our database of 13F filings includes 782 entities reporting on 192M shares of the 10 Bitcoin ETFs worth $9.7B.

Below, we show the frequency statistics by ETF Ticker. Unsurprisingly, the largest reported holdings (red box below) belong to Grayscale’s $GBTC (almost $4B), Blackrock’s $IBIT (nearly $3B), and Fidelity’s $FBTC ($2B+).

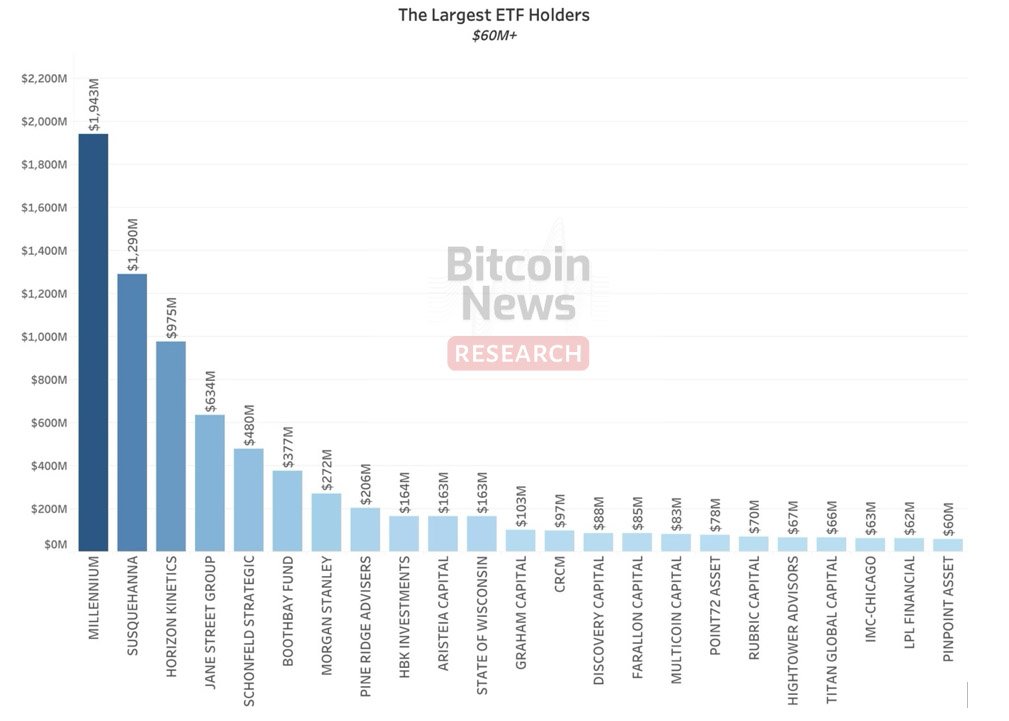

The figure below shows the largest ETF holders by total holdings.

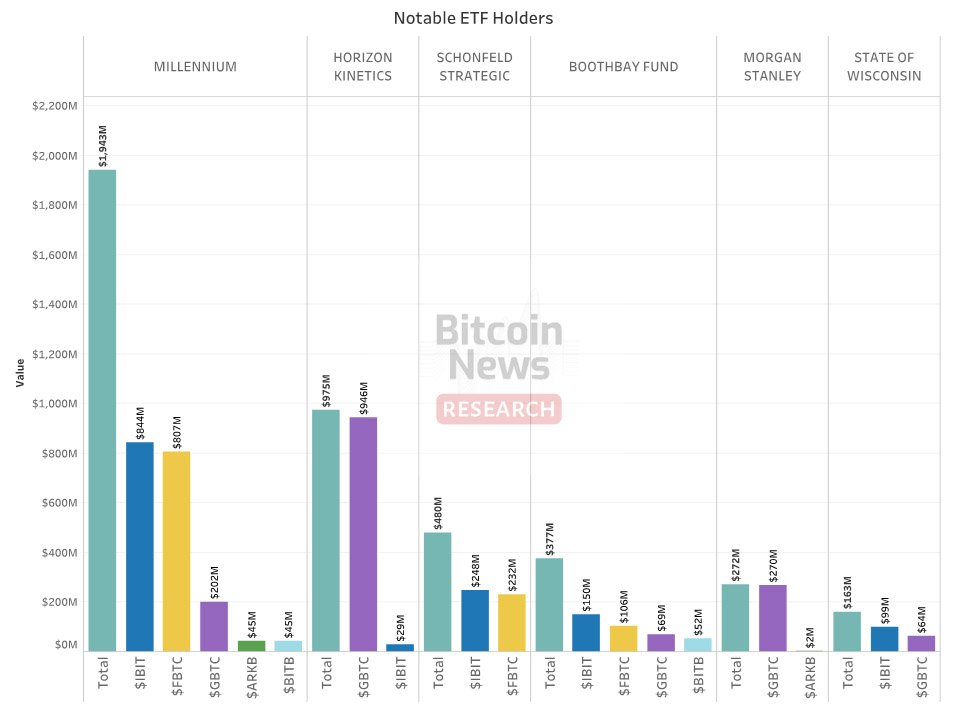

Millennium, Horizon Kinetics, Schonfeld Strategic, Booth Bay, and Morgan Stanley are the top five, excluding Susquehanna and Jane Street Group, who are also market makers and liquidity providers. The State of Wisconsin Investment Board is also high on the above list. Let’s dive deeper into the top 6 holders:

1. Millennium Management

Millennium Management is one of the largest and most successful hedge funds globally. Its AUM is over $64B, and it has more than 5,600 employees.

They had previously invested in Bitcoin futures and (unfortunately) other crypto related products. They hold almost $2B of spot Bitcoin ETF products, representing a ~3% portfolio allocation to Bitcoin.

2. Horizon Kinetics

Horizon Kinetics is a private investment advisory firm that provides portfolio management and consulting services to individuals, high-net-worth individuals, trusts, and estates. According to recent reports, it manages approximately $7 billion in assets. The firm’s investment philosophy is long-term and value-driven.

They view Bitcoin as a hedge against inflation and a non-correlated asset. In a 2022 blog post, Murray Stahl, the firm’s co-founder, wrote: “The future bitcoin return should be genuinely extraordinary.” They now own nearly $1B of Bitcoin ETFs, a 14% portfolio allocation!

3. Schonfeld Strategic Advisors

Schonfeld Strategic Advisors is a private multi-manager platform hedge fund. They, too, have a long-term focus and offer fundamentals-driven strategies while also managing tactical funds.

Interestingly, one of their key company principles is patience and long-term horizon. Schonfeld manages approximately $13.8B (as of 2023) in assets and hires around 1000 employees. They reported owning $408M worth of bitcoin, which is a 3% portfolio allocation!

4. Boothbay Fund Management

Boothbay Fund Management is a multi-strategy hedge fund manager founded by Ari Glass in 2011. The firm invests in a broad set of areas, including equities, fixed income, and credit.

Boothbay is more of a flexible and opportunistic player than a long-term investor, seeking to capitalize on market dislocations and inefficiencies.

They have been active in employing digital-asset arbitrage strategies for several years now. They oversee around $4B in assets and now own $377M worth of Bitcoin ETFs, a 9.4% total portfolio allocation.

5. Morgan Stanley

Morgan Stanley is a leading investment banking and wealth management provider. It manages a portfolio of approximately $1.5 trillion in assets. In 2021, the firm allowed its wealth management clients access to three Bitcoin funds, marking a major step for the organization.

Their CEO, James Gorman, recently made cautiously optimistic remarks: “Bitcoin is not going away. It’s not a fad. I just don’t think it’s a core investment. I think it’s a speculative asset of which there are plenty of choices.”

They now hold $272M worth of Bitcoin ETFs, which is small compared to the company’s total AUM but aligns with its traditionally cautious stance.

6. State of Wisconsin Investment Board (SWIB)

The State of Wisconsin Investment Board (SWIB) is a public pension fund responsible for managing the assets of the Wisconsin Retirement System (WRS) and several other state trust funds established in 1951.

SWIB oversees approximately $156B in assets and reports owning $163M worth of Bitcoin ETFs, which is a 0.1% total portfolio allocation.

For a pension fund, this is a good start. Their recent 13F filings indicate that their investment (non-cash) portfolio is valued at $37B, which makes their bitcoin allocation 0.44% of the investment portfolio.

Conclusion

The latest 13F filings show that very well capitalized institutions are beginning allocating to bitcoin. Giant hedge funds, investment banking providers, and pension funds are among those on the list.

Together, they’ve invested nearly $10B, which points to growing confidence in Bitcoin as a reputable asset class.

Once Bitcoin enters institutional portfolios, it is unlikely to leave given how quickly Bitcoin’s price appreciates. This is exacerbated in a slow growth environment where ever-growing national debt threatens to continue debasing the price of money over the long run.