Imagine a world where public sentiment on critical questions isn’t just debated endlessly but measured in real-time through the power of financial stakes. Enter Kalshi: a game-changing, fully regulated event trading platform that offers unprecedented clarity in an unpredictable world.

Kalshi isn’t your typical exchange. It’s a vision brought to life—a marketplace where anyone can stake their beliefs on future outcomes and, crucially, see where the collective wisdom of the crowd lands.

What makes Kalshi revolutionary isn’t only the range of events you can bet on—like inflation rates, the fate of government policies, or bitcoin’s price next year—but the unique power it gives to ordinary people to quantify risk in a way that used to be the exclusive domain of big finance.

Prediction market contracts are designed around simple yes-or-no questions, which makes them clear and definitive. Each contract represents a potential outcome of an event and is traded at a price reflecting the perceived probability of that outcome occurring.

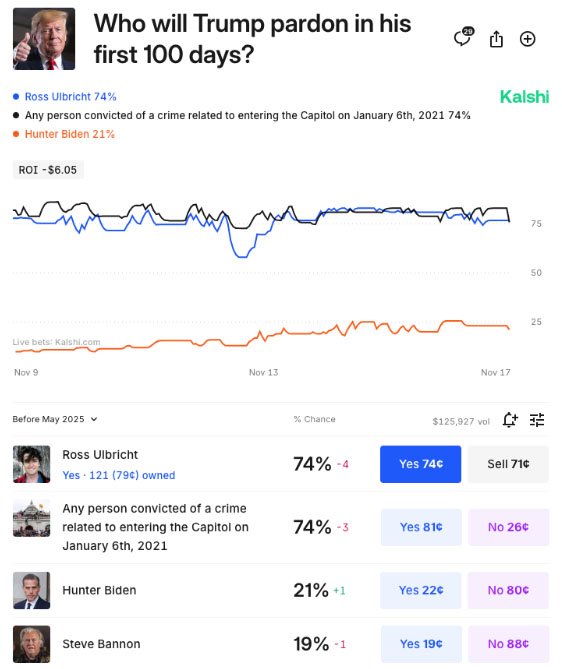

For instance, if you believe a certain event will happen, you can buy a contract at a price below $1, like 74¢. If the outcome is “yes” and proves to be true, the contract pays out the full $1, allowing you to earn the difference as profit. If the answer is “no,” you lose the amount you paid.

This binary structure—strictly yes or no—is essential because it provides unambiguous resolutions, making it easier to determine outcomes and ensure that the markets remain efficient, transparent, and grounded in reality.

By forcing every prediction into a binary framework, prediction markets can aggregate diverse opinions and give a clear picture of what people expect to happen, all while being easy to understand and straightforward to use.

Founders Tarek Mansour and Luana Lopes Lara had a bold idea, inspired by their experiences in elite financial institutions and the data-driven rigor of MIT.

They observed how much of finance revolves around predicting outcomes, but they also saw a gaping inefficiency: there were no streamlined, accessible ways to directly trade on these predictions.

Their vision wasn’t about complicating finance—it was about democratizing it. Kalshi allows anyone to place a bet on the future, turning complex market forces into straightforward yes-or-no questions.

And unlike offshore markets which are banned for residents in the United States, Kalshi is fully regulated by the Commodity Futures Trading Commission (CFTC), providing trust and legitimacy that participants will get paid out on their prediction contracts when they are correct.

For many, prediction markets aren’t just financial tools; they’re a way to make a statement. Take the case of Ross Ulbricht, founder of the infamous Silk Road, who is currently serving a double life sentence for his role in creating a decentralized online marketplace.

The case has sharply divided public opinion, with some viewing it as a cautionary tale and others seeing it as a tragic example of disproportionate punishment by the U.S. government to prove a point.

As Trump prepares for his return to the White House, Kalshi offers a space where people can bet on whether he’ll issue a pardon to Ulbricht. With odds standing at 74% at the time of writing, there is a strong belief in this possibility.

For those who support Ulbricht’s release, placing this bet goes beyond potential profit; it’s a way to champion a cause they deeply care about.

Prediction markets have a unique ability to blend finance with personal philosophy, allowing people to back their convictions and see how they align with broader societal views.

What’s truly remarkable about prediction markets is their capacity to aggregate insights from a wide spectrum of participants. Kalshi’s event contracts exemplify a form of crowdsourced forecasting that has repeatedly proven more accurate than traditional experts.

When people have financial skin in the game, they tend to make more thoughtful predictions, resulting in data points that can surpass even the best pundits.

During the 2024 Presidential election, prediction markets like Kalshi provided results more swiftly than traditional media outlets such as CNN and Fox News.

This rapid dissemination underscores the efficacy of prediction markets: when diverse participants invest financially in outcomes, their collective insights often reveal truths and anticipate results more promptly than mainstream sources.

Kalshi’s platform isn’t limited to high-profile events; it also serves as a tool for managing everyday risks. Each trade on Kalshi involves two counterparties—individuals taking opposing positions on a prediction.

For instance, if one trader bets on the occurrence of a government shutdown, another must bet against it.

This structure fosters a balanced marketplace where differing views are directly evaluated. Over time, these markets highlight the perspectives of more informed participants, as their well-founded predictions often yield consistent profits.

This mechanism is crucial: every contract only exists because of differing opinions. For example, a homeowner worried about rising mortgage rates can hedge against this risk, while another participant who believes rates will decrease can take the opposing side, hoping to profit from their forecast.

These instruments empower individuals to manage personal financial risks effectively. Because every trade has two sides, the markets remain dynamic, continually reflecting new information and shifts in sentiment.

Kalshi’s journey to becoming the first CFTC-regulated exchange for event contracts wasn’t without hurdles, particularly when it came to their efforts to list Congressional Control Contracts.

The Commodity Futures Trading Commission (CFTC) raised legitimate concerns, arguing that such contracts could pose risks to election integrity, potentially incentivizing market manipulation or undermining public trust in the democratic process.

The CFTC’s worries were grounded in the idea that monetary incentives tied to political outcomes could lead to the spread of misinformation or influence voters in unintended ways.

Kalshi, however, contended that regulated election markets can provide valuable, real-time data about electoral dynamics, leveraging the collective wisdom of market participants to generate accurate predictions.

They argued that the contracts were not contrary to the public interest and highlighted that existing safeguards against market manipulation would apply.

Additionally, Kalshi emphasized the transparency and regulatory oversight that would come with hosting these contracts on a licensed exchange, as opposed to unregulated markets.

In a significant legal battle, the federal court sided with Kalshi, finding that the CFTC had not demonstrated a concrete risk of harm sufficient to justify banning the contracts.

The court ruled that while the Commission’s concerns about election integrity were important, the evidence presented was speculative and unsubstantiated. As a result, Kalshi was granted the right to move forward, setting a precedent for how regulated event markets can coexist with democratic values.

At its heart, Kalshi embodies the idea that financial markets can be a force for good. By bringing transparency and rigor to speculative betting, they offer a platform where reality is the ultimate judge, not the loudest opinion or the most viral tweet.

When people bet on an outcome, they’re compelled to confront the truth—whatever that may be. This mechanism can reveal hidden truths, dispel myths, and, most importantly, provide real-time insight into what society collectively expects.

As our world becomes more interconnected and volatile, tools like Kalshi will only grow in importance. They offer a window into human psychology, a pulse check on public sentiment, and a pragmatic way to navigate risk.

Whether you’re hedging against real-world uncertainties or simply intrigued by the power of collective forecasting, platforms like Kalshi provide a way to turn insights into tangible action.