Bitcoin has completed its fourth halving event, marking the end of another epoch on April 19, 2024. This significant milestone, which occurs approximately every four years, reduces the reward for mining new blocks by half, effectively decreasing the rate at which new bitcoin is generated.

This event has substantial implications for miners, investors, and the broader Bitcoin market.

Bitcoin halving is a built-in feature of the Bitcoin protocol, designed to occur every 210,000 blocks. Introduced by the pseudonymous creator, Satoshi Nakamoto, the halving mechanism aims to control the supply of bitcoin, creating a disinflationary environment.

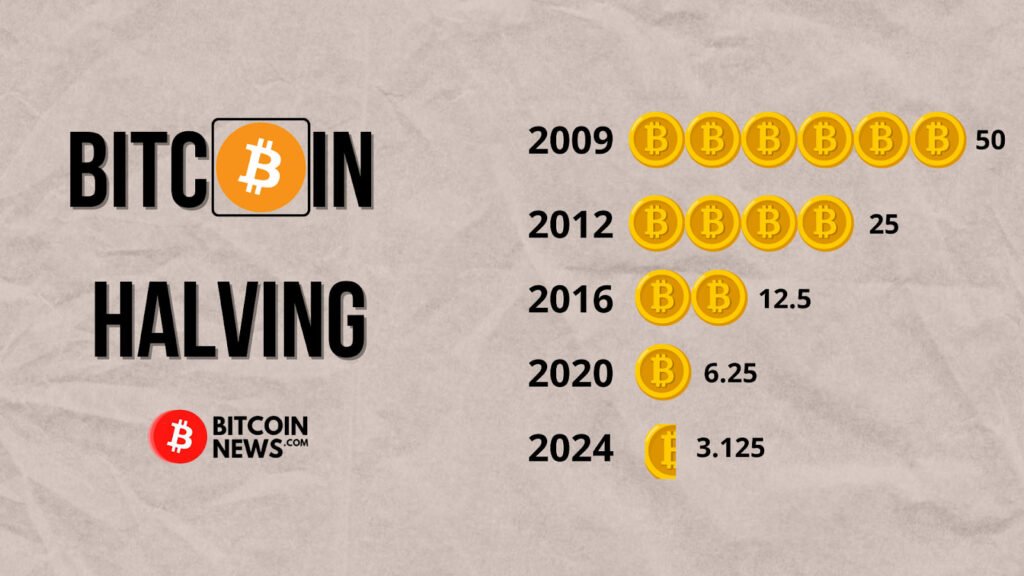

Initially, miners received 50 bitcoin per block. After the first halving in 2012, this reward was reduced to 25 bitcoin, then to 12.5 bitcoin in 2016, and 6.25 bitcoin in 2020. With the recent halving, the reward is now 3.125 bitcoin per block.

For miners, the halving represents a mixed opportunity. On one hand, the reduction in block rewards directly impacts their revenue. With the same amount of computational power, miners now earn half the bitcoin they did before the halving.

This scenario can lead to increased competition and force less efficient miners to shut down their operations if they cannot cover their costs.

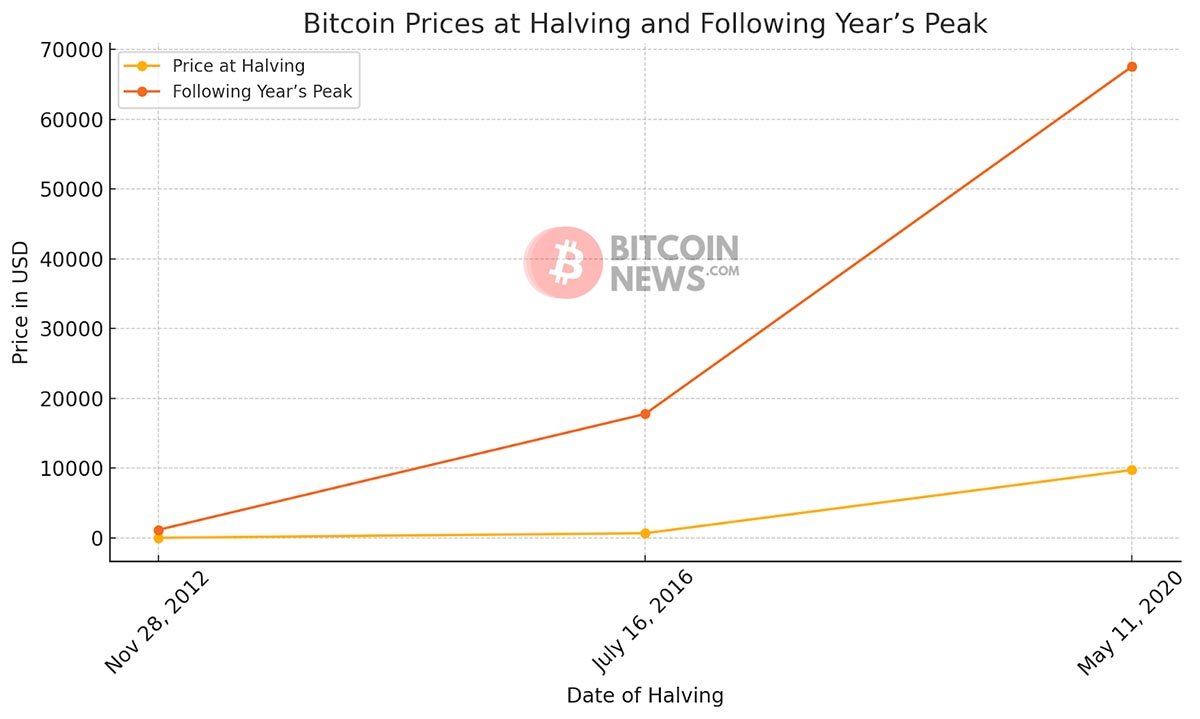

On the other hand, halvings have historically been associated with significant price increases for bitcoin.

The reduced supply and sustained or increased demand often lead to higher prices, potentially offsetting the lower rewards.

For instance, following the 2016 halving, bitcoin’s price surged from around $650 to nearly $20,000 by the end of 2017. Similarly, the 2020 halving saw bitcoin’s price rise from approximately $9,000 to an all-time high of over $68,000 in 2021.

For investors, Bitcoin halving events are often seen as bullish signals.

The reduced rate of new bitcoin issuance is expected to create scarcity, which, according to the laws of supply and demand, should drive up prices. This expectation can lead to increased buying pressure both before and after the halving.

Related: What Happens When There Is A Bitcoin Supply Shock?

However, the market response is not always immediate. Post-halving price increases can take months or even years to fully materialize.

Investors must also consider the broader economic environment, regulatory changes, and technological developments within the Bitcoin space, all of which can influence bitcoin/fiat’s price trajectory.

Bitcoin’s halving has ripple effects throughout the Bitcoin market. It often sets the tone for market sentiment and trends.

A bullish outlook on bitcoin can spill over to other Bitcoin-related investments, leading to broader market rallies. Conversely, if bitcoin faces downward pressure post-halving, it can negatively impact related markets.

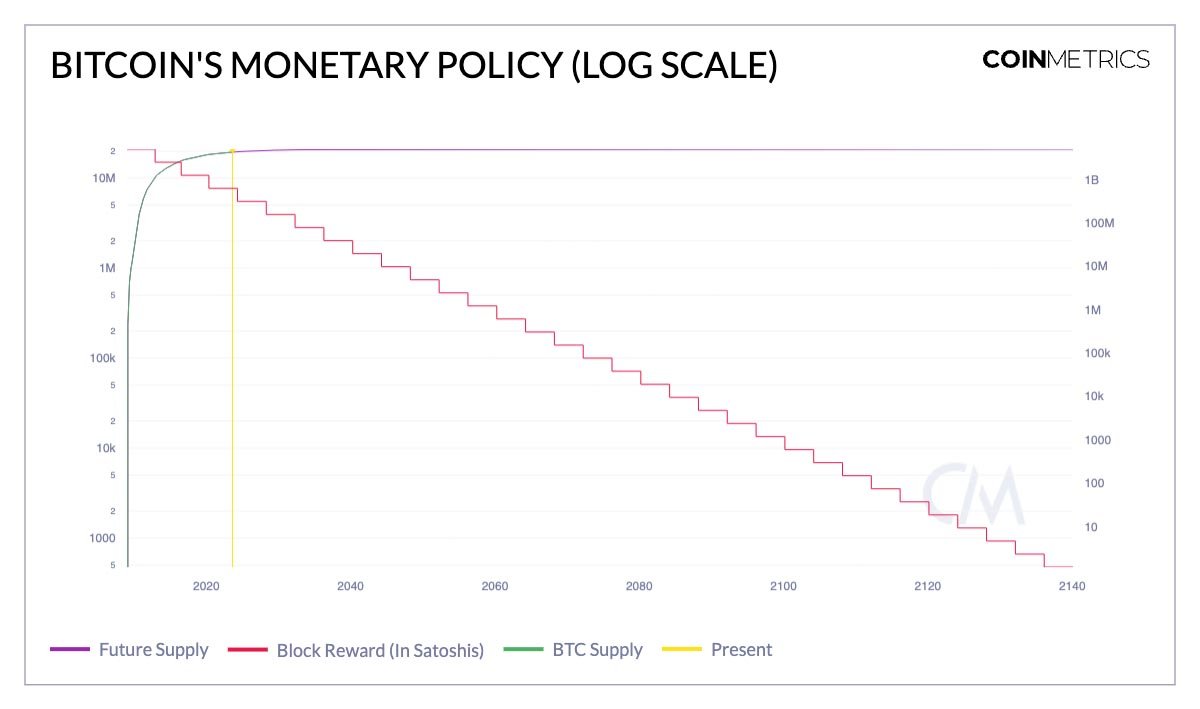

The halving event highlights the robustness and predictability of Bitcoin’s monetary policy, contrasting sharply with traditional fiat currencies, which can be subject to inflationary pressures due to central banks’ policies.

This characteristic continues to attract investors looking for a hedge against inflation and a store of value.

As Bitcoin matures and its halving events become less impactful in terms of available supply of bitcoin, it will increasingly rely on other factors for its valuation.

These include adoption rates, technological advancements such as the Lightning Network for faster transactions, and regulatory developments across different jurisdictions.

The fourth halving marks another step in Bitcoin’s journey towards its maximum supply of 21 million coins, expected to be reached around the year 2140.

Each halving serves as a reminder of Bitcoin’s unique monetary policy and its foundational principles of decentralization and limited supply.

In conclusion, Bitcoin’s fourth halving is a pivotal event with far-reaching consequences for miners, investors, and the entire Bitcoin ecosystem.

As history has shown, while the immediate effects may vary, the long-term implications are likely to reinforce Bitcoin’s position as a leading scarce asset and a cornerstone of the financial revolution.