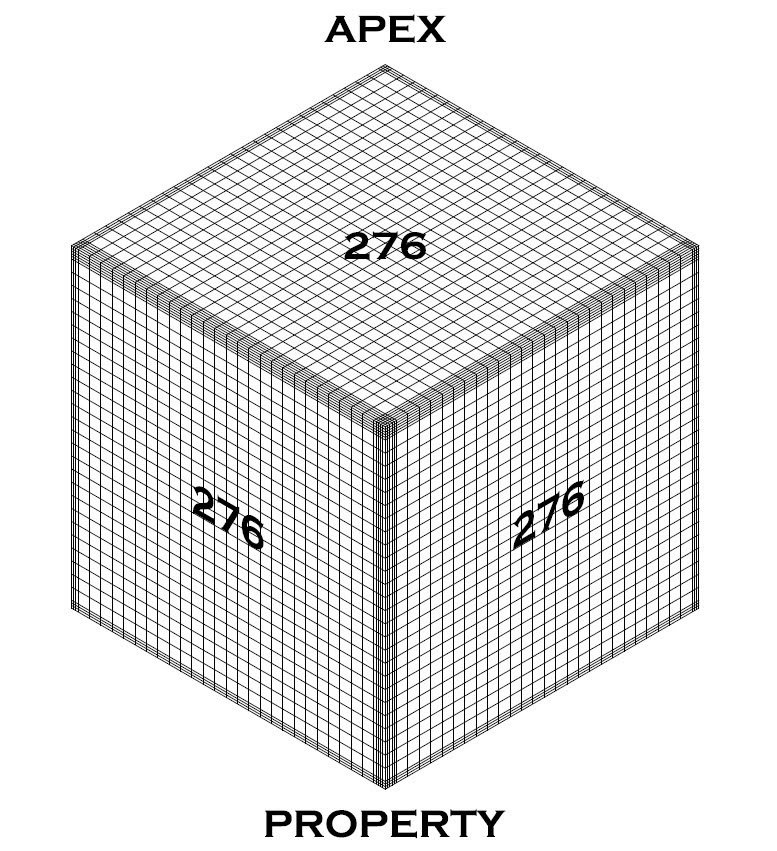

This is what the most valuable property in the world looks like. It is a digital Rubik’s cube with 21,000,000 units. You can’t touch it, or live in it, yet all of the value in the world, transferred into the digital realm, will be captured in this space one day. It is a digital citadel, a city in cyberspace, and the apex property.

How is Bitcoin Property?

Its ability to perform multiple functions can create confusion around what Bitcoin is. Bitcoin is considered property because it possesses characteristics that align with traditional definitions of property. It is something you can prove that you own. You control it, and you can transfer the ownership of it. Just like other forms of property, such as real estate or stocks, Bitcoin can be bought, sold, exchanged, and used as collateral.

Additionally, its ownership is recorded on a decentralized ledger known as the blockchain, providing proof of ownership and facilitating secure transactions. Therefore, despite being intangible and existing in digital form, Bitcoin is recognized as property under many legal systems and can be subject to property laws and regulations.

Own a Piece of the Internet of Money

The first 50 years of the digital world, humanity had no tool to enforce scarcity. Anyone can copy a .jpg file an infinite number of times. Inability to enforce scarcity in the non-physical realm led the internet to evolve into the predatory surveillance capital apparatus of today, where the most valuable commodity online is data.

In a world where digital items can be properly valued, more complex economic systems can be erected on that foundation. Bitcoin will enable a new way of thinking about digital ownership. Think of this real estate as Jessie Myers conceived, being the bedrock for a new era in the digital economy.

This image was included in Fidelity’s research report titled Bitcoin First, published in January 2022. In that report, Fidelity identified the real estate in Cyber City itself as being the most valuable asset.

“What is interesting about this architecture is that an investor can own part of the base layer of this new technology and can be relatively agnostic about what specific applications are built on top of it. It would be akin to being able to own the base layer of the internet and getting exposure to all of the innovation on top (e.g., Google, Amazon, etc.) without having to try to pick the specific winners and losers.”

The Apex Property

Bitcoin is unique as property because it’s uniformly valuable and available to anyone who has the internet. Its divisibility means no one is excluded regardless of how much they can afford. Since it cannot be confiscated or taken by force, Bitcoin solves the problem of protecting valuable property. Because it doesn’t degrade over time, Bitcoin as property is pristine and timeless.

While defending his most recent Bitcoin purchase, Michael Saylor spelled the plan out when he was pushed to explain what his endgame for accumulating this digital property is.

“It’s the best investment asset. The end game is to acquire more Bitcoin. Whoever gets the most Bitcoin wins.”

Using the analogy of real estate, Saylor compared his strategy to land developers in New York City, who have been handsomely rewarded for reinvesting in New York City for the past three hundred years. He stated, New York City is the end game of real estate in North America, so it wouldn’t make sense for people to sell that real estate for paper.

He went on to explain that a commonality among the world’s ultra-wealthy is the strategy of not trading desirable and rare property for paper. “The Royal Family of England didn’t sell all of its property in Central London to buy paper money. Anyone that’s rich in the world owns property… They want to own the property forever.”

He punctuated his argument with the statement:

“Bitcoin is the end game for anyone who wants to own the greatest property in the 21st century.”

Bitcoin’s Black Hole Effect

Humanity has always searched for property that can store monetary energy. It is why we chase the ownership of rare and valuable things. Art, real estate, collectibles, gold are all stores of value. The invention of scarcity in the digital world has leveled the playing field and provided us all with fair access to an apex store of value. This is why Bitcoin outperforms, and will continue to do so. As more people understand what Bitcoin offers, more will choose to reallocate capital from other stores of value to Bitcoin.

Related reading: Bitcoin: The Monetary Metric System

Bitcoin is a city in cyberspace that’s 276 blocks wide, 276 blocks high, 276 blocks deep. Every person on the planet, all 8 billion, will want to live there one day. As capital flows in from the fiat world, fiat values of other stores of value will drop in Bitcoin terms. Those who sell their digital property for paper money today will be selling it for things that will eventually trade their value for smaller and smaller blocks of the best form of property that has ever existed.

The end game is the ability to store your monetary energy. It’s a game that everyone has to play.

Store Your Energy Forever

Bitcoin is not an asset class. It is the most efficient store of monetary energy the human race has ever seen. 8 billion people need a place to store their monetary energy. So does every company, government, endowment, pension, and any other entity that needs to preserve wealth over space and time. So long as there is money there will be a need to store it.

Bitcoin is the rarest form of property in the world, and it is globally accessible and available to anyone with an internet connection. It is indestructible. It will outlive you. Trading your Bitcoin for paper today is a trade that can only get worse as time passes.