Bitcoin has captivated the financial world since its inception in 2009 by the pseudonymous creator Satoshi Nakamoto. One of the most intriguing aspects of Bitcoin is its monthly returns, which offer a fascinating glimpse into its performance and volatility over time.

This article delves into the patterns, trends, and implications of bitcoin’s monthly returns, shedding light on its role as a store of value and investment vehicle.

Bitcoin’s monthly returns have historically exhibited substantial volatility, a characteristic that both attracts and deters investors. This volatility is a double-edged sword; while it presents opportunities for significant gains, it also poses risks of notable losses.

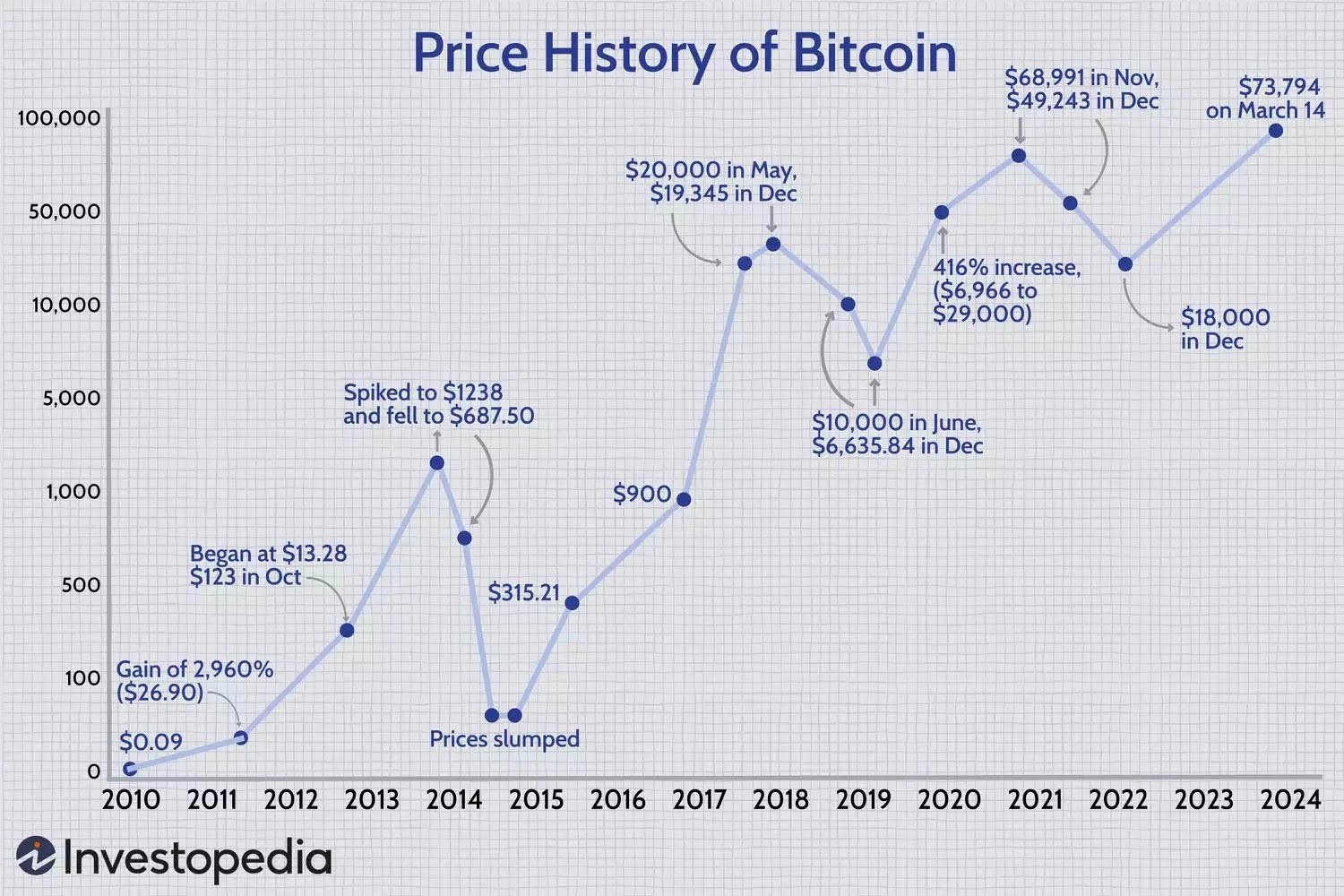

Over the past decade, bitcoin has experienced several periods of explosive growth. For instance, in 2017, bitcoin’s monthly returns reached staggering heights, with December alone witnessing a return of over 39%.

This period marked bitcoin’s first journey to nearly $20,000, capturing global attention and sparking a wave of new investors. Conversely, bitcoin has also seen months of sharp declines.

The bear market of 2018, for example, saw bitcoin’s value plummet, with monthly returns frequently in the red. January 2018 experienced a significant drop of approximately 27%, highlighting the asset’s susceptibility to market sentiment and external factors.

Despite the apparent randomness of bitcoin’s monthly returns, some patterns and seasonal trends have emerged. Historically, certain months tend to show better performance than others.

For instance, April and May have often been positive for bitcoin, possibly due to increased market activity and optimism in the spring. On the other hand, September has frequently been a challenging month, with negative returns more common.

These patterns, while intriguing, are not foolproof indicators for future performance. Bitcoin’s market is influenced by a myriad of factors, including regulatory news, technological advancements, macroeconomic trends, and geopolitical events, making precise predictions difficult.

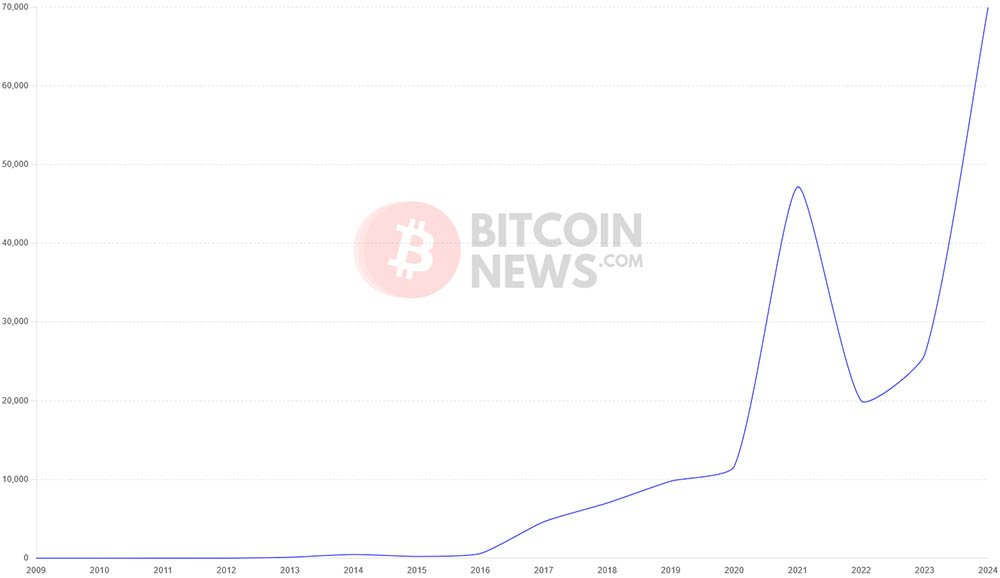

Despite September traditionally being a challenging month, bitcoin’s overall year-on-year trend shows a significant upward trajectory.

Several key factors influence bitcoin’s monthly returns, each playing a crucial role in shaping its market dynamics:

- Regulatory Developments: Announcements from governments and financial regulators can significantly impact bitcoin’s price. Positive regulatory news often leads to bullish sentiment, while negative news can trigger sell-offs.

- Market Adoption and Technological Advances: Increased adoption of Bitcoin by businesses and advancements in blockchain technology can boost investor confidence, driving up monthly returns.

- Macro-Economic Trends: Global economic conditions, including inflation rates, monetary policies, and geopolitical tensions, can affect Bitcoin’s appeal as a hedge against traditional financial systems.

- Market Sentiment and Media Coverage: Public perception and media coverage play substantial roles in bitcoin’s volatility. Positive media attention can attract new investors, while negative press can induce fear and uncertainty.

Understanding bitcoin’s monthly returns is crucial for investors looking to navigate its volatile landscape.

For long-term holders, or “HODLers,” the focus tends to be on bitcoin’s overall upward trajectory rather than short-term fluctuations. Historically, bitcoin has demonstrated a significant increase in value over longer periods, rewarding patient investors.

For traders, the volatility presents opportunities to capitalize on short-term price movements. However, this approach requires a deep understanding of market dynamics, risk management, and often, a strong stomach for market swings.

Bitcoin’s monthly returns offer a window into this complex and dynamic new world of investments. While historical patterns provide some insights, the unpredictable nature of the market necessitates a cautious and informed approach.

As Bitcoin continues to mature and integrate into the global financial system, its monthly returns will likely remain a topic of keen interest and rigorous analysis.

In conclusion, Bitcoin’s journey is far from over. Whether viewed as digital gold, a revolutionary technology, or a speculative asset, its monthly returns encapsulate the excitement, challenges, and potential of this groundbreaking financial phenomenon.